FPT Corporation’s stock (FPT) debuted on the Vietnamese stock market in December 2006, closing its first session at VND 400,000 per share. At the time, its market capitalization was approximately VND 24.3 trillion, equivalent to around USD 1.5 billion.

Over nearly 19 years of trading, FPT now has 1.7 billion outstanding shares. As of October 14th, the closing price was VND 92,400 per share, bringing its market cap to over VND 157 trillion, or nearly USD 6 billion.

FPT is renowned as the most consistent dividend payer on the Vietnamese stock exchange, typically distributing VND 2,000 per share in cash and approximately 15% in stock dividends annually (with some years reaching up to 25%).

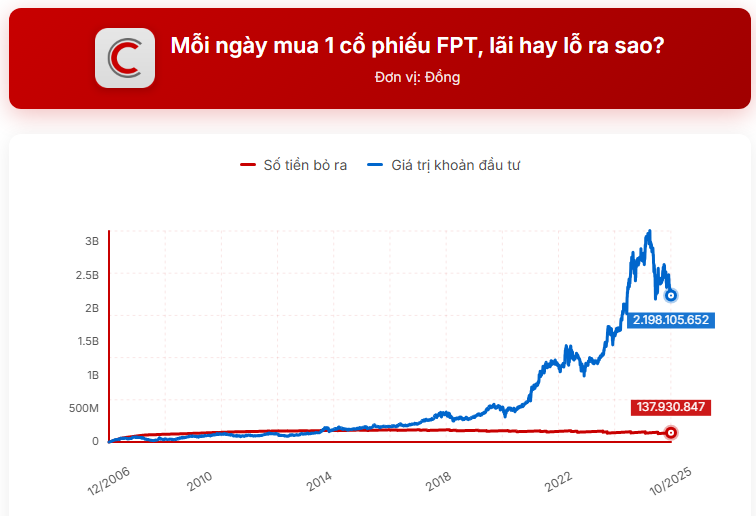

A hypothetical investor employing a “buy one FPT share per day” strategy would now hold 23,789 shares after nearly 4,700 trading sessions. While the initial investment totals nearly VND 397 million, the cumulative cash dividends received would amount to VND 259 million.

This effectively reduces the net investment to approximately VND 138 million. Meanwhile, the current market value of the shares held stands at nearly VND 2.2 billion, reflecting a remarkable 1,500% return on investment.

Historically, this investment strategy endured significant losses in the early years post-IPO, peaking at over 80% in June 2008 when FPT’s share price plummeted to around VND 50,000.

It wasn’t until 2014, more than seven years after inception, that the strategy began to break even. Robust growth followed from 2021 onward, with peak returns of 2,200% recorded in December 2024.

However, despite the broader market’s record highs in 2025, FPT shares have experienced a sharp decline this year.

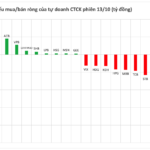

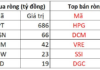

Proprietary Trading Firms Unleash Nearly $35 Million in Net Selling on First Trading Day: Which Stocks Are in the Crosshairs?

Proprietary trading firms net sold a staggering VND 774 billion on the Ho Chi Minh Stock Exchange (HOSE), marking a significant shift in market dynamics.

FPT Chairman Truong Gia Binh Pledges to “Conquer the Skies, Venture into the Open Seas, and Delve Deep into the Earth” in Partnership with the Government

Chairman Truong Gia Binh believes that a nation’s true strength lies in its globally trusted products and services. Globalization, he asserts, is a shared responsibility across large corporations, SMEs, and startups alike. As the leader of FPT, he pledges to join hands with the Prime Minister and the Government to ‘conquer the skies, venture into the vast oceans, and delve deep into the earth.’