|

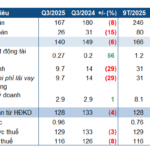

SVH’s Q3/2025 Business Targets

Source: VietstockFinance

|

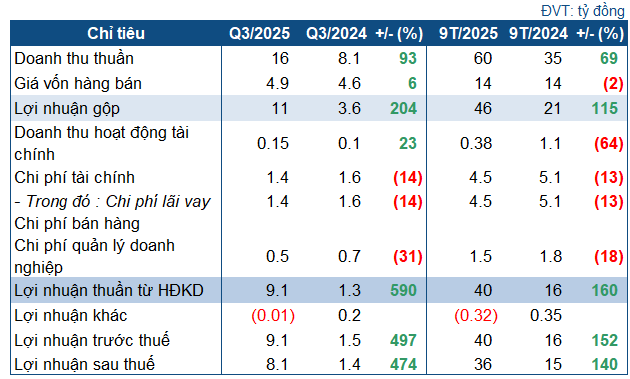

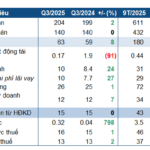

In Q3, SVH achieved nearly VND 16 billion in net revenue, a 93% increase year-over-year. Cost of goods sold rose slightly, driving gross profit to surge to VND 11 billion, triple that of the same period last year.

Expenses were significantly reduced, with financial costs down 14% to VND 1.4 billion and corporate management costs down 31% to over VND 500 million. Ultimately, post-tax profit reached over VND 8.1 billion, 5.7 times higher than the same period last year.

As a hydropower company, SVH’s profits depend on electricity sales. The company reported favorable weather conditions in Central Vietnam and stable machinery operations in 2025, leading to strong growth in output and revenue compared to the same period last year.

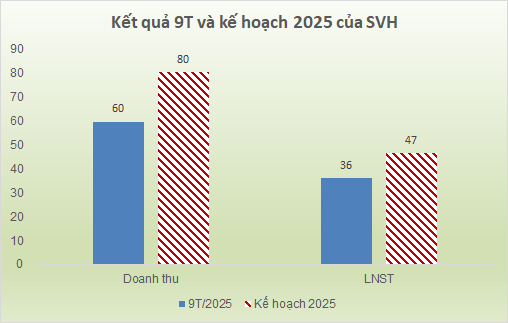

For the first nine months of 2025, SVH recorded VND 60 billion in net revenue and VND 35 billion in post-tax profit, up 68% and 140% year-over-year, respectively. According to the 2025 Annual General Meeting plan, the company has achieved 74% of its revenue target and over 77% of its full-year post-tax profit goal.

Source: VietstockFinance

|

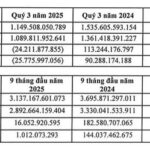

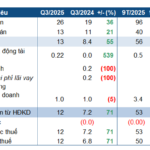

As of September 30, 2025, SVH’s total assets reached VND 514 billion, a slight increase from the beginning of the year, primarily in long-term assets. Short-term assets totaled VND 79 billion, down 7%, with only VND 6.5 billion in cash, a 48% decrease.

Another notable item is the increase in construction in progress costs from VND 241 billion to VND 257 billion.

On the capital side, the company’s total liabilities decreased by over 10% from the beginning of the year to VND 255 billion, mainly due to reduced short-term loans. Short-term debt decreased by 28% to nearly VND 43 billion, while long-term debt slightly decreased to VND 188 billion.

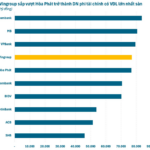

In recent developments, during Q3, SVH’s parent company, Trung Son Power, announced plans to divest its entire 86.01% stake (over 12.7 million shares) to restructure its investment portfolio. Trung Son registered to sell during September 8 – October 6 but was unsuccessful, and later re-registered for October 16 – November 14. SVH’s Chairman, Mr. Le Thai Hung, also serves as the CEO of Trung Son Power. In addition to the parent company’s holdings, Mr. Hung personally owns nearly 1.5 million SVH shares, equivalent to 10.03% of the capital, making him the second-largest shareholder. The transaction is valued at VND 76.5 billion, based on SVH shares priced at VND 6,000 per share, with no liquidity for several years.

Notably, Trung Son Power acquired these shares between March and May 2019 through two matched transactions on the exchange at around VND 10,000 per share, totaling over VND 127 billion. Compared to the current stagnant price of VND 6,000 per share, this investment is estimated to be at a 40% loss.

– 10:48 17/10/2025

Vietnam’s Largest Auto Distributor Reports Q3 Profit Surging 59x Year-on-Year, Stock Hits Daily Limit Up

In the first nine months of the year, the company achieved a remarkable net revenue of 20,547 billion VND, marking a 27% increase compared to the same period in 2024. The parent company’s post-tax profit soared to 450 billion VND, an astounding 8.7-fold growth year-over-year.

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.