According to the Ministry of Construction’s Q3 report, apartment prices in Hanoi and Ho Chi Minh City (HCMC) remain high, with an upward trend compared to the same period last year.

In Hanoi, the average primary market price ranges from VND 70–80 million per square meter, a 5.6% increase since the beginning of the year and a 33% surge compared to Q3 2024. Luxury projects have recorded significantly higher prices, reaching VND 150–300 million per square meter.

In HCMC, the average primary market price stands at around VND 75 million per square meter, stable since the year’s start but up 36% year-on-year. High-end projects are priced from VND 150 million per square meter and above.

CBRE’s report highlights that in Q3, the average primary market price for apartments in Hanoi exceeded VND 90 million per square meter of net usable area, surpassing HCMC’s average apartment price for the same period. Hanoi’s average primary market price in the last quarter was 16% higher than the previous quarter and 41% higher than the same period last year.

The continuous rise in apartment prices in major cities is making homeownership an increasingly distant dream for many residents.

Dr. Lê Xuân Nghĩa, a member of the Prime Minister’s Policy Advisory Council, emphasizes that housing is a significant challenge that only the government can address. The most pressing issue is curbing the rapid increase in real estate prices, which destabilizes the market and affects those with genuine housing needs.

According to Dr. Nghĩa, the core reason for the soaring real estate prices is the supply-demand imbalance. The limited supply is due to the restricted number of newly licensed projects, particularly in the social housing and affordable housing segments. Meanwhile, demand remains high and continues to grow.

Additionally, some real estate companies hold large land reserves but fail to develop projects, exacerbating the supply shortage. “Speculative demand exists but is not the primary cause of price increases. The root of the problem lies in the severe supply shortage, especially for products that meet real housing needs,” he stated.

Mr. Nguyễn Quốc Hiệp, Chairman of the Vietnam Association of Construction Contractors, believes that current real estate prices are heavily influenced by input costs, particularly land costs.

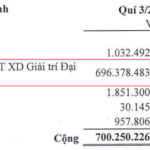

According to Mr. Hiệp, land costs currently account for the largest share of project development expenses, approximately 30% for typical real estate projects, and this figure is rising sharply. He cited a project his company is developing, where land prices were adjusted upward by 30% within just six months, significantly increasing input costs.

He proposes implementing a price control mechanism through appropriate tax policies, as without effective regulatory tools, the upward trend in real estate prices will be difficult to curb.

Dr. Nguyễn Minh Phong, former Head of Economic Research at the Hanoi Institute for Socio-Economic Development Studies, notes that Vietnam’s real estate market is facing dual trends of recovery and risk.

On one hand, projects with resolved legal and planning issues and streamlined procedures are creating significant opportunities for investors. On the other hand, overheated credit growth, localized oversupply, and non-performing loan risks are critical warnings. He believes that with proper control, opportunities will outweigh risks, but it is essential to avoid exceptions for any interest group.

Tâm Nguyên

The Bizarre Journey of a Real Estate Empire: 9X Profit Surge During the Pandemic, From Broker to Tycoon, and the Founder’s Hidden Secret

Khải Hoàn Land, once a modest player in the real estate brokerage industry, has emerged as a powerhouse, achieving a staggering ninefold profit surge during the pandemic. Today, the company is forging an empire with multi-billion-dollar projects, while its founder’s intriguing connection to Vietnamese literature remains a captivating enigma.

Cen Land Completes Payment for VND 450 Billion Bond Issuance

On October 13th, Century Land Joint Stock Company (stock code: CRE) announced the successful full repayment of both principal and interest for its VND 450 billion bond issuance (bond code: CRE202001) ahead of schedule.

Credit Policies, Tax Regulations, and Housing Inequality in Vietnam

Property prices not only reflect the physical balance of supply and demand but also serve as a mirror to the equity of opportunity distribution. When credit and tax policies disproportionately favor those who already possess assets, the system perpetuates inequality, turning real estate into a hotbed for both financial risk and eroding trust.