At the “360 Investment – Optimizing Assets, Seizing Opportunities” seminar on October 18, Mr. Nguyen Minh Duc, Deputy Head of Business Development at S&I Rating, shared insightful perspectives on the bond market.

Mr. Nguyen Minh Duc (S&I Rating) speaking at the seminar – Photo: Huy Khai

|

According to Mr. Duc, in 2021, Vietnam’s stock market surged by 35%, reaching its peak that year. Simultaneously, the bond market recorded its highest-ever trading and outstanding values. However, by 2025, while the stock market continued its strong growth, the bond market was still in the process of reshaping.

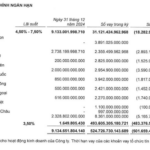

S&I Rating’s statistics reveal that by Q3/2025, there were 144 bond issuance rounds, including 143 domestic rounds totaling 148 trillion VND and one overseas issuance by VPBank worth 300 million USD.

Despite a 26% drop in Q3 trading volume compared to Q2, some banks like Techcombank, BIDV, and ACB saw significant issuance growth in Q2. Year-to-date, total issuance value reached 425 trillion VND, up 35% year-on-year.

However, the corporate bond-to-GDP ratio stood at 11% in 2021, while stock market capitalization was 78%. By Q3/2025, both figures declined, indicating vast growth potential for both markets. In developed nations like the U.S., Japan, and South Korea, debt ratios typically range from 90% to 140% of GDP, highlighting Vietnam’s expansion opportunities.

Regarding issuance trends, while major corporations like Vingroup faced challenges in 2021–2023, the situation improved significantly by 2025. In September 2025 alone, successful issuances included Vingroup (6 trillion VND), MBBank (6 trillion VND), VIB (over 2 trillion VND), VPBank (2.8 trillion VND), ACB (3 trillion VND), and Vinhomes (15 trillion VND in Q3).

Most issuances were concentrated in banking and real estate sectors. Coupon rates for banks slightly decreased compared to Q2, while Vinhomes and Vingroup bonds dropped from 12.5% to 11% annually.

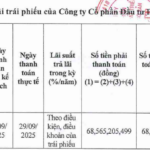

Delayed bond payments have gradually decreased, signaling a positive shift from previous periods.

New legal policies implemented in September 2025 aim to enhance safety and transparency in public bond issuances. These include stricter debt-to-equity ratios, streamlined procedures, and mandatory credit ratings for issuers, enabling investors to assess financial health before investing.

S&I Rating advises investors to focus not only on yields but also on issuers’ financial health and creditworthiness for safer, more effective investments.

– 11:38 18/10/2025

DNSE Offers 1 Trillion VND in Public Corporate Bonds

DNSE Securities Corporation (HOSE: DSE) has officially launched a VND 1,000 billion bond issuance to bolster its capital for margin trading and securities advance payment activities.

Vietjet Successfully Raises VND 1,000 Billion Through Bond Issuance

Vietjet has successfully raised VND 1,000 billion through the issuance of its VJC12503 bond series, with a maturity period of 60 months.