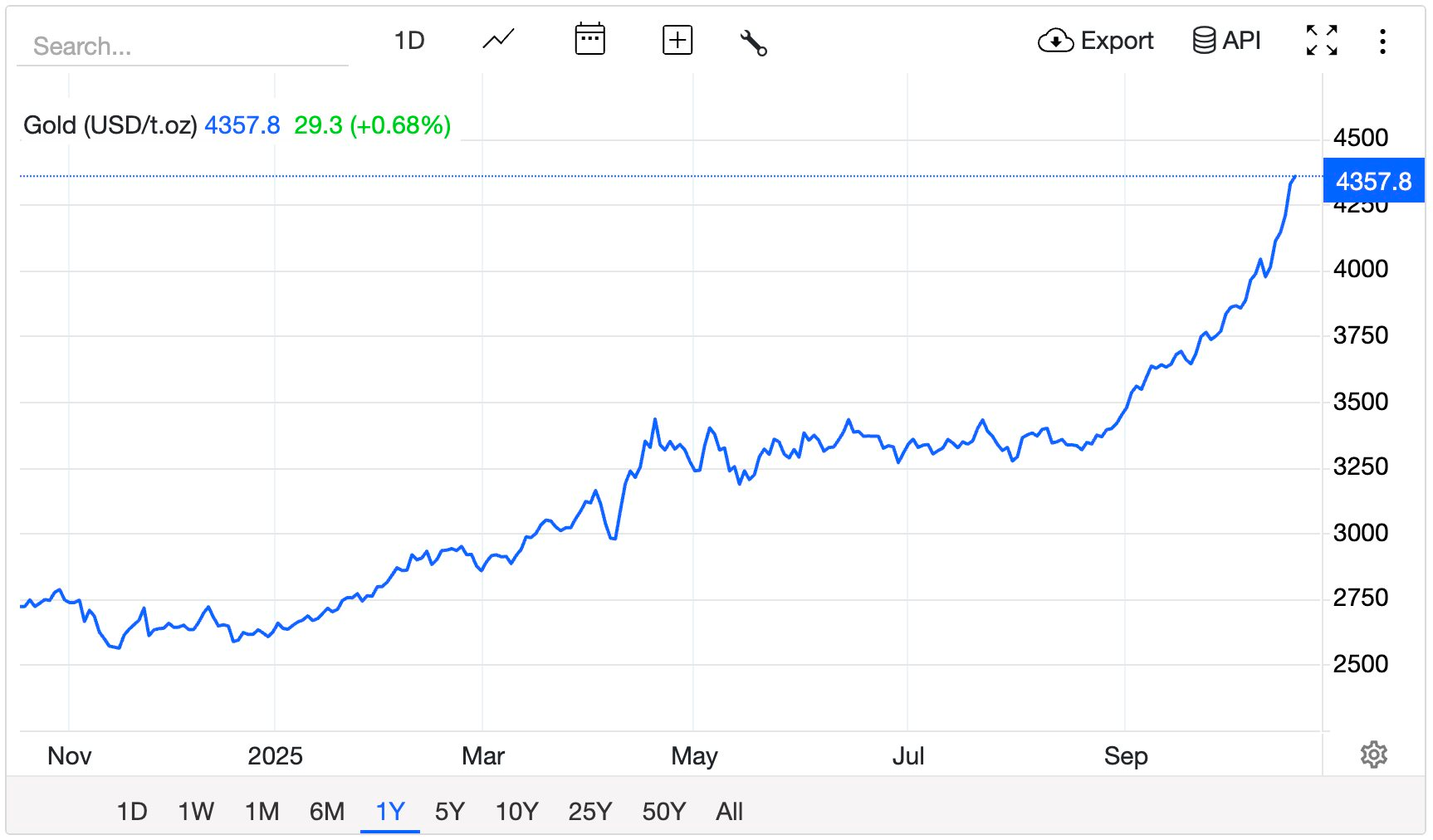

The gold market continues to demonstrate robust fundamentals, propelling gold prices to record highs above $4,300 per ounce. Notably, the market lacks significant selling pressure, as investors see no urgency to lock in profits amidst this strong upward momentum.

In a recent interview with Kitco News, John Merrill, Founder, Chairman, and Chief Investment Officer (CIO) of Tanglewood Total Wealth Management, revealed that gold currently constitutes approximately 12% of his total portfolio—a substantial increase from his target allocation of 10%.

Merrill explained that his optimism about gold dates back to 2023, when he initially allocated 5% to 6% of his portfolio to the precious metal. He noted that he has rebalanced his gold holdings several times over the past two years due to its unprecedented growth. However, looking ahead, he sees no compelling reason to take profits at this juncture.

“We will continue to hold gold,” he stated. “We typically rebalance at year-end, so we’ll reassess our gold position then, regardless of price movements.”

Gold prices have surged past $4,300 in just a few days.

Even if he trims some profits from gold, Merrill emphasized that fundamental shifts in the global economy mean he will maintain a core position.

“We will own gold. I don’t know what the percentage will be over the next 20 years, but we will own gold because there’s no substitute for it,” he asserted.

Merrill attributed the rising global public debt as the primary driver of gold demand. He noted that investors are eager to protect their assets as fiat currencies worldwide lose purchasing power.

Simultaneously, he highlighted that escalating public debt poses significant risks to long-term Treasury bonds, once considered the ultimate safe-haven asset.

“We began recognizing this in 2023—that there are new dynamics driving gold. We never viewed gold as an inflation hedge due to its inconsistent historical performance, but it is a disaster hedge. Now, it has evolved beyond a disaster hedge to become a currency hedge,” he explained.

Merrill suggested that gold’s role as a currency hedge may have originated during the 2008 Global Financial Crisis, when gold prices soared to all-time highs as the Federal Reserve slashed interest rates to 0% and implemented quantitative easing.

He added that the government’s stimulus spending during the 2020 pandemic exacerbated public debt issues, and the threat of recession will only worsen the global financial system’s health.

Beyond unchecked government spending, Merrill noted that the weaponization of the U.S. dollar against Russia and escalating global trade wars are eroding confidence in the dollar as the world’s reserve currency.

“Gold has emerged as the alternative because no other currency is large enough, stable enough, or free enough to function as a reserve currency,” he remarked.

Merrill pointed out that deglobalization trends make it increasingly difficult for nations to collaborate on developing any new form of reserve currency.

Despite gold trading at all-time highs—up nearly 60% this year—and appearing overbought, Merrill does not view this as an obstacle to further investment demand.

He added that while gold seems overbought relative to major currencies, it remains undervalued compared to equity markets.

Source: Kitco

Gold Ring Prices Surge to 159 Million VND per Tael as of October 17th Afternoon Update

By this afternoon, a prominent enterprise has adjusted the price of gold rings to a range of 156 to 159 million VND per tael, marking an increase of over 4 million VND per tael compared to this morning’s rates.