Source: VietstockFinance

|

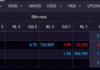

From below VND 50,000 per share in early April, the stock price of MSN has surged by over 80% in just six months. Over the past 12 months, the stock has improved by approximately 12%, with an average trading volume of 6.6 million shares per session.

| Price Movement of MSN Stock from 2023 to Present |

Previously, on October 16th, a notable highlight occurred when the trading volume of MSN via negotiated transactions soared to over 44.1 million shares, equivalent to a value of more than VND 3,473 billion. The significant rise in Masan’s stock is attributed to the large-scale share offering by SK Invest VINA II Pte. Ltd, a subsidiary of SK Group (South Korea), which is finalizing the sale of approximately 42.6 million MSN shares, valued at around USD 127 million, through negotiated transactions.

The offering price was set in the range of VND 78,000 to 79,300 per share, with registration and allocation taking place from October 15th to 16th, and the settlement date expected on October 20th. Following this transaction, SK Group will have almost completely divested from Masan, retaining only 1,000 shares.

This move is part of SK Group’s strategy to restructure its investment portfolio in Vietnam. The conglomerate, which is the second-largest diversified enterprise in South Korea with over 200 subsidiaries, has invested more than USD 3.5 billion in Vietnam in recent years.

Several securities firms, including SSI, BVSC, VDSC, and VCBS, have recently issued positive forecasts for Masan’s Q3/2025 business results. According to estimates, the Group could achieve a post-tax profit of approximately VND 1,700 billion, a 31% increase year-on-year, driven by sustainable growth in its core segments.

Analysts attribute the primary momentum to the WinCommerce retail chain and the fast-moving consumer goods sector of Masan Consumer, where brands like Chin-Su, Nam Ngư, Omachi, and Wake-Up 247 continue to maintain steady growth. Additionally, the branded meat (MEATLife), tea and coffee (Phúc Long Heritage), and high-tech materials (Masan High-Tech Materials) segments are making positive contributions.

– 11:43 AM, October 17, 2025

Lotte’s Withdrawal from Thu Thiem Project Deemed a Waste by Economic-Finance Committee Chair Phan Van Mai

Mr. Phan Văn Mãi highlighted the absence of a mechanism that empowers leaders of public service units to make decisions on the most effective use of state-assigned assets.

“Masan’s Mineral Segment to Witness Significant Growth: Vietcap Predicts Surge in Tungsten Prices”

As of Q2 2025, Masan High-tech Materials has turned a corner, reporting positive profits after consecutive quarters of losses.