MSN surged to its ceiling price of VND 88,200 per share, maintaining this level until the market closed. Buyers dominated with over 7.2 million shares still seeking to purchase at the ceiling price, highlighting a strong influx of capital.

Notably, MSN recorded a massive block trade of over 44 million shares.

According to market insights, MSN shares have garnered attention following news of SK Invest Vina I’s divestment plans. The South Korea-based SK Group affiliate is offering approximately 42.6 million MSN shares, equivalent to nearly 3.6% of outstanding shares, at a price range of VND 78,000 to VND 79,300 per share.

The total transaction value is estimated at over USD 127 million. This development has sparked speculation among investors about Masan potentially welcoming a new foreign partner.

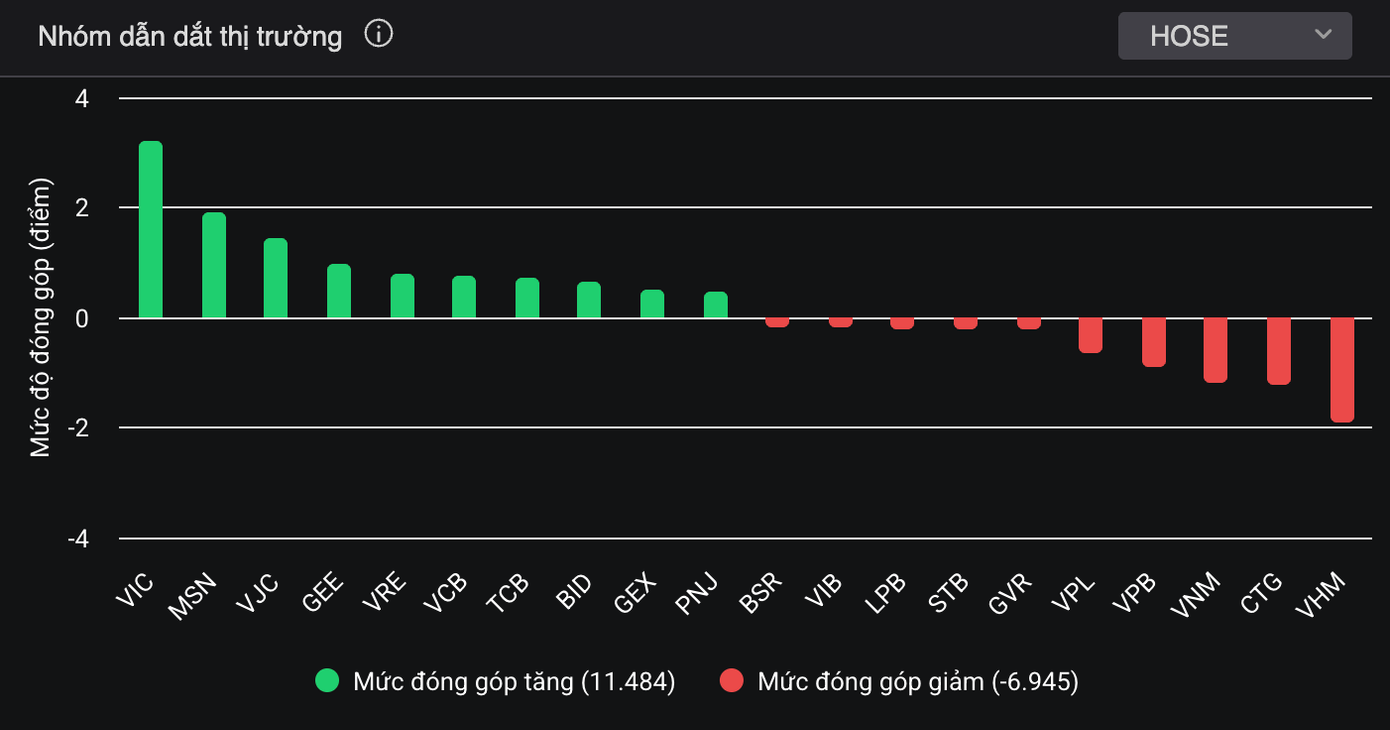

VIC reclaimed its top position among market leaders.

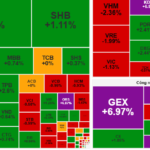

Beyond MSN, today’s market also witnessed the resurgence of the Vingroup cluster, further bolstering the VN-Index’s upward momentum. VIC led the index support group, while VRE also posted strong gains. Conversely, VHM and VPL remained in negative territory.

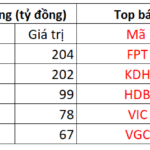

Additionally, major tickers such as VJC, VCB, TCB, BID, and the Gelex group (GEX, GEE) demonstrated positive movements, reinforcing market optimism. GEE hit its ceiling price, GEX climbed over 4%, and both maintained top liquidity on the exchange. Total liquidity on HoSE soared to nearly VND 40 trillion—a rare high in recent sessions—indicating a return of capital to blue-chip and real estate stocks.

Real estate tickers including NLG, DIG, DXS, and DXG all surged to their ceiling prices, while PDR, NVL, CEO, TCH, and SCR saw trading volumes in the tens of millions. Notably, foreign investors unexpectedly turned net buyers with over VND 420 billion, focusing heavily on NLG, DXG, and GEX. VIX ended a five-session net selling streak.

At the close, the VN-Index rose 8.9 points (0.51%) to 1,766.85. The HNX-Index gained 0.35% to 277.08, while the UPCoM-Index remained flat at 112.37.

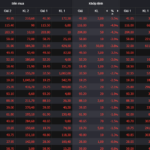

“Vietnamese Brokerages Deploy VND 400 Billion to Scoop Up Stocks Amid Market Dip: Which Tickers Are Top Targets for Proprietary Traders?”

Proprietary trading desks at securities companies collectively net bought VND369 billion on the Ho Chi Minh Stock Exchange (HOSE), signaling a notable shift in market sentiment and strategic positioning.