The Undervalued Link Between Packaging and Carbon Footprint in Supply Chains

According to the Ellen MacArthur Foundation, adopting circular economy principles in packaging can significantly reduce greenhouse gas emissions across supply chains.

Packaging constitutes a substantial portion of a product’s total carbon footprint, particularly through Scope 3 emissions—indirect emissions from purchasing goods and end-of-life product handling[1].

While the traditional linear model (produce-use-dispose) generates carbon emissions from raw material extraction and waste disposal, circular packaging designed for reuse, recycling, or biodegradability can mitigate environmental impact.

The OECD projects that without stronger policies, global plastic use will nearly triple from 460 million tons in 2019 to 1,231 million tons by 2060, with plastic leakage into the environment doubling[2].

The delay in transitioning to circular packaging poses a risk to businesses’ emission reduction goals, as highlighted by international commitments. The Global Plastics Treaty and the EU’s Circular Economy Action Plan both emphasize packaging as a critical lever for achieving climate targets. The Ellen MacArthur Foundation’s Global Commitment has mobilized over 1,000 organizations worldwide, including companies representing 20% of global plastic packaging production, to commit to a circular economy vision for plastics[3].

McKinsey research reveals that fast-moving consumer goods companies derive 90% of their environmental impact and over 80% of their emissions from their supply chains, with packaging playing a pivotal role[4]. For Unilever, raw materials and packaging account for over 60% of direct emissions in the value chain, necessitating focused reduction efforts[5].

The Current State of Circular Packaging in Vietnam

Vietnam faces significant challenges in managing plastic waste. The World Bank estimates that 2.8–3.1 million tons of plastic waste are generated annually on land, with at least 10% leaking into the ocean[6].

Vietnam ranks 5th globally in poorly managed plastic waste, with a rate of 54%, 22 percentage points higher than the global average[7].

World Bank research indicates that Vietnam recycles only about 33% of major plastics like PET, HDPE, LDPE, and PP[8]. This is partly due to post-collection waste handling methods: most urban household waste in Vietnam is directly landfilled without any preliminary processing, creating a significant barrier to circular economy development and resource recovery from packaging.

Key bottlenecks in Vietnam’s circular packaging system include fragmented collection and sorting infrastructure, low-grade recycling technology (downcycling), and a lack of markets for recycled materials. Informal recycling systems dominate, with informal recyclers in Da Nang recovering materials equivalent to 6–7.5% of total waste sent to landfills[9].

The implementation of Extended Producer Responsibility (EPR) under Decree 08/2022/NĐ-CP began in January 2024, with mandatory minimum recycling rates for various packaging types: PET (22%), paperboard (20%), aluminum (22%), and other hard plastics (10–15%)[10]. However, ineffective source waste segregation remains a challenge.

Companies like Pro Vietnam Packaging Recycling JSC have made notable progress, collecting and recycling over 64,000 tons of packaging in 2024, up from 3,000 tons in 2022[11]. Yet, this remains limited compared to the total 3.8 million tons of annual plastic waste[12].

Unilever aims to halve its use of virgin plastic and ensure 100% recyclable or compostable packaging by 2025. In Vietnam, the company collaborates with local businesses for plastic collection and recycling. The Ellen MacArthur Foundation notes that Unilever has increased post-consumer recycled (PCR) plastic content in many products, with some lines reaching 100% PCR. While this model helps create markets for recycled materials, the core challenge remains the unstable supply of high-quality PCR and its higher cost compared to virgin plastic, reflecting Vietnam’s infrastructure bottlenecks[13].

ESG Bottleneck: When Packaging Determines Capital Costs and Exports

According to PwC, Vietnam is among the top 5 Asian countries on track to meet 2030 emission reduction commitments, but this requires fundamental changes in waste management and supply chain approaches[14].

Experts highlight that over 90% of corporate greenhouse gas emissions fall under Scope 3 activities, including raw material extraction, supplier operations, logistics, product use, and end-of-life handling. This means that failure to manage packaging lifecycles directly impacts overall emission reduction goals[15].

