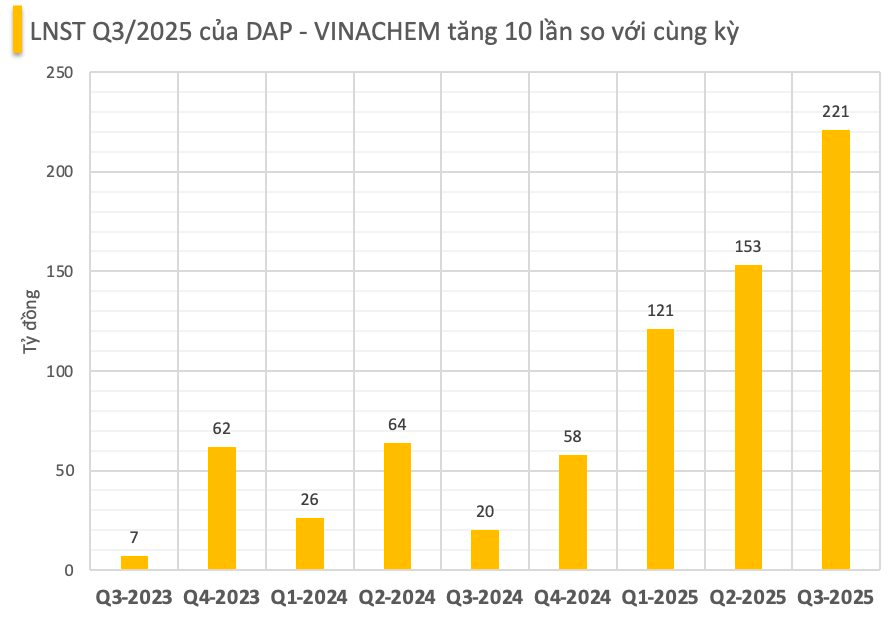

DAP – VINACHEM’s Q3 2025 Financial Highlights

DAP – VINACHEM Joint Stock Company (Stock Code: DDV) has released its Q3 2025 financial report, showcasing a remarkable 85% year-over-year surge in net revenue to VND 1,396 billion.

The company attributes this growth primarily to increased sales volume and higher average selling prices compared to the same period last year. The average selling price for the quarter stood at VND 17.74 million per ton, marking a VND 4.56 million increase year-over-year. Additionally, DAP fertilizer sales volume rose by 2,030 tons (3.8% YoY), while chemical sales contributed an additional VND 387 billion in revenue.

Consequently, pre-tax profit reached VND 276 billion, with net profit after tax hitting VND 221 billion—a tenfold increase from the previous year.

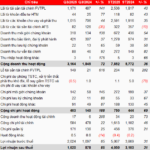

Q3 2025 Revenue and Cost Breakdown

In Q3 2025, both total revenue and total expenses increased year-over-year. However, revenue growth outpaced expense growth, driving a 988% surge in net profit after tax to VND 200.781 billion.

For the first nine months, cumulative revenue reached VND 4,175 billion—a 68% YoY increase and 120% of the annual plan. Pre-tax profit stood at VND 620 billion, nearly tripling the annual target, while net profit after tax climbed 348% YoY to VND 496 billion.

DAP – VINACHEM is majority-owned by the Vietnam Chemical Group, holding 64% of its shares.

On the stock market, DDV shares closed at VND 35,000 on October 17, up 6.38% from the previous session.

VPBank Surpasses Annual Total Asset Plan in Just 9 Months, Driven by Ecosystem Synergy

Harnessing the unique power of its diverse and expansive ecosystem, Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) has built a robust foundation, setting the stage for significant growth and breakthrough advancements in the upcoming period.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

Unveiling Sunshine Group’s Hottest Mega Projects: A Staggering $3.4 Billion Asset Portfolio Redefining the Market

Alongside impressive Q3 2025 business results, Sunshine Group has consistently delivered market-leading breakthroughs in Hanoi and Ho Chi Minh City with a series of projects priced up to 25% lower than comparable developments in the same areas.

Hue Holds Over 1,500 Residential Units in Real Estate Project Inventories

The real estate market in Hue City witnessed a significant surge in inventory during Q3/2025, with 1,512 residential units across various projects remaining unsold—a notable increase of 380 units compared to the previous quarter. Despite this, authorities have noted positive signs of recovery in the market.