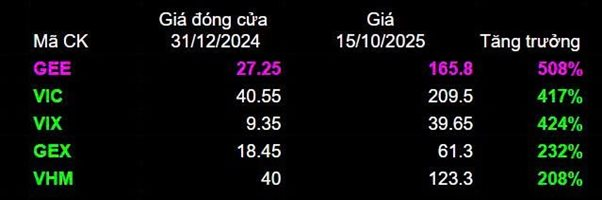

Gelex Electric’s GEE stock has witnessed a remarkable price surge over the first nine months of 2025. From a closing price of VND 27,250 per share on December 31, 2024, GEE’s market price soared to VND 165,800 per share in today’s session (October 15), marking a staggering 508% increase. In the last four sessions, GEE hit its daily limit up three times, including today’s trading session.

This rally has propelled the company’s market capitalization to over VND 60 trillion, equivalent to USD 2.3 billion.

In terms of growth rate, GEE has outperformed its industry peers. Its 508% growth has significantly surpassed VIC’s 417% increase. Additionally, GEE has outshined other stocks in the group, such as VIX (424%), GEX (249%), and VHM (208%), solidifying its leadership in this year’s price performance race.

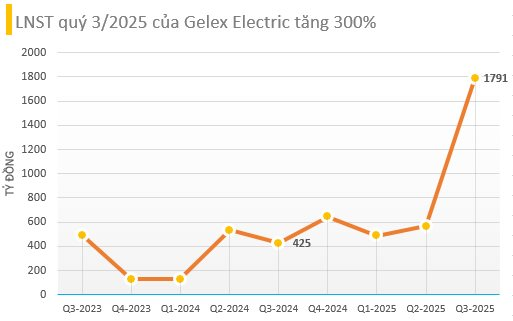

GEE’s price momentum is underpinned by its robust Q3 2025 financial results. According to the consolidated financial report, Gelex Electric recorded a post-tax profit of VND 1,791.7 billion, a 329% year-on-year increase. The company’s management attributed this success to optimized production costs, which improved gross profit margins, alongside gains from capital restructuring activities.

The separate financial report reveals GEE’s post-tax profit reached VND 1,747.2 billion, a 650.6% surge compared to the same period last year. The primary driver was financial activity revenue of VND 2,085 billion, largely from investment sales proceeds, dividends, and profit-sharing.

A key catalyst for GEE’s rally is the IPO plan of its subsidiary, Gelex Infrastructure.

This move is expected to not only raise substantial capital for industrial zone and renewable energy projects but also unlock value across the entire ecosystem.

GGG Increases Accumulated Losses to Nearly VND 357 Billion, Prepares to Issue 20 Million Shares for Capital Raising to Upgrade Factory

Amidst ongoing financial challenges, CTCP Ô tô Giải Phóng (UPCoM: GGG) reported another quarter of losses in Q3/2025, pushing its cumulative deficit to nearly 357 billion VND as of September 30, 2025.

TCBS Secures HOSE Listing Approval Following $460 Million IPO Success

Following the successful completion of its IPO of over 231 million shares, Technocom Securities JSC (TCBS) has been approved for listing on the Ho Chi Minh City Stock Exchange (HOSE) under the ticker symbol TCX. This Techcombank subsidiary is projected to achieve a market capitalization exceeding 110 trillion VND, positioning it as the industry leader in the securities sector.