Deputy Prime Minister Ho Duc Phoc chaired a meeting with ministries, sectors, and enterprises regarding the draft Decree on restructuring state capital in enterprises – Photo: VGP/Tran Manh

|

On the afternoon of October 14, Deputy Prime Minister Ho Duc Phoc chaired a meeting with ministries, sectors, and enterprises regarding the draft Decree on restructuring state capital in enterprises.

The Ministry of Finance’s report stated that the draft Decree on restructuring state capital in enterprises consists of 8 chapters, 100 articles, and 2 accompanying appendices.

In addition to general provisions and implementation clauses, the draft Decree on restructuring state capital in enterprises regulates: Equitization of enterprises; conversion of enterprises with 100% state-owned charter capital into limited liability companies with two or more members, and conversion of enterprises with 50% or more state-owned charter capital; consolidation, merger, division, separation, and dissolution of enterprises; transfer of state capital invested in joint-stock companies, limited liability companies with two or more members; transfer of the right to represent state capital ownership in enterprises; transfer of investment projects, capital, and assets of enterprises; transfer of the right to purchase shares, pre-emptive rights to purchase shares, and the right to purchase capital contributions.

Additions of significant content on equitization and restructuring of state capital

The draft Decree on restructuring state capital in enterprises amends and supplements several fundamental contents compared to current regulations, such as:

Regarding equitization: The draft adds provisions to fully determine and update land-related matters in line with practical realities, such as determining the value of land use rights and land lease rights during equitization.

Simultaneously, it enhances decentralization in implementing equitization steps and other capital restructuring forms, following the principle that each level independently decides on restructuring for enterprises under its management.

Specifically, the Prime Minister decides on equitization, capital transfer, reorganization (division, separation, consolidation, merger, dissolution), and transfer of ownership representation for 8 Corporations and General Corporations (PVN, EVN, VNPT, TKV, Viettel, Vinachem, Vietnam Railways Corporation, SCIC); the representative agency of the owner decides for Level I enterprises, and Level I enterprises decide for Level II enterprises.

Regarding other forms of state capital restructuring: Comprehensive regulations are provided to address practical cases, such as merging Level II enterprises into Level I enterprises, transferring investment projects, capital, and assets between enterprises; transferring the right to purchase shares and capital contributions. For each restructuring form, the draft Decree specifies authority, procedures, and financial handling.

The draft adds specific regulations on dissolving state-owned agriculture and forestry companies with 100% state-owned charter capital, transferring state capital in enterprises investing in joint-stock companies and limited liability companies with two or more members, and principles for issuing criteria to classify state-owned enterprises and foreign-invested enterprises.

At the meeting, representatives from the Government Office, Ministry of Justice, State Audit, Ministry of Construction, Ministry of National Defense, State Bank, Government Inspectorate, Ministry of Public Security, Ministry of Agriculture and Rural Development, Hanoi City, Ho Chi Minh City, and enterprises such as the Vietnam Rubber Industry Group, Viettel, HUD, SCIC, EVN, PVN, VNPT, and Agribank discussed: Land use rights post-equitization; land area allocation for equitized enterprises; equitization subjects; enterprise consolidation and merger; capital transfer; rights and obligations of enterprises; accountability during equitization; decentralization in enterprise management as per Law 68; restructuring loss-making enterprises; valuation methods; intangible asset valuation regulations; responsibility of valuation consulting units; management of capital and assets in joint ventures between state-owned and foreign enterprises; financial handling mechanisms during enterprise dissolution; and more.

Deputy Prime Minister Ho Duc Phoc: Equitization is not for selling land but to enhance enterprise capabilities – Photo: VGP/Tran Manh

|

Equitization is not for selling land but to enhance enterprise capabilities

After hearing Deputy Minister of Finance Cao Anh Tuan’s exchanges with ministries and enterprises, Deputy Prime Minister Ho Duc Phoc concluded the meeting by instructing the Ministry of Finance to clearly and appropriately argue for proposing the Prime Minister to decide on equitization, capital transfer, reorganization, and transfer of ownership representation for 8 Corporations and General Corporations (PVN, EVN, VNPT, TKV, Viettel, Vinachem, Vietnam Railways Corporation, SCIC), with the remaining decisions to be approved by the managing agency.

Regarding land-related matters and land-use purpose changes, the Deputy Prime Minister emphasized that the draft Decree should not provide detailed guidance but should follow the Land Law’s regulations, preventing land rent losses, land grabs, and other issues.

“We equitize not to sell land but to enhance enterprise capabilities, fostering a stronger, more sustainable, and resilient economy,” the Deputy Prime Minister stressed.

Regarding equitization subjects, the Deputy Prime Minister required strict adherence to the Law on Management and Investment of State Capital in Enterprises (Law No. 68). The draft Decree should only regulate Level I enterprises, with Level II and lower enterprises approved by Level I enterprises. State management agencies are responsible for inspections.

On valuation matters, the Deputy Prime Minister stated: The agency selecting the valuation unit is responsible for its choice. The valuation unit is accountable for selecting and applying valuation methods. The selection and application of valuation methods must ensure maximum benefit for the state; any losses incurred will result in accountability.

Deputy Prime Minister Ho Duc Phoc also provided opinions on: financial support for dissolving enterprises; regulations on the authority to recover assets after joint ventures; and more.

The Deputy Prime Minister requested the Ministry of Finance to absorb and synthesize meeting opinions to finalize the draft, ensuring accuracy, transparency, and avoiding multiple interpretations, for submission to the Government for consideration and decision-making./.

– 08:20 15/10/2025

Prime Minister Announces 2025 Public Investment Target of 1.11 Million Billion VND, Aiming for 100% Disbursement

On the morning of October 18th, Prime Minister Phạm Minh Chính chaired the National Conference on Accelerating Public Investment for 2025. This marks the fourth conference of the year focused on public investment, held in a hybrid format—in-person at the Government Office and virtually connecting with 34 provinces and cities nationwide.

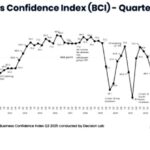

European Business Confidence in Vietnam Reaches Three-Year High

The EuroCham Business Confidence Index (BCI) for Q3/2025 soared to 66.5 points, marking its highest level in three years. This surge reflects the growing optimism among European businesses operating in Vietnam, driven by administrative reforms, green transition initiatives, and resilience amidst global challenges.

Credit Policies, Tax Regulations, and Housing Inequality in Vietnam

Property prices not only reflect the physical balance of supply and demand but also serve as a mirror to the equity of opportunity distribution. When credit and tax policies disproportionately favor those who already possess assets, the system perpetuates inequality, turning real estate into a hotbed for both financial risk and eroding trust.