As the trend of cashless payments continues to grow, credit cards are becoming a preferred choice for many customers due to their buy-now-pay-later feature, enabling users to manage their spending and cash flow effectively. Additionally, QR code payments have gained popularity for their speed, convenience, and security.

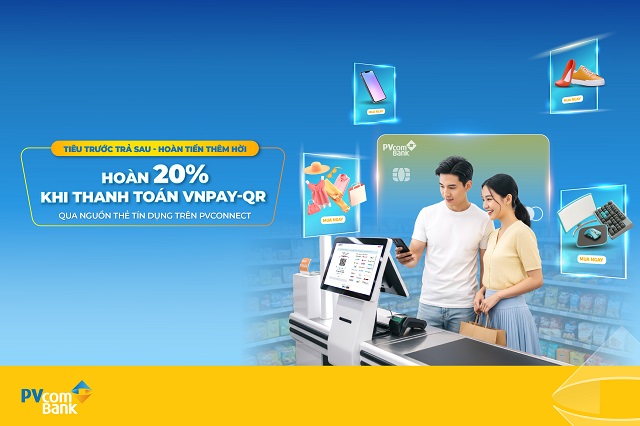

Get 20% cashback on VNPAY-QR payments using PVcomBank credit cards

|

Understanding customer needs, PVcomBank recently launched the VNPAY-QR payment solution using credit cards, enhancing the digital payment experience for its users. Customers can now access the PVConnect digital banking app, scan the VNPAY-QR code at the point of sale, and select their credit card as the payment source for instant transactions.

Excitingly, PVcomBank Mastercard holders can enjoy 20% cashback on VNPAY-QR payments made with their credit cards, up to a maximum of 30,000 VND. This promotional offer is valid until January 15, 2026, and applies once per month for PVcomBank Mastercard credit cardholders who make VNPAY-QR transactions of 50,000 VND or more, recorded on both primary and supplementary cards.

In addition to the convenience of paying later without worrying about insufficient funds, customers can enjoy an interest-free period of up to 55 days when using their credit cards for VNPAY-QR payments. Transaction limits are set at 200 million VND per transaction per day for Platinum/World cardholders and 100 million VND per transaction per day for Standard cardholders.

The VNPAY-QR payment solution using credit cards allows PVcomBank customers to seamlessly switch between their payment accounts and credit cards, providing better control over their spending and cash flow. For those who prefer using their credit cards, the default payment source can be set to the credit card for VNPAY-QR transactions, streamlining the process and reducing transaction steps.

With all transactions conducted 100% online via the PVConnect app, customers no longer need physical cards or cash, saving time while ensuring security and data privacy. Furthermore, PVcomBank credit cardholders can enjoy exclusive benefits such as earning PVOne points for every transaction, redeemable for over 2,000 attractive rewards; 0% installment plans with flexible terms of up to 12 months at major retailers nationwide; and exclusive offers within the WOW Rewards ecosystem.

– 2:30 PM, October 17, 2025

QR Code Payments: Revolutionizing Every Corner of Life

Payment infrastructure serves as the lifeblood of the economy, ensuring the seamless flow of capital and fostering stability and sustainable growth.

“One-Tap Payments with Eximbank Visa on Samsung Pay”

Following the successful integration of Mastercard with Samsung Pay, Vietnam Export-Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) is expanding its services to include Visa cards. This move offers customers even more options for a modern, secure, and convenient payment experience.