|

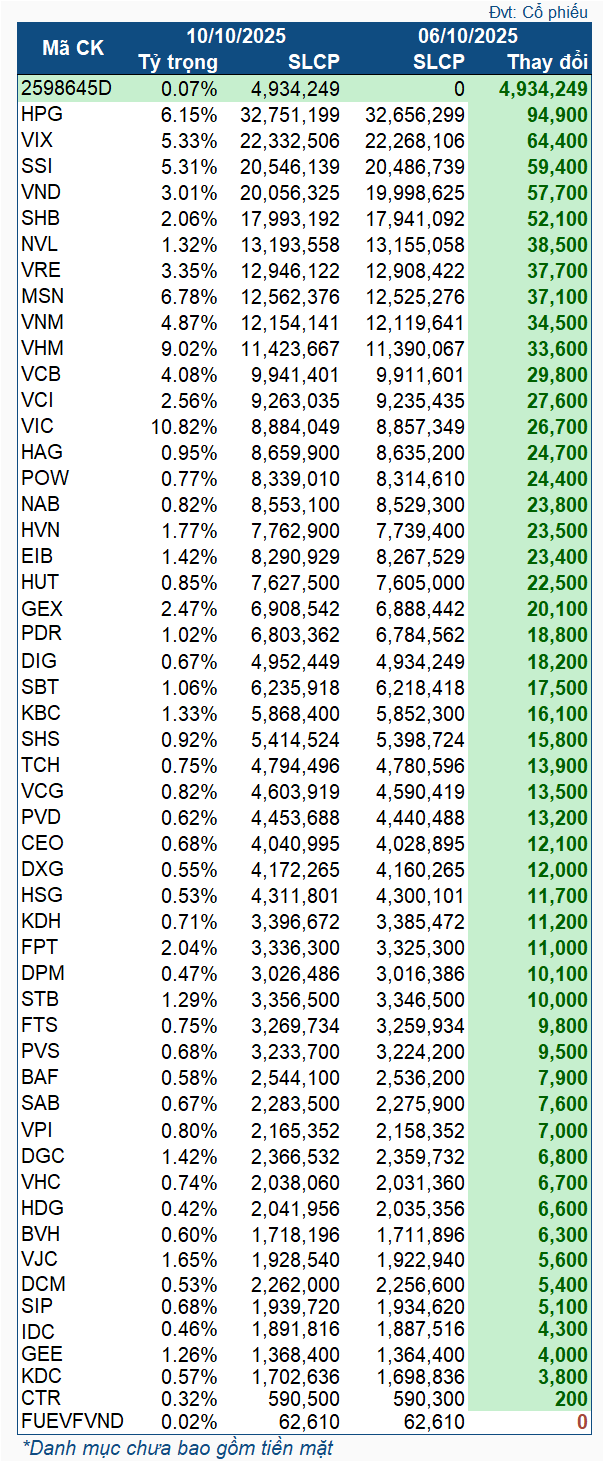

VNM ETF Stock Changes for the Week of October 6-10

|

During this period, HPG saw the strongest net buying in terms of volume, with nearly 95,000 shares. VIX, SSI, and VND followed closely, with net volumes around 60,000 shares each. Next was SHB, with over 52,000 shares. Conversely, no stocks were net sold.

Additionally, the fund acquired more than 4.9 million warrants for DIG (2598645D). These warrants are part of DIG‘s rights issue to existing shareholders, totaling 150 million shares, with an expected offering price of 12,000 VND per share. The rights ratio is 1,000:232 (1 share receives 1 warrant, and 1,000 warrants allow the purchase of 232 new shares). The expected capital raised is 1,200 billion VND, which will be used to fund payments for the CSJ and Vi Thanh projects.

The net buying activity of VNM ETF occurred during the week when global index provider FTSE Russell announced Vietnam’s upgrade (on October 8) from Frontier Market status to Secondary Emerging Market status.

“The FTSE Russell Index Governance Board acknowledges the progress made by Vietnamese market regulators in developing the market and confirms that Vietnam has met all criteria for Secondary Emerging Market classification under the Equity Country Classification framework,” FTSE Russell stated.

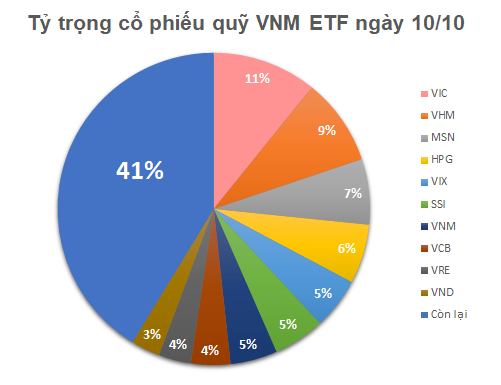

As of October 10, the total assets under management of VNM ETF exceeded 590 million USD, up from 570 million USD on October 6. The assets are allocated across 51 stocks, 1 fund certificate, and 1 warrant. The top holdings by weight are VIC at over 10.8%, followed by VHM (9.02%), MSN (6.78%), HPG (6.15%), and VIX (5.33%).

– 16:14 15/10/2025

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

Unraveling the Psychological Knots Post-Promotion

While it’s premature to declare a new bull run in Vietnam’s stock market, last week witnessed several encouraging signs. The VN-Index closed at a record high of 1,747 points, marking the first time the index surpassed the 1,700 threshold since FTSE Russell upgraded Vietnam to “Secondary Emerging Market” status on October 8th.

Unlocking Opportunities: VPS Securities’ Vision with VCK Code – Three Pillars for Success

At the “VPS The Next Chapter” event, VPS Securities unveiled its anticipated stock code, VCK. During the event, Mr. Nguyễn Lâm Dũng, Chairman of the Board and CEO of VPS, shared insights into the leading brokerage firm’s future business strategies.