Caution dominated the afternoon session, preventing the VN-Index from sustaining its upward momentum. The VN-Index closed the October 15th session at 1,757, marking a 3.11-point decline compared to the previous session. Market liquidity remained robust, reaching nearly VND 38 trillion.

Foreign trading activity emerged as a notable drawback, with net selling totaling VND 883 billion across the market.

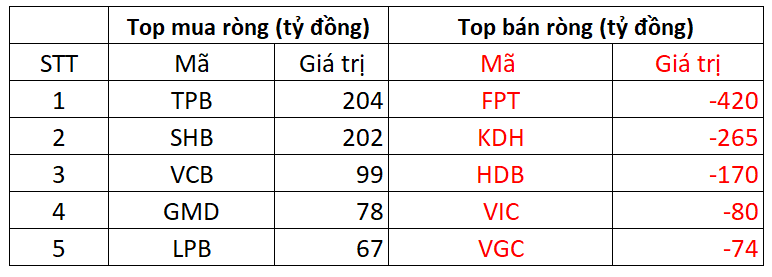

On HOSE, foreign investors net sold VND 829 billion

On the buying side, TPB led foreign acquisitions on HOSE with over VND 204 billion. SHB followed closely, attracting VND 202 billion in purchases. Additionally, VCB and GMD saw significant buying interest, with VND 99 billion and VND 78 billion, respectively.

Conversely, FPT experienced the heaviest foreign selling pressure, with VND 420 billion. KDH and HDB also faced significant sell-offs, with VND 265 billion and VND 170 billion, respectively.

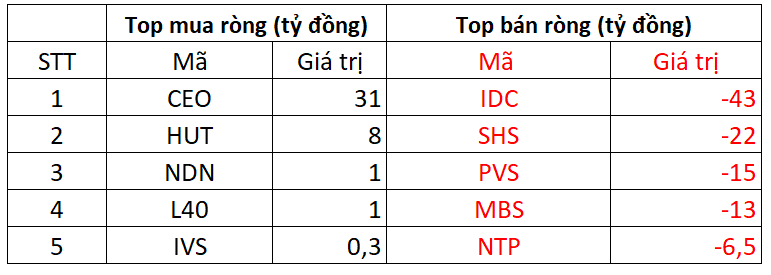

On HNX, foreign investors net sold VND 68 billion

In terms of purchases, CEO topped the list with VND 31 billion in net buying. HUT followed with VND 8 billion. Foreign investors also allocated smaller amounts to NDN, L40, and IVS.

Capture1.PNG

On the selling side, IDC faced the most significant foreign selling pressure, nearing VND 43 billion. SHS followed with VND 22 billion, while PVS and MBS saw sell-offs ranging from VND 13 billion to VND 22 billion.

On UPCOM, foreign investors net bought VND 14 billion

MCH led foreign purchases with VND 16 billion. VEA and VVS also attracted modest buying interest, each seeing a few billion dong in net purchases.

Conversely, QNS faced foreign net selling of VND 5 billion. Other stocks like HBC and HPT also experienced net selling pressure.

Mai Chi

“Vietnamese Brokerages Deploy VND 400 Billion to Scoop Up Stocks Amid Market Dip: Which Tickers Are Top Targets for Proprietary Traders?”

Proprietary trading desks at securities companies collectively net bought VND369 billion on the Ho Chi Minh Stock Exchange (HOSE), signaling a notable shift in market sentiment and strategic positioning.

International Dairy Brand Lof Seeks $65 Million Bank Loan

International Dairy Lof seeks additional funding of VND 700 billion from BIDV and VND 800 billion from VietinBank to bolster working capital and support ongoing production and business operations.