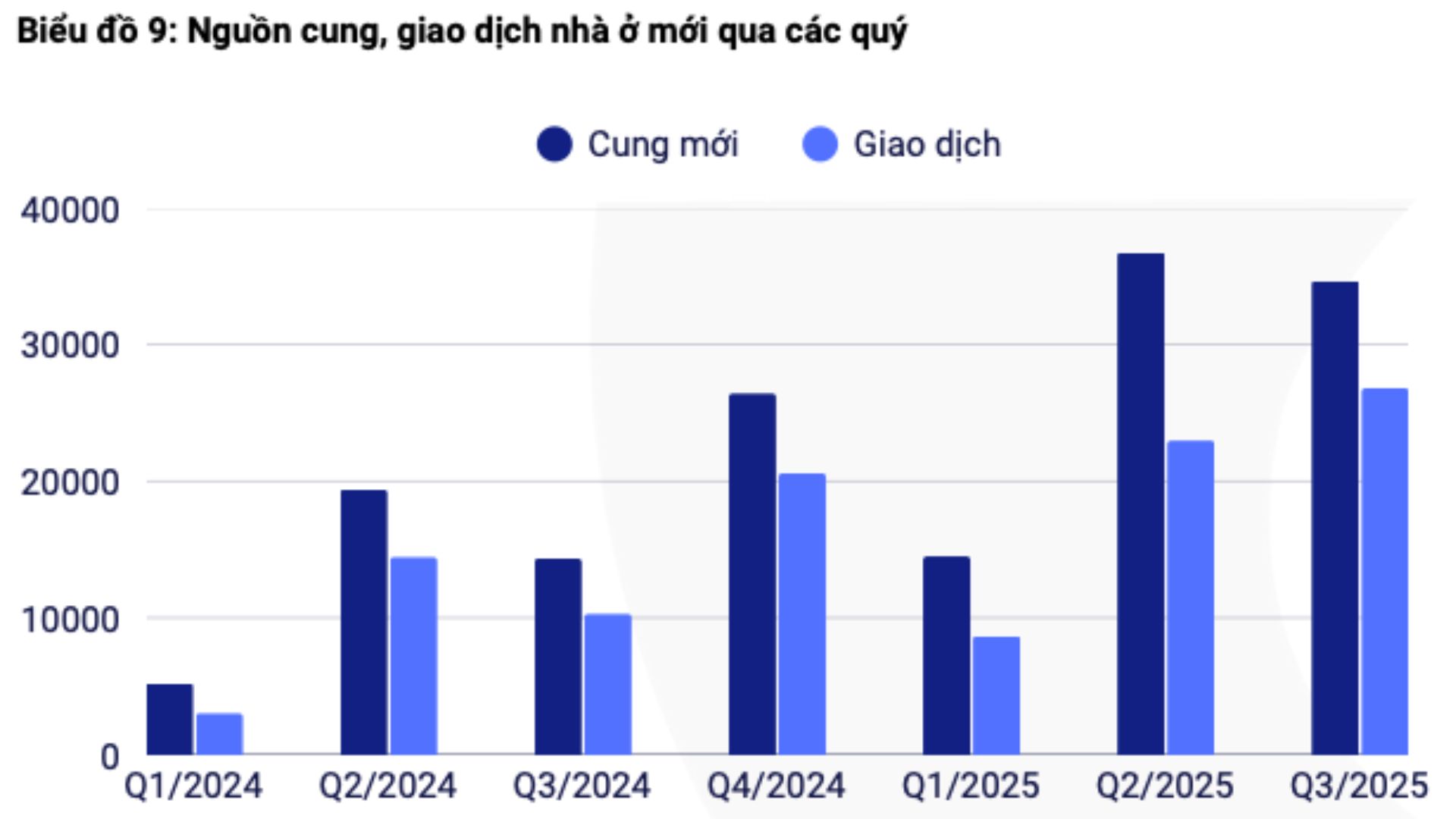

According to a report by the Vietnam Institute of Real Estate Market Research (VARS IRE), the residential real estate market recorded 34,686 new products in Q3, a slight 5% decrease from the previous quarter but 2.4 times higher than the same period in 2024.

