Despite regional stock markets hovering near peaks, FPT shares continue their downward spiral, probing new lows. By the close of October 15th, FPT shed an additional 3% in value, dipping below 90,000 VND per share. This marks the lowest point in approximately 18 months. Notably, the current price even undercuts the tariff bottom witnessed in mid-April this year.

Compared to the all-time high set in the final days of the Year of the Dragon 2024 (January 23-24, 2025), FPT shares have lost nearly 33% of their value. Market capitalization has consequently plummeted by over 88 trillion VND, settling at around 153 trillion VND. This figure no longer secures FPT a spot in the top 10 by market cap, a stark contrast to its position as the largest private conglomerate on the stock exchange just last year.

Significantly, selling pressure has predominantly originated from foreign investors. Since the beginning of 2025, foreign investors have net sold over 17 trillion VND worth of shares in Vietnam’s leading technology company. No other stock has faced such intense selling pressure during this period. This has left FPT with a foreign ownership room of over 216 million shares (approximately 13% of total outstanding shares), a situation rarely seen before.

Thus, in just a few months, the narrative surrounding FPT shares has undergone a dramatic shift, starkly contrasting the optimism at the start of the Year of the Snake 2025. Recall that during FPT’s spring opening ceremony, Chairman Truong Gia Binh drew parallels between Yin-Yang and the Five Elements, highlighting favorable conditions for the corporation’s growth.

“All factors align harmoniously for FPT, and we enter the Year of the Snake 2025 with abundant prosperity. In other words, we cannot refuse the opportunities that come our way, as they are too abundant to ignore,” shared Chairman Binh. At that time, few could have anticipated the current “gloomy” scenario for FPT shares.

However, the corporation’s leadership foresaw challenges early on. During the annual shareholders’ meeting in mid-April, Mr. Truong Gia Binh characterized 2025 as an exceptionally difficult year. The primary reason cited was the slowdown in global technology spending, which impacted overseas IT revenue—a key growth driver for FPT.

