Coteccons Construction JSC (HoSE: CTD) has recently approved a public bond issuance plan with a maximum value of VND 1.4 trillion. According to the Board of Directors’ resolution, these bonds are non-convertible, unsecured, and uncollateralized, with a 3-year term and an expected interest rate of 9% per annum—a competitive rate amidst the recovering bond market.

Coteccons plans to issue 14 million bonds, each with a face value of VND 100,000, through SSI Securities Corporation as the underwriter. The offering will commence after the company receives the Registration Certificate from the State Securities Commission, with the specific issuance date determined by the Chairman of the Board.

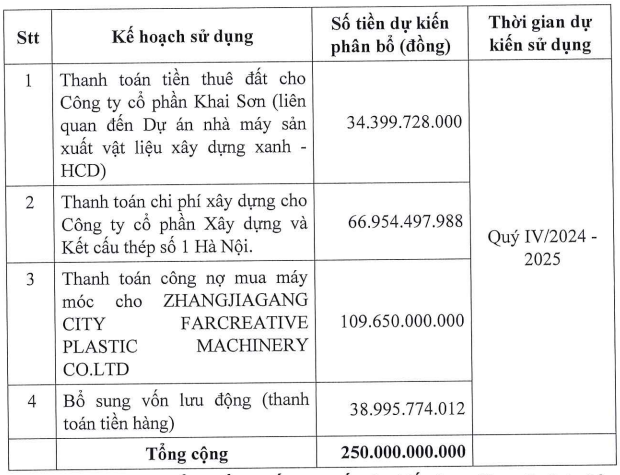

The entire proceeds from this bond issuance will be allocated to working capital, supporting production and business activities, settling payments with suppliers and subcontractors, and covering employee salaries and bonuses.

Allocation of VND 1.4 trillion raised from Coteccons’ bond issuance.

In addition to the capital raising plan, Coteccons has also approved a strategic overseas investment initiative. The company intends to establish a wholly-owned subsidiary abroad, funded entirely by shareholders’ equity, to undertake international investment and construction projects.

According to the announcement, Coteccons will hold its 2025 Annual General Meeting of Shareholders on October 20, 2025, via an online format. The Board of Directors is expected to present the 2026 business plan, targeting consolidated revenue of VND 30 trillion and after-tax profit of VND 700 billion, reflecting strong growth expectations post-restructuring.

Simultaneously, Coteccons plans to issue over 5.1 million bonus shares to increase its charter capital from VND 1.036 trillion to VND 1.087 trillion, utilizing funds from the Development Investment Fund as per the audited 2025 financial report. The issuance is scheduled for 2026–2027, pending regulatory approval.

In terms of business performance, Coteccons recorded positive results in the first six months of 2025, with after-tax profit reaching VND 456.2 billion, a 47.4% increase compared to the same period in 2024.

As of June 30, 2025, Coteccons’ total assets increased by 29.9% from the beginning of the year to VND 29.701 trillion, equivalent to a rise of over VND 6.8 trillion. Current assets grew by more than VND 7.5 trillion to VND 27.963 trillion. Notably, cash and cash equivalents increased by over VND 500 billion to VND 2.712 trillion.

On the liabilities side, the company’s total debt rose by 45.2% from the beginning of the year to VND 20.736 trillion, with short-term debt accounting for the majority at VND 20.683 trillion.

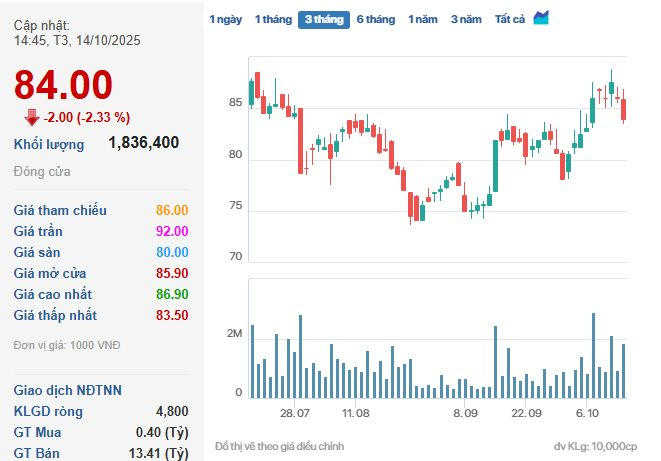

CTD stock price has experienced significant volatility recently.

On the stock market, as of the close on October 14, CTD shares were priced at VND 84,000 per share, down 2.33% from the previous session, with a trading volume of over 1.8 million units.

Currently, Coteccons’ market capitalization stands at over VND 8.52 trillion—significantly lower than the book value of this construction industry giant.

Coteccons Seeks to Raise VND 1.4 Trillion via Bond Issuance to Settle Outstanding Debts

The Board of Directors of Coteccons Construction Joint Stock Company (HOSE: CTD) has approved a plan to publicly issue bonds with a maximum total value of VND 1.4 trillion, scheduled for implementation from late this year to early next year.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

Sonadezi Invests Over VND 167 Billion to Acquire Office Building from Affiliated Company

Sonadezi has officially approved the acquisition of an office building within Bien Hoa 1 Industrial Park from Sonadezi Giang Dien, with the transaction valued at approximately VND 167.3 billion.