Business risks from underdeveloped circular packaging include technical barriers in export markets. The EU mandates that 50% of plastic packaging must be recycled by 2025 and 55% by 2030[16], while banning plastic waste exports to non-OECD countries from 2026, potentially affecting 140 kilotons of annual waste imports to Malaysia and Vietnam[17].

Additionally, Vietnam’s recycled products face challenges entering markets like the EU due to complex certification procedures and stringent technical requirements.

Achieving Net Zero goals requires approximately $368 billion in Vietnam, necessitating transparency from businesses to access sustainable financing[18]. Lack of transparency in packaging lifecycle management and supply chains directly impacts ESG metrics and access to these funds.

Brand reputation is increasingly affected as consumers and investors prioritize sustainability. A 2024 Vietnam Report survey found that 92.1% of consumers are concerned about packaging’s environmental impact, reflecting a significant shift in market expectations[19].

Packaging: From Cost Burden to Driver of Sustainable Growth

To transform packaging from a “carbon burden” into a sustainable competitive advantage, Vietnamese businesses must integrate packaging strategies into overall operations through research and development of materials, design for recyclability, and reuse models (refill/reuse). The Ellen MacArthur Foundation estimates that increasing recycled content in packaging could keep one oil barrel in the ground every two seconds, equivalent to over 23 million barrels annually and avoiding 3.4 million tons of CO2 each year[20].

Policy-wise, Vietnam needs to refine the EPR mechanism to create an effective recycling market by establishing national standards for green packaging and mandatory recycled content. Decree 05/2025/NĐ-CP clarifies EPR-obligated entities and raises the exemption threshold from 20 billion VND to 30 billion VND in product sales revenue[21].

Decision 222/QĐ-TTg sets targets to increase renewable energy’s share to 47% of primary energy, ensure 95% of urban solid waste and 80% of rural waste are collected and treated, reduce direct landfilling to below 50%, and improve industrial and household waste recycling rates[22].

Public-private partnerships (PPP) are being promoted for large-scale collection, sorting, and recycling infrastructure, as seen in UNDP’s Material Recovery Facility (MRF) project in Quy Nhon. This project not only transforms waste into valuable resources but also significantly improves the livelihoods of informal recyclers by integrating them into the waste management system.

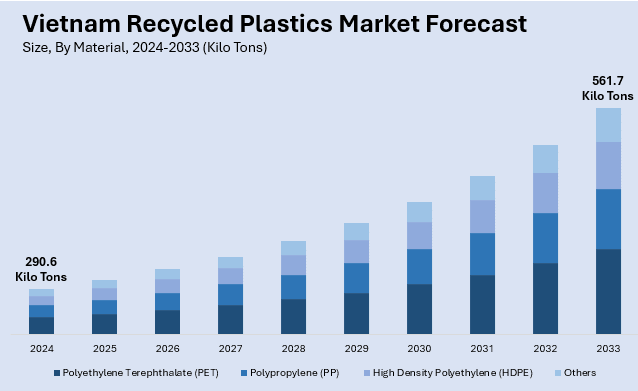

Vietnam’s recycled plastics market is projected to grow from 290.6 thousand tons in 2024 to 561.7 thousand tons by 2033, at a CAGR of 7.22%. Active participation from domestic and foreign investors is expected to quadruple the design capacity of PET recycling facilities by 2023[23].

|

Forecast of Vietnam’s Recycled Plastics Market

Thousand Tons

Source: imarcgroup

|

Repositioning packaging from a carbon burden to an innovation opportunity requires collaboration among stakeholders. Businesses should establish partnerships with local partners having extensive collection networks, connect with textile companies and waste processors, and leverage local consulting expertise to navigate Vietnam’s business environment and legal frameworks.

Transitioning from a “take-make-dispose” model to a circular economy in packaging reduces environmental risks and creates a sustainable competitive edge.

