According to the inspection conclusion published on October 17, the Government Inspectorate has transferred case files involving suspected violations at Novaland and related companies to the Ministry of Public Security for further investigation and handling. Novaland has also issued an official response to these matters.

The results of the Government Inspectorate’s in-depth inspection of the corporate bond market from 2015 to 2023, conducted across 67 major issuing organizations including banks and large corporations, revealed that the Novaland group and its affiliates were a key focus of the inspection. Numerous complex cases have been referred to investigative agencies for clarification.

Regarding Novaland Group, the conclusion highlights a serious violation involving the creation of transactions to withdraw funds from bond capital. Specifically, Ms. Võ Thị Kim Khoa received funds from Nova Housing Trading JSC to contribute capital to The Century Golden Real Estate Company.

However, the inspection concluded that “this capital contribution did not exist in reality, as most of it was transferred on the same day.” Subsequently, Novaland used VND 1.5 trillion raised from bond issuance to repurchase this “fictitious” capital contribution.

The funds were then circulated through multiple intermediary companies by the individual recipient and ultimately returned to Nova Housing Trading JSC.

A corner of Aqua City, Dong Nai. Photo: Novaland

This method is alleged to have been systematically repeated across multiple companies.

Aqua City LLC used VND 4.6 trillion from bond issuance to repurchase capital contributions in Phuc Hoa and Green Land. This capital was also formed from funds of Nova Housing Trading JSC and transferred immediately after contribution.

Similarly, Unity Real Estate LLC (VND 584 billion) and Lucky House Investment Services JSC (VND 400 billion) conducted transactions to repurchase capital contributions created in a similar manner.

The Government Inspectorate concluded that a total of approximately VND 7,084 billion from these companies was transferred back to Nova Housing Trading JSC.

Additionally, the conclusion highlighted the act of raising trillions of dong for real estate projects that did not meet legal conditions for sale or business cooperation. GreenWich Company issued VND 2,000 billion in bonds to invest in the Cu Lao Phuoc Hung Urban Area (Dong Nai).

After receiving the funds, the partner transferred the money to various parties, “showing signs of misuse,” while GreenWich had overdue debt of VND 1,812 billion in principal and interest as of June 2023.

Similarly, BNP Global issued VND 2,100 billion for the Mui Yen project (Binh Thuan) despite the project lacking a construction permit. Notably, VND 1,000 billion of this amount was seized by SCB Bank after being transferred through intermediary companies. BNP Global currently has overdue debt of VND 1,216 billion and is deemed “unable to rectify the situation.”

Furthermore, Residence Company (VND 3,000 billion) and Gia Duc Real Estate LLC (VND 1,300 billion) also issued bonds to deposit for purchasing villas at the Nova World Phan Thiet project, while the project did not meet legal conditions for sale.

Response from Novaland

In response to the above, Novaland issued an official statement. The company confirmed a total bond debt of VND 34,878 billion as of June 30, 2023, and emphasized its restructuring efforts. As of September 30, 2025, Novaland reported settling VND 15,319 billion (nearly 44% of total debt), reducing the remaining debt to VND 19,559 billion.

Regarding the purchase of “non-substantive” capital contributions, Novaland asserted no involvement in the seller’s prior transactions and stated that at the time of the transaction, the seller was the legal owner who had committed to the legality of the capital contribution.

Concerning information disclosure deficiencies, the company explained that these arose from objective, force majeure events such as the Covid-19 pandemic and were promptly rectified afterward. Novaland also affirmed its responsibility in managing capital and using funds for approved purposes.

The company stated it had proactively submitted explanations to the Government Inspectorate and pledged transparent cooperation with authorities to clarify issues, while swiftly addressing shortcomings to ensure bondholders’ rights.

Novaland CEO Awarded Nearly 15 Million ESOP Shares

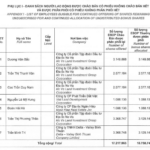

Following Novaland Group’s successful ESOP share offering and ESOP bonus share issuance to employees, NVL CEO Dương Văn Bắc acquired 7.34 million ESOP shares and received an additional 7.34 million ESOP bonus shares. Meanwhile, Bùi Đạt Chương, brother of Novaland Chairman Bùi Thành Nhơn, purchased 1.5 million ESOP shares and was granted 1.5 million ESOP bonus shares.

Novaland Surges Past 20.4 Trillion VND in Chartered Capital Following Two Successful Share Issuances

On October 9th, Novaland successfully completed two rounds of share issuance, offering over 97 million shares to its employees. This strategic move resulted in a significant increase in the company’s chartered capital, surpassing 20.4 trillion VND.

Novaland CEO Bags Nearly 15 Million ESOP Shares at 74 Billion VND, Pocketing Over 158 Billion VND in Gains

As of October 2, 2025, Novaland employees have successfully subscribed and paid for over 31.53 million ESOP shares out of the planned 48.75 million shares offered. With 17.22 million shares remaining unsold, Novaland’s Board of Directors will continue offering these ESOP shares to company employees at a price of 10,000 VND per share.

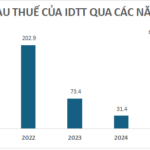

Industrial Park Investor Thu Thua Raises $100 Billion Through Bond Issuance

On September 30, 2025, Thu Thua Industrial and Urban Development Joint Stock Company (IDTT) issued a bond tranche IDT12501 with a total value of 100 billion VND.