At the seminar titled “Perfecting Tax and Customs Policies to Drive Business Development,” organized by the Finance and Economics Magazine under the Ministry of Finance today (October 16), Mr. Đặng Ngọc Minh, Deputy Director of the Tax Department, highlighted that 2025 is a pivotal year. The tax sector must not only meet its budget collection targets but also implement significant reforms in institutional frameworks, policies, and organizational structures.

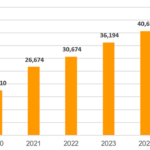

As of October 14, the total budget revenue managed by the tax sector exceeded 1.74 million billion VND, surpassing the assigned plan by 1.5%. Notably, revenue from the production and business sector progressed well, while land-related revenue doubled compared to the same period in 2024.

Total budget revenue managed by the tax sector has surpassed 1.74 million billion VND, exceeding the assigned plan by 1.5%.

One of the key highlights is the draft amendment to the Personal Income Tax Law, which is set to be presented to the National Assembly in the October session. Additionally, tax policies for business households are under scrutiny.

According to the Tax Department’s leadership, the shift from the “lump-sum tax” mechanism to a simplified declaration and accounting system will level the playing field for business households. Households with revenue exceeding 3 billion VND will be encouraged to use electronic invoices, adopt simple accounting practices, and apply a 17% tax rate similar to small enterprises.

The draft Personal Income Tax Law also considers adjusting the family circumstance deduction to 21.7 million VND per month (covering both the taxpayer and dependents). This adjustment aims to alleviate the tax burden on workers, ensuring fairness and alignment with current income levels.

Mr. Đặng Ngọc Minh revealed that this year, the tax sector is implementing two major organizational restructuring phases. In March, the sector streamlined its structure from 63 regional Tax Departments to 20. By July, in line with the two-tier local government model, the sector further reorganized into 34 provincial and city Tax Departments and approximately 350 grassroots units.

This restructuring has reduced the sector’s workforce by over 8,000 employees. Mr. Minh emphasized that, amidst reduced manpower and increasing workloads, digital transformation is the core solution to maintain management efficiency and enhance taxpayer services.

Attention Business Owners: New Tax Rates Effective January 1, 2026

The Ministry of Finance has officially approved the plan titled “Transforming Tax Management Models and Methods for Household Businesses Upon the Abolition of Presumptive Tax,” set to take effect on January 1, 2026.

VPBank CEO Nguyễn Đức Vinh: VPBankS IPO Strengthens Entire Ecosystem Foundation

According to VPBank CEO Nguyen Duc Vinh, the IPO of VPBankS is part of a strategic initiative to strengthen the capital foundation across the entire ecosystem, benefiting not only the securities company but also the entire group. This move will enable the conglomerate to continue pursuing its critical objectives.

Eximbank Honored with “Asia’s Outstanding Enterprise” and “Fast-Growing Enterprise” Awards at APEA 2025

On October 9, 2025, Eximbank was honored at the Asia Pacific Enterprise Awards (APEA) 2025 with two prestigious accolades: the Corporate Excellence Award and the Fast Enterprise Award. This achievement marks a significant milestone, solidifying Eximbank’s growing prominence in the regional financial market.

SHB Boosts Capital to Strengthen Financial Resilience and Drive Growth in the New Era

SHB is set to seek shareholder approval via written consent for its 2025 charter capital increase plan. This strategic move aims to solidify its position as Vietnam’s leading private commercial bank, enhance its capacity to meet growing credit demands, and facilitate business expansion. By investing in digital transformation, SHB seeks to elevate customer experiences and strengthen its competitive edge in the next phase of growth.