In the first nine months of the year, the total supply of residential real estate exceeded 100,000 units, 22% higher than the entire previous year. Of these, over 86,000 were new products, with the remainder being existing inventory.

In terms of segments, low-rise buildings and land plots accounted for 32.2% of the total supply in the last quarter, equivalent to 11,000 units. Meanwhile, condominiums continued to lead the market with 67.8% of new supply. The supply-demand imbalance in the housing market remains unresolved, particularly in Hanoi and Ho Chi Minh City, where demand is highest but most new projects are priced above 100 million VND/m² due to limited supply and rising input costs.

A positive sign for housing demand is the improving supply of social housing, with an increasing pace thanks to the involvement of major developers. Notably, Vingroup is currently developing and selling nearly 11,000 units, significantly contributing to expanding supply and meeting the real housing needs of residents.

Source: VARS IRE.

In Q3, the market recorded approximately 34,000 successful transactions, primarily from the condominium segment, which accounted for over 66% with an absorption rate of 81%. The low-rise segment also saw positive results, with a 60% absorption rate.

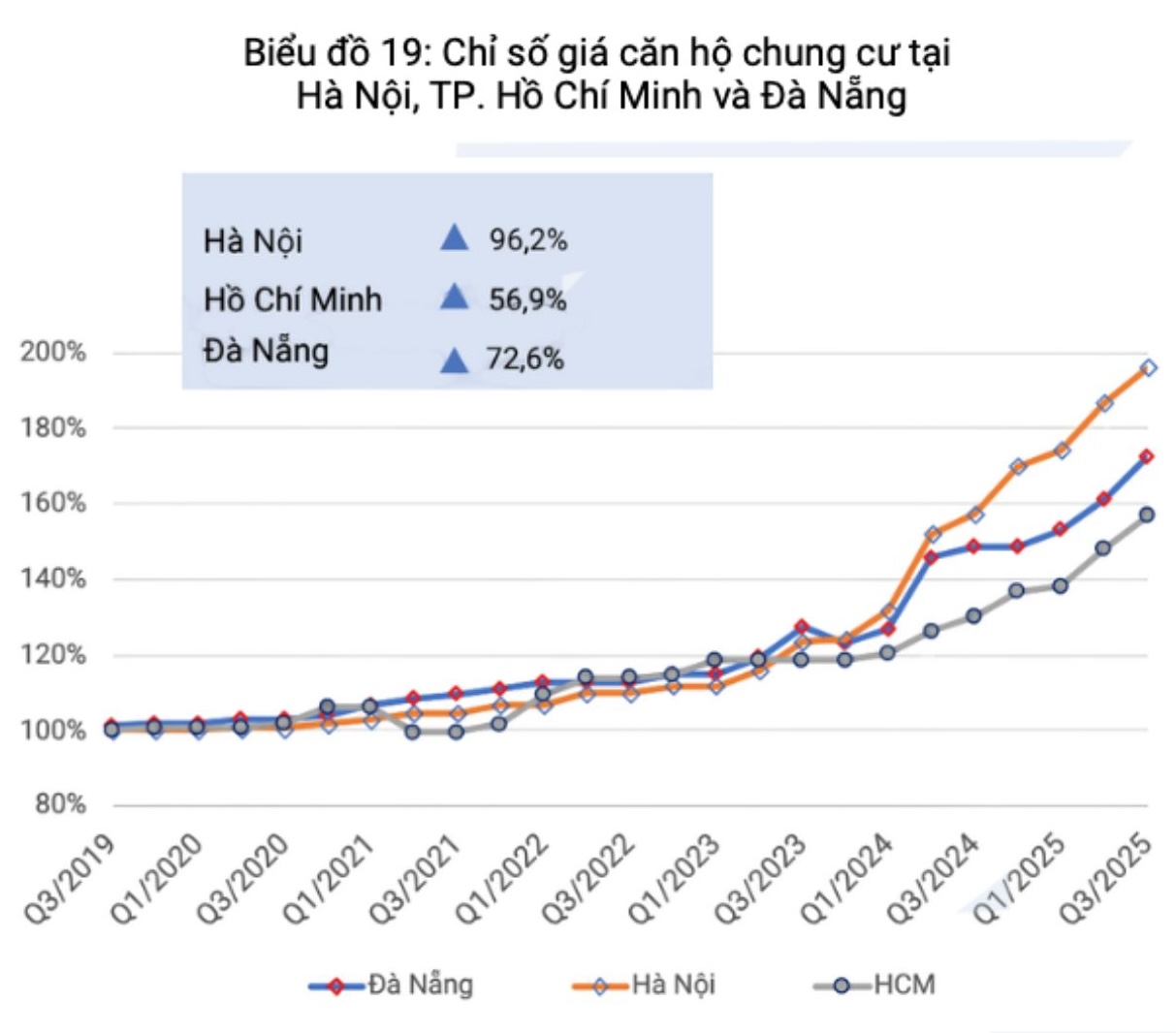

The average selling price of condominiums in Hanoi reached 78.9 million VND/m², a 5% increase from the previous quarter. In Ho Chi Minh City, the average price was 81.6 million VND/m². In Da Nang, the average price was 67.4 million VND/m², a 7% increase from the previous quarter.

Source: VARS IRE.

Mr. Le Dinh Chung, a member of VARS’s real estate market research task force, noted that newly launched projects with higher prices than the same period last year were still well-absorbed, even selling out on the first day. This is driven by real housing demand and increased investment in a context of cheap money and inflationary pressures, prompting a search for safe-haven assets.

Mr. Chung added that prices for newly launched properties remain high, pulling up secondary market prices. Secondary transactions have become more active due to high primary prices and the predominance of future projects. In Hanoi, sharply rising primary prices have pushed up the overall market, with many condominium projects seeing increases of hundreds of millions to billions of VND in a short time.

