Gold prices have surged significantly over the past year, yielding substantial profits for long-term investors. However, as prices surpassed the historic high of 160 million VND per tael, analysts suggest that the upward momentum is narrowing, with increasing risks of a correction if the U.S. Federal Reserve (Fed) cuts interest rates sooner than expected. Consequently, many investors are locking in profits by restructuring their portfolios, seeking dual-yield investment channels that offer both asset appreciation and long-term cash flow.

“With just 7 taels of gold, equivalent to 1 billion VND, I was able to purchase a 100m² coastal plot in areas like Dong Hai Ward (Khanh Hoa) or Vung Tau Ward (Ho Chi Minh City). Instead of holding gold at its peak, I and several close investors decided to take profits and shift to coastal land. We anticipate a 30–50% annual return on these plots near major infrastructure projects set to complete soon,” shared Mr. Vu The Hoa, an investor from Hanoi.

Similarly, investor Le Phuong Anh (Ho Chi Minh City) remarked, “I bought gold in early 2024 when it was around 70 million VND per tael. Now that prices have doubled, I’ve sold a portion. With the proceeds of approximately 1 billion VND, equivalent to 500 million VND at the time of purchase, I acquired a 100m² coastal plot in Ninh Thuan (old). I expect my assets to double once the coastal road infrastructure is completed.”

Data from Batdongsan.com.vn reveals a notable shift in investment focus during Q3/2025. In Hanoi, real estate interest dropped by 22% compared to Q3/2024, while Ho Chi Minh City remained stable. Conversely, satellite and coastal markets accelerated: areas around Hanoi saw an 11% increase. In the South, Binh Duong (old) captured 84% of total interest, Dong Nai rose by 38%, Ba Ria – Vung Tau (old) by 34%, and Long An by 28%. Central Vietnam maintained steady growth, with a 13% increase in interest compared to the same period in 2024.

Batdongsan’s data also highlights impressive price growth in coastal land over the past three years: in Da Nang, land prices rose by 68%, and apartments by 50%. Specifically, Ngu Hanh Son and Son Tra districts saw increases of 33% and 41%, respectively. Hai Phong recorded a 38% rise, though interest levels have not fully recovered.

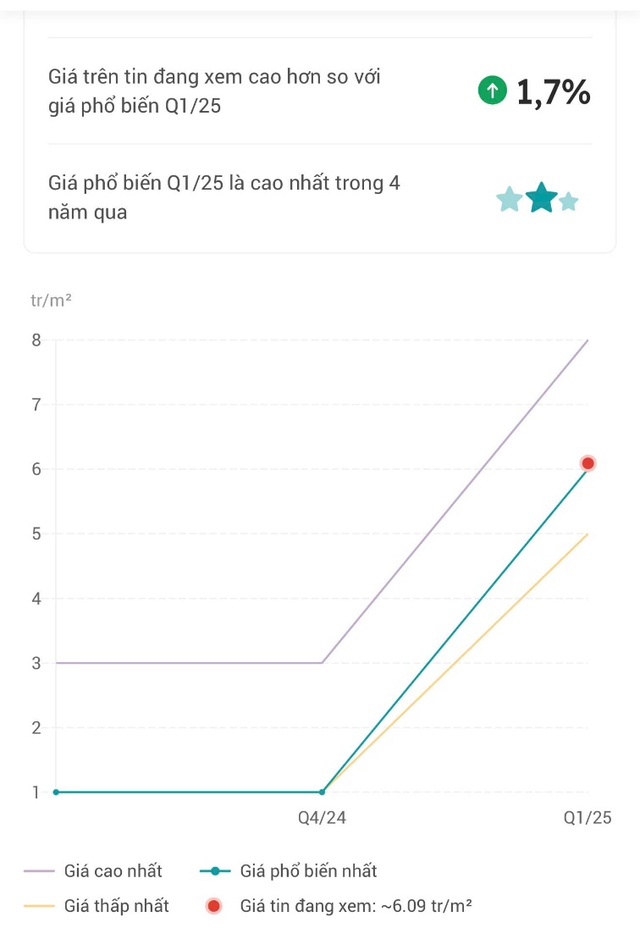

In Ninh Thuan (old), certain coastal areas like An Hai and Ninh Phuoc saw land prices skyrocket by 500% in just 12 months, while central Phan Rang prices increased by only 10% year-over-year.

According to experts from Hacom Holdings, these figures not only reflect the surging demand for coastal land but also underscore confidence in tourism infrastructure, industrial development, and coastal urbanization—a key trend in Vietnam’s next decade. As capital shifts from major cities to areas with completed infrastructure, large land reserves, and lower prices, forward-thinking investors are securing land in emerging regions rather than fully developed ones.

Land prices in An Hai, Ninh Phuoc, Ninh Thuan surged by 500% in 12 months, source: batdongsan.com.vn

Additionally, the Ministry of Finance reported that Vietnam’s Q3/2025 GDP grew by 8.23%, the highest since 2011 (excluding the post-COVID-19 period in 2022). Over the first three quarters, GDP increased by 7.84%, nearing the annual target of 8%. Notably, public spending in the first nine months reached 440 trillion VND, up 37%, primarily allocated to inter-regional infrastructure, coastal highways, airports, and logistics—key drivers of coastal real estate value.

Meanwhile, FDI continues to flow strongly into Vietnam, with real estate ranking among the top three sectors attracting investment. This indicates that international investors recognize the long-term potential of the market, particularly in rapidly urbanizing areas with extensive coastal land reserves.

A South Central Coast coastal project gaining investor attention

According to Tran Ngoc That, Deputy Director of Hacom Holdings, three factors are driving the shift from gold to coastal land: booming inter-regional infrastructure (North-South Expressway, Long Thanh Airport, Phan Thiet Airport, Thanh Son Airport in old Ninh Thuan, Chu Lai Airport, etc.), accelerated coastal urbanization and tourism, and relatively low land prices compared to potential. Many coastal areas are priced at just 1/5–1/10 of central urban prices, with significant growth potential. “Coastal land is becoming a profit hub, making it understandable why investors are rebalancing portfolios from gold to real estate, from safe-haven to growth assets,” he explained.

Expert Tran Binh An, Director of Teen Economics—a free investment advisory for young investors, predicts that coastal land could become a strategic asset class from 2025–2030, similar to gold’s role from 2010–2020. Unlike gold, which merely stores value, coastal land offers both asset appreciation and income generation, benefiting directly from infrastructure and tourism growth. “With gold prices at record highs and coastal land prices in some provinces still at rock bottom, the shift to coastal real estate is inevitable. Coastal land in Da Nang, Ninh Thuan, Ba Ria – Vung Tau, Binh Thuan, and Quang Ngai is poised to become a new investment hotspot,” Ms. Tran Binh An emphasized.

The Grand Vision of Can Gio’s Landmark Reclamation Project: A Six-Month Progress Update

After nearly six months of groundbreaking, the bustling construction site of the Can Gio Coastal Tourism Urban Area is a hive of activity, with hundreds of machines and barges operating non-stop.

Surge in Real Estate Stocks: Unraveling the Market Momentum

A surge in investment is flowing into the real estate sector, with DIG, DXG, NVL, and PDR leading the market as the most liquid stocks.