Pioneering Independent Sustainability Report: Leading Transparency in Governance

MSB’s pioneering spirit is evident in its publication of an independent Sustainability Report alongside its Annual Report, starting in 2022. This initiative addresses the expectations of investors, shareholders, and partners in responsible finance. In 2024, for the third consecutive year, the bank aligns its reporting with the Global Reporting Initiative (GRI) standards and evaluates its activities against the United Nations Sustainable Development Goals (SDGs).

In governance, the 2024 Report introduces enhanced transparency by detailing the bank’s sustainable development governance structure. MSB continues to strengthen compliance and transparency, effectively implementing risk management and long-term investment projects. This ensures secure and efficient digitization of customer journeys and internal processes.

Environmentally, MSB achieved a 72% reduction in paper usage, 25% in electricity consumption, and 9% in water usage in 2024 compared to the previous year. In green finance, the bank’s total green credit portfolio reached VND 5,165 billion. MSB also employs an internal green taxonomy system to assess, develop products, and manage environmental risks in credit operations.

Socially, MSB fosters inclusive and equitable workforce development, with women representing 53.37% of management and 63.41% of total employees. All staff participated in training programs, averaging 126 to 136 hours per person annually. MSB also contributes to community welfare, donating VND 17 billion to initiatives such as school construction, scholarships, and infrastructure support in underserved areas.

MSB employees awarding scholarships to students in need

A training session at MSB

Leading Carbon Emissions Measurement: Proactively Managing Emissions

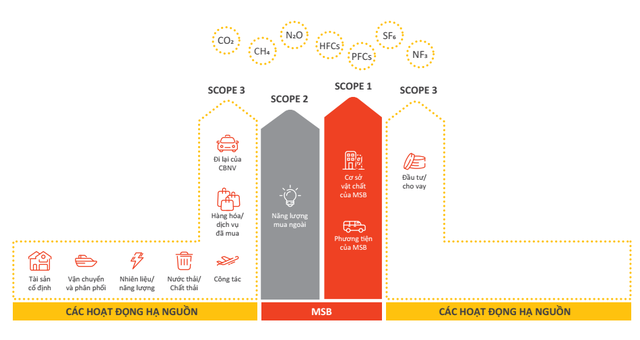

MSB’s emission scopes

MSB is among Vietnam’s first banks to measure and control carbon emissions from banking operations. In 2024, partnering with S&P Global – Sustainable 1, MSB collected data and calculated emissions across all three scopes, including upstream (supply chain) and downstream (loan portfolio), adhering to GHG Protocol, PCAF methodology, and TCFD reporting guidelines.

From 2022 to 2024, MSB reduced Scope 1 & 2 emissions by an average of 23.3% annually, despite a 6% workforce increase. For Scope 3, MSB estimated emissions from its corporate loan portfolio, covering 58.2% of total loans in 2024, accounting for over 99% of the bank’s total emissions. These estimates inform MSB’s emission reduction strategy, aligning with Vietnam’s economic development and international carbon commitments.

With S&P Global Sustainability 1’s support, MSB conducted its first physical risk assessment for 104 critical operational sites, enhancing risk management and operational efficiency.

Joining IFC’s Green Banking Alliance: Strengthening Green Finance Commitment

Mr. Vo Tan Long, Chairman of MSB’s Sustainability Committee (4th from left, back row), at the Green Commercial Banking Alliance launch in Hong Kong (Photo: Organizer)

A key milestone in MSB’s green strategy is joining the IFC-led Alliance for Green Commercial Banks, comprising 20 leading Asia-Pacific banks with over USD 5,600 billion in assets. This membership underscores MSB’s commitment to Vietnam’s green transition by integrating international green finance standards into its operations.

OCB Unveils Independent 2024 Sustainability Report, Reinforcing Commitment to Transparency and Sustainable Growth

Recently, Orient Commercial Joint Stock Bank (OCB) officially launched its independent 2024 Sustainability Report, themed *Crafting a Green Future*, marking the second consecutive year the bank has released a specialized report in this field.

SeABank Unveils Sustainability Report, Reinforcing Commitment to Long-Term Value Creation

SeABank (HOSE: SSB) proudly introduces its inaugural standalone Sustainability Report, marking a significant milestone in its journey towards long-term value creation. With a strong focus on Environmental, Social, and Governance (ESG) criteria, the bank’s commitment to sustainability is demonstrated through tangible, transparent, and measurable actions.

How Have Four Strategic Resolutions Transformed the Banking Industry?

Vietnam is entering a transformative era marked by the rapid introduction of four pivotal strategic resolutions. Amid this shift, the commercial banking sector, as the economy’s driving force, is proactively unveiling critical plans to align with significant changes set to unfold in the coming year.

Unlocking Vietnam’s Green Bond Market: Tackling the Biggest Bottleneck

For Vietnam’s green bond market to truly flourish, a synchronized approach is essential. This includes refining the legal framework, implementing targeted financial support policies from the government, and fostering proactive corporate governance practices focused on sustainability.