Illustrative Image

According to preliminary statistics from the General Department of Customs, Vietnam’s soybean imports in September reached over 140,000 tons, valued at more than $67 million, a 52.8% decrease in volume and value compared to August.

In the first three quarters of the year, Vietnam imported over 1.9 million tons of soybeans, worth more than $904 million, a 22.4% increase in volume and a 9.5% rise in value compared to the same period last year.

Brazil is Vietnam’s largest soybean supplier, with over 1.1 million tons valued at more than $518 million, an 18% increase in volume and a 10% rise in value compared to the same period in 2024. Import prices decreased by 6%, to $469 per ton.

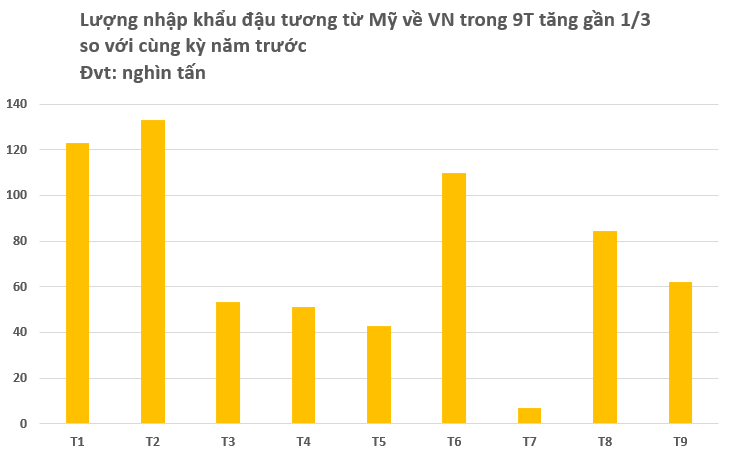

The United States is the second-largest market, with over 667,000 tons of soybeans valued at more than $301 million, a 30% increase in volume and a 10% rise in value. Despite the significant increase in import volume, prices dropped sharply by 16%, to $451 per ton, the lowest among all markets.

Canada ranks third, with over 142,000 tons valued at more than $67 million, a 45% increase in volume and a 17% rise in value. Import prices decreased by 20%, to $477 per ton.

Globally, since the beginning of 2025, soybean trade between the U.S. and China has experienced significant fluctuations, with Beijing clearly reducing purchases from the U.S. and shifting heavily to South American suppliers. According to customs data and market analysis, China has increased soybean imports from Brazil and Argentina for several months, leading to a sharp decline in U.S. imports during the peak export season.

China’s reduced purchases are evident in the new season: during the summer and early autumn months, U.S. soybean shipments to China nearly halted, causing exports to this market to account for only a small fraction of the U.S.’s annual export volume. This has put pressure on domestic prices and farmer incomes during the harvest season.

Vietnam is one of the world’s largest soybean importers, with total imports estimated at 2.2 million tons of whole soybeans and 5.9 million tons of soybean meal in the 2023-2024 crop year. Vietnam is the third-largest importer of U.S. soybeans in Southeast Asia and the 13th largest globally.

The U.S. Soybean Export Council (USSEC) forecasts that Vietnam’s demand will continue to rise due to the strong growth of the food and animal feed industries. This is driven by Vietnamese consumers’ increasing interest in plant-based products like soybeans.

Soybean meal consumption is projected to reach 6 million tons by 2025, reflecting the growing demand for food and animal feed in the domestic market. This growth is a result of Vietnam’s rapidly expanding livestock industry, with stable increases in pork, poultry, and seafood production.

Vietnam is currently the world’s sixth-largest pork producer, while its seafood industry ranks fourth, contributing approximately 4-5% to GDP. The demand for soybeans in industrial feed production is substantial, particularly as consumers increasingly prefer protein-rich, plant-based products.

![[On Seat 07] MG – From a Widely Criticized Car Brand to Impressive Sales Figures and the Opportunities for MG7 in Vietnam](https://xe.today/wp-content/uploads/2024/08/v-quote-te-3-100x70.jpg)