In a newly released report, KBSV Securities assesses that Vietnam’s stock market has shown positive developments in the first nine months of 2025, marked by three distinct phases of volatility.

The first phase spanned from the beginning of the year until the announcement of countervailing tariffs on April 2nd. During this period, the VN-Index rose steadily, fueled by expectations of domestic economic stimulus policies and positive macroeconomic indicators, alongside robust corporate earnings.

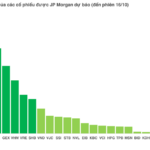

The second phase witnessed significant market turbulence, with a sharp decline until the temporary suspension of countervailing tariffs was announced on April 9th. Subsequently, the market rebounded strongly until mid-August, driven notably by the performance of Vingroup-affiliated stocks.

The third phase extended through the end of Q3, with the market trading sideways as investors awaited FTSE’s reclassification announcement. By the end of Q3 2025, the VN-Index had surged 31% year-to-date, while trading volumes also increased by 31% compared to the same period last year.

Positive Outlook for Q4 2025

Entering Q4, KBSV anticipates that the growth drivers established in recent quarters will continue to strengthen and expand.

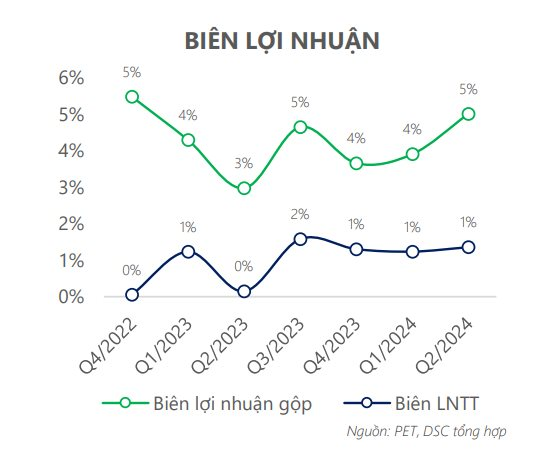

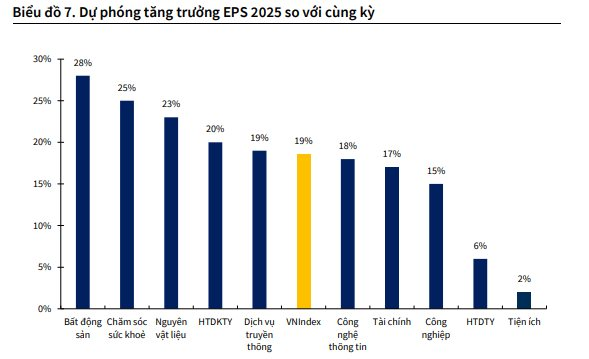

Specifically, listed companies’ earnings are expected to maintain their high growth trajectory. KBSV has revised its full-year EPS growth forecast for the market upward to 18.6% (from 16.7% in the 2025 Market Outlook report). This adjustment reflects a more optimistic macroeconomic outlook and improved operational efficiency among businesses.

Alongside accommodative fiscal and monetary policies, KBSV highlights government efforts to bolster the private sector, focusing on key industrial and financial sectors, while removing policy and legal barriers. These measures have proven effective in aiding business recovery, deemed appropriate amid slowing FDI inflows due to tariff impacts.

Supportive Policies and Global Environment Underpin Growth

Accommodative fiscal and monetary policies are expected to persist, supporting the 8%+ GDP growth target for 2025 and 10% for 2026. While exchange rate pressures and inflation risks may limit policy flexibility, interest rates are projected to remain low (or rise slightly) through year-end. This environment should facilitate robust credit growth, estimated at 20% year-on-year.

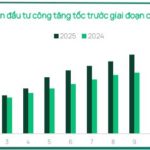

Additionally, accelerated public investment disbursement, private sector support, and real estate sector relief will remain key drivers for the stock market in Q4 2025.

Globally, the macroeconomic environment appears favorable, with expectations of two Fed rate cuts in H2 2025. Global equity markets continue to benefit from major central banks’ easing stance, while the world economy sustains its recovery momentum, albeit at a slower pace.

KBSV believes that the most significant uncertainties related to global trade tensions have subsided following the U.S. countervailing tariff announcement in late July 2025. This development sets the stage for foreign capital inflows to return to Vietnam, particularly after FTSE’s September 2026 emerging market upgrade announcement. Transshipment-related tax risks are expected to be deferred to 2026.

VN-Index Projected to Reach 1,814 by Year-End

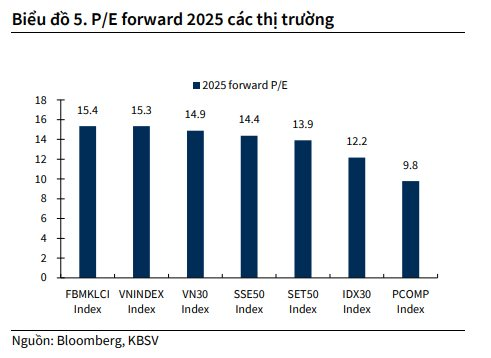

KBSV has revised its year-end 2025 VN-Index target upward to 1,814 (from 1,530 in the previous report), corresponding to 18.6% EPS growth and a P/E ratio of approximately 16.7x – in line with the 5-year historical average.

This more optimistic valuation assumes that transshipment-related tariff risks are deferred to H1 2026. Meanwhile, domestic growth drivers remain intact, including low interest rates, credit expansion, real estate support policies, and initiatives to boost domestic consumption – all aimed at achieving the 8%+ GDP growth target.

Vietnam’s official upgrade to emerging market status by FTSE is another factor expected to enhance valuations and attract foreign capital inflows.

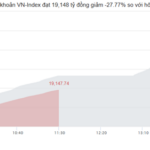

Market Pulse 15/10: VN-Index Closes in the Red, Financial and Tech Sectors Buck the Trend

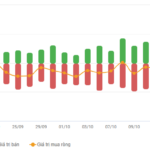

At the close of trading, the VN-Index dipped 3.11 points (-0.18%), settling at 1,757.95 points, while the HNX-Index climbed 0.79 points (+0.29%), reaching 276.12 points. Market breadth favored decliners, with 446 stocks closing lower compared to 257 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.