[1] https://content.ellenmacarthurfoundation.org/m/3eac8667edd240cc/original/Completing-the-picture-How-the-circular-economy-tackles-climate-change.pdf

[2] https://www.oecd.org/content/dam/oecd/en/publications/support-materials/2022/02/global-plastics-outlook_a653d1c9/Global%20plastics%20outlook%20-%20policy%20scenarios.pdf

[3] https://content.ellenmacarthurfoundation.org/m/528a7cd095787dec/original/The-Global-Commitment-2024-Progress-Report.pdf

[4] https://www.zurich.com/knowledge/topics/climate-change/how-to-reduce-carbon-in-our-supply-chains

[5] https://www.weforum.org/stories/2022/11/scope3-supply-chain-emissions-cop27-ikea-philips-zf-unilever/

[6] https://documents1.worldbank.org/curated/en/099735006282232159/pdf/P16730702478dc09c0a53403286ba348755.pdf

[7] https://www.switch-asia.eu/site/assets/files/4399/plastic_policies_vn_final.pdf

[8] https://documents1.worldbank.org/curated/en/441451632841781531/pdf/Market-Study-for-Vietnam-Plastics-Circularity-Opportunities-and-Barriers.pdf

[9] https://www.undp.org/sites/g/files/zskgke326/files/2023-02/UNDP%20Circular%20Economy%20handbook%20%5Bshort%5D%20-%20Eng.pdf

[10] https://epr.monre.gov.vn/vi/bai-viet/tong-hop-he-thong-hoa-quy-dinh-phap-luat–ve-trach-nhiem-tai-che-san-pham-bao-bi-cua-nha-san-xuat-nhap-khau/

[11] https://en.mae.gov.vn/Pages/chi-tiet-tin-Eng.aspx?ItemID=8977

[12] https://www.switch-asia.eu/site/assets/files/4399/plastic_policies_vn_final.pdf

[13] https://www.unilever.com/news/news-search/2024/how-were-aiming-for-greater-impact-with-updated-plastic-goals/

[14] https://www.pwc.com/vn/en/publications/2024/energy-transition-in-vietnam.pdf

[15] https://nexioprojects.com/supply-chain-emissions-the-hidden-impact-of-your-carbon-footprint/

[16] https://b-company.jp/plastic-recycling-ascendant-trends-and-opportunities-in-a-sustainable-future-in-vietnam/

[17] https://www.bain.com/insights/building-a-resilient-plastic-circularity-framework-in-southeast-asia/

[18] https://eurochamvn.org/wp-content/uploads/2024/01/2.-ESG-Disclosure-Brief-Research-July-2024.pdf

[19] https://vietnamnews.vn/environment/1722857/green-shift-opens-new-chapter-for-viet-nam-s-packaging-and-recycling-industries.html

[20] https://content.ellenmacarthurfoundation.org/m/528a7cd095787dec/original/The-Global-Commitment-2024-Progress-Report.pdf

[21] https://kpmg.com/vn/en/home/insights/2025/02/key-amendments-to-vietnam-environment-protection-regulations.html

[22] https://www.vietnam-briefing.com/news/vietnam-national-action-plan-circular-economy-2035.html/

[23] https://www.imarcgroup.com/vietnam-recycled-plastics-market

– 09:00 18/10/2025

The Plastic Box and the Waste Oil: An Unbearable Burden for Nature.

For far too long, used engine oil has posed a significant threat to both the environment and human health. The conventional practice of packaging oil in small bottles, ranging from a few milliliters to a liter, for lubrication and maintenance of vehicles like motorcycles and cars has led to a pressing environmental challenge. It’s time to address this nagging issue and find sustainable solutions.

The $4 Billion Vietnam Packaging Market: Navigating the “Greening” Tide and Securing Orders Amidst Foreign Competition

The Thai suppliers of similar products have an edge when it comes to packaging and could swiftly usurp Vietnamese businesses.

The Green Revolution: Leading the Way in Eco-Consciousness

With extended producer responsibility, businesses are now accountable for the collection and recycling of waste generated from their products. This shift has led to a surge in recycling demands, empowering recyclers with additional resources and presenting a unique opportunity to revolutionize waste management.

Sustainable Con Dao: Embracing a Circular Economy for Long-Term Prosperity

To foster sustainable development in Con Dao, aviation and high-speed ferry businesses have actively risen to the occasion with a plethora of supportive initiatives. These initiatives are designed to turn the vision of socioeconomic progress, hand in hand with environmental conservation, into a tangible reality.