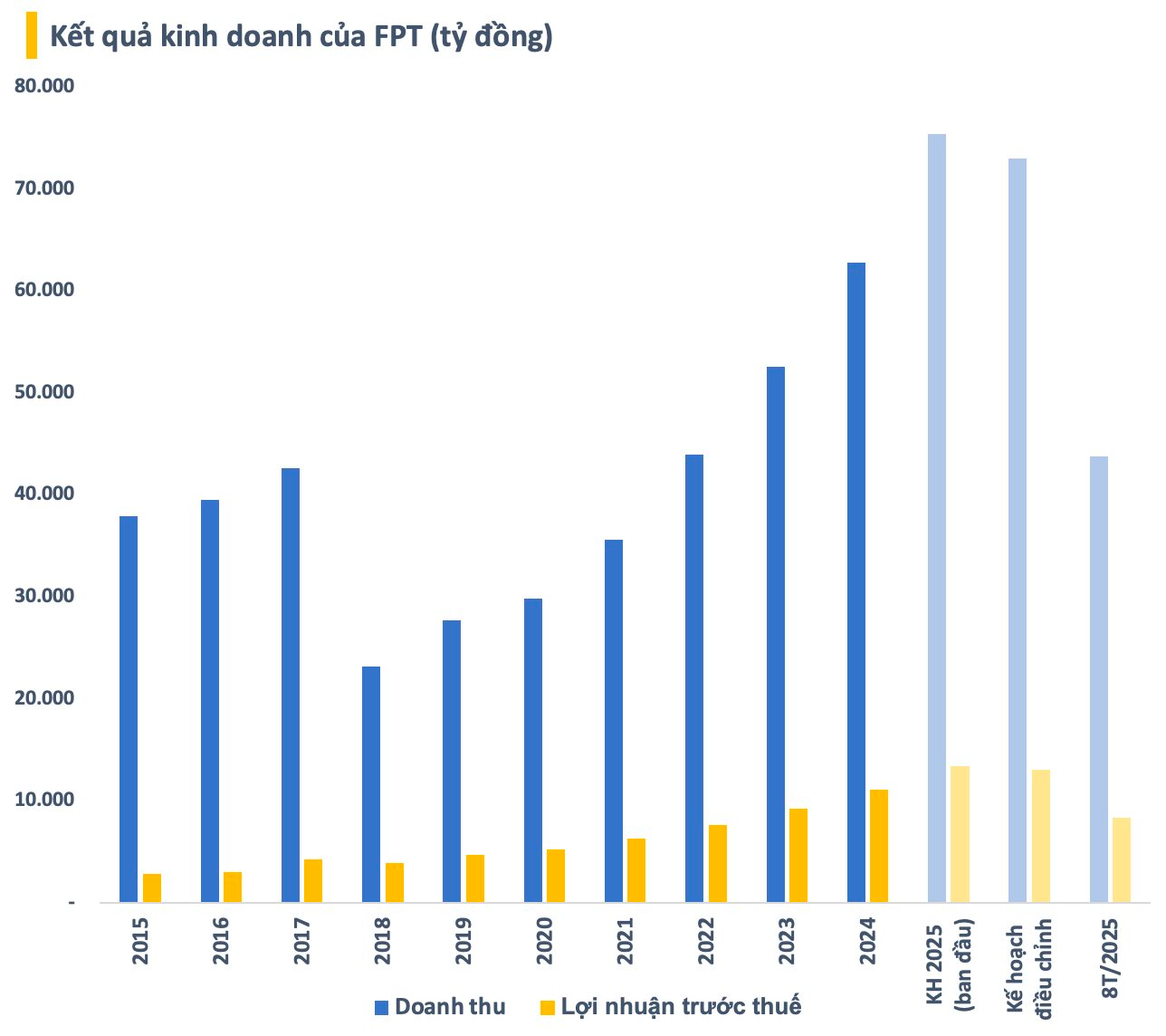

On the other hand, Chairman Binh viewed 2025 as an unimaginable opportunity. Consequently, FPT shareholders approved an ambitious business plan for 2025, targeting record revenue of 75.4 trillion VND and pre-tax profit of 13.395 trillion VND, representing increases of 20% and 21%, respectively, compared to 2024. However, the corporation left open the possibility of adjusting these plans.

Mr. Nguyen Van Khoa, CEO of FPT, noted that the plan had been approved by the Board of Directors at the beginning of the year. Given global uncertainties, FPT also sought shareholder authorization for the Board to adjust the 2025 business plan as necessary.

By mid-August, during an investor meeting, Vietcap’s update revealed that FPT’s management had revised the plan under a new baseline scenario, targeting 15% revenue growth and 18-19% profit growth year-over-year. These figures are lower than the initial targets set at the shareholders’ meeting of 20% revenue growth and 21% pre-tax profit growth.

Under the new plan, FPT aims for 2025 revenue and pre-tax profit of approximately 73 trillion VND and 13 trillion VND, respectively.

In terms of business results, for the first eight months of the year, FPT recorded revenue of 43.818 trillion VND, up 10.5% year-over-year. Pre-tax profit reached 8.315 trillion VND, a 17.5% increase from the same period last year. Notably, the growth in business results for the eight months remains below the newly adjusted baseline scenario.

Vietstock Daily 16/10/2025: Clear Market Polarization?

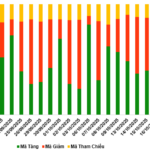

The VN-Index remains volatile, with declining liquidity reflecting investors’ cautious sentiment. Currently, the Stochastic Oscillator has issued a sell signal in the overbought territory, indicating heightened short-term correction risks. Should selling pressure persist, the index is likely to retest the 1,700–1,711 point range, aligning with the September 2025 peak.

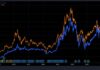

VIC Stock Hits Record High of Over 200,000 VND/Share, VN-Index Extends Winning Streak

Vingroup’s VIC stock has shattered records, soaring to an all-time high of over 205,000 VND per share. This unprecedented surge not only marks a historic milestone for the conglomerate but also propels the market forward, adding more than 17 points to its cumulative gains.