Dr. Vo Tri Thanh, Director of the Brand and Competition Development Research Institute, stated that property prices have risen far beyond reasonable levels over many years, creating a significant gap with people’s affordability.

“Adjusted for average inflation, property prices should have doubled over 10 years, but in reality, they have increased by tens of times. In 1990, a motorcycle could be traded for a house, but now it can only buy a nice window frame,” he said.

Explaining the price increase, Dr. Thanh noted that this phenomenon stems not only from economic factors but also cultural ones, as Vietnamese people view land and property as a “nest egg,” leading to consistently high ownership demand. However, the sharp rise in property prices, akin to inflation, harms the poor and middle-income groups while distorting investment structures.

He warned that if capital continues to flow heavily into one sector, the economy could suffer from the “Dutch disease.” When the real estate market becomes overly developed, attracting excessive investment and resources, it can lead to a decline in other productive sectors.

A notable consequence is the current career choice trend among young people. Many are drawn to two groups of professions: those with a “glamorous” appeal, such as showbiz, KOLs, and KOCs, and those in finance and services, where quick money can be made. Meanwhile, sectors requiring manual labor, technical skills, or direct production face increasing labor shortages.

“Dr. Nguyễn Văn Đính: How Some Developers and Distributors Use ‘Drip Feeding’ to Create Scarcity and Fuel FOMO”

According to Dr. Nguyen Van Dinh, speculative groups hoarding properties and leveraging margin trading to profit from price differences are driving housing prices even higher. Despite this, numerous projects continue to report high absorption rates, with some even selling out on the day of their launch.

Should 20% Land Allocation for Social Housing Be Replaced with Monetary Contributions?

In a recent draft on land use obligations for developers, the Ministry of Construction has introduced a provision allowing financial contributions in lieu of allocating 20% of project land for social housing construction.