Breakthrough Business Results, Multiple Growth Categories

According to the recently released Q3/2025 Financial Report, DNSE Securities achieved operating revenue of VND 489.5 billion, total revenue of VND 491.7 billion, a 2.5-fold increase compared to the same period last year. Pre-tax profit reached VND 171.1 billion, with post-tax profit nearing VND 136.8 billion, a threefold increase year-over-year.

Benefiting from the robust market uptrend in Q3, DNSE’s proprietary trading activities delivered exceptional profits. Gains from financial assets measured at fair value through profit or loss (FVTPL) exceeded VND 71 billion, a sevenfold increase compared to the same period.

Profits from loans and receivables reached VND 171.2 billion, nearly doubling year-over-year. Brokerage revenue hit VND 156.2 billion, a fivefold increase compared to the same period. For the first nine months, DNSE’s operating revenue surpassed VND 1,023 billion, total revenue neared VND 1,030 billion, pre-tax profit reached VND 328.6 billion, and post-tax profit was VND 263.3 billion, all nearly doubling year-over-year.

Thus, after nine months, DNSE has surpassed its profit target set at the Annual General Meeting earlier this year.

DNSE’s outstanding loans also reached a new record of VND 5,750 billion, up 48% since the beginning of the year.

In terms of asset size, as of September 30, 2025, DNSE’s total assets exceeded VND 14,000 billion, a 32% increase year-to-date.

Maintaining Top Market Share Position

According to Ms. Nguyễn Ngọc Linh, CEO of DNSE, the vibrant market conditions this year have provided DNSE with excellent opportunities to leverage its technology-driven product ecosystem to attract customers and drive business growth. This period marks a record-breaking performance in DNSE’s history.

Ms. Nguyễn Ngọc Linh, CEO of DNSE

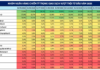

In new account market share, DNSE maintains a stable position among the top firms. In the first three quarters of 2025, DNSE opened 361,000 new accounts, accounting for over 20% of the market’s new accounts. Currently, DNSE holds over 1.3 million securities accounts, representing 12% of the total market accounts.

In Q3, DNSE also solidified its market share in both the base and derivatives segments. According to the Hanoi Stock Exchange (HNX), DNSE ranked in the Top 6 for listed stock brokerage market share with 4.63%.

In derivatives, DNSE maintained its Top 2 position and narrowed the gap with the Top 1, achieving nearly 24% market share, a 6% increase from the previous quarter. This highlights DNSE’s continued growth prospects in this key business segment.

DNSE’s consistent market share growth stems from its unique and superior digital securities product features, including pioneering trading support tools.

Among these, DNSE’s proprietary Margin Deal management system stands out, allowing customers to trade individual orders with varying interest rates and ratios, optimizing investment strategies.

DNSE also integrates human expertise with AI technology to provide investors with real-time value, from tailored investment ideas and flexible action plans to AI Order tools that optimize order matching prices by splitting orders.

AI Order is one of DNSE’s standout AI-powered features

Over the past three years, DNSE has focused on developing a stable and secure trading platform, ensuring superior price and order processing speeds. This has been key to capturing market share from active, high-frequency investors.

As of Q3, DNSE’s accounts with NAV (net asset value) exceeding VND 1 billion increased by 50% compared to the end of 2024, reflecting growth in high-quality customer segments.

To prepare for business expansion and capitalize on the market’s explosive potential, DNSE has undertaken significant capital-raising activities. From October 6 to 27, 2025, DNSE is issuing 10 million bonds to raise VND 1,000 billion for securities margin trading and advance payment activities.

The DSE125018 bonds offer an attractive 8.3% annual interest rate for the first two periods, with a floating rate thereafter based on a 3.5% base plus the reference rate. DNSE pays interest semi-annually, ensuring stable cash flow for investors.

With robust capital preparation and a strong product system, DNSE is well-positioned to seize opportunities and continue its growth trajectory as Vietnam’s market faces significant prospects, including expected foreign capital inflows following FTSE Russell’s upgrade of the Vietnamese stock market.

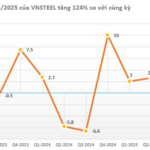

Steel Company Reports 120% Surge in Q3/2025 Post-Tax Profits

Driven by improved business performance and a rebounding market, consumption volumes surged significantly, resulting in higher profit margins in Q3 2025 compared to Q3 2024.