|

Q3 2025 Business Results of BHA

Source: VietstockFinance

|

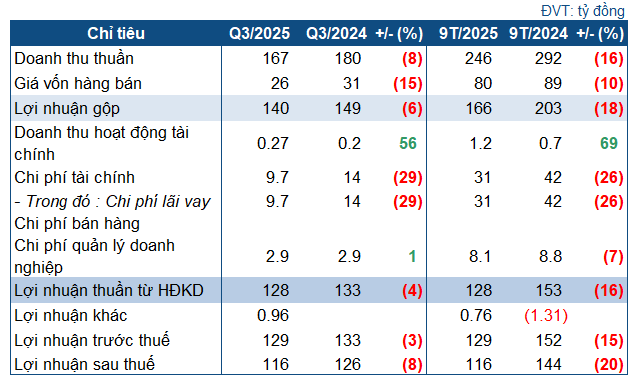

According to the Q3/2025 financial report, BHA recorded a net revenue of VND 167 billion, an 8% decrease compared to the same period last year. The cost of goods sold also declined by 15%, resulting in a 6% drop in gross profit to VND 140 billion.

A highlight of the quarter was a significant 29% reduction in financial expenses, down to VND 9.7 billion. Despite this, BHA reported an after-tax profit of over VND 116 billion, an 8% decrease year-over-year. The company attributed this to lower average water flow into the reservoir during Q3/2025, leading to reduced sales revenue.

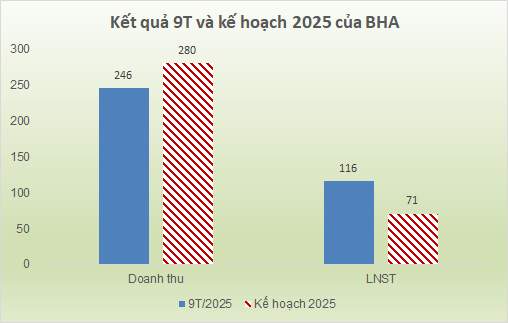

However, the Q3/2025 results mark a strong recovery for BHA compared to the first six months of the year, which saw a loss of over VND 200 million. For the first nine months, cumulative revenue reached nearly VND 246 billion, a 16% decline year-over-year, while after-tax profit fell by 20% to VND 116 billion. After just one profitable quarter, the company achieved 88% of its annual revenue target and exceeded its profit goal by 64%, as set by the 2025 Annual General Meeting.

Source: VietstockFinance

|

As of late September, BHA‘s total assets stood at over VND 1.53 trillion, a slight decrease from the beginning of the year, with VND 192 billion in current assets, up 23%. Notably, cash and short-term deposits plummeted by more than 54%, to just over VND 55 billion.

Conversely, short-term receivables surged to VND 137 billion, 4.7 times higher than at the start of the year, primarily due to a sharp increase in customer receivables. The company also incurred an additional VND 21 billion in construction-in-progress costs, mainly for the Bac Ha Hydropower Plant project.

On the liabilities side, total financial debt (short-term and long-term) decreased significantly by 28%, to VND 385 billion. This was largely due to BHA repaying a substantial portion of its short-term loans, reducing them from nearly VND 180 billion to VND 27 billion. Cash flow for the nine months indicates that the company allocated nearly VND 174 billion to repay loan principals.

– 2:43 PM, October 17, 2025

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.

Fertilizer Company Reports Staggering 1,000% Profit Surge in Q3 2025

The company attributes its revenue growth primarily to increased sales volume and a higher average selling price compared to the same period last year. Specifically, the average selling price for this period stood at 17.74 million VND per ton, marking a significant increase of 4.56 million VND per ton over the previous year.

Hodeco Secures Significant Profits Despite Real Estate Revenue Shortfall Through Strategic Sale of Affiliated Company Equity

Amidst a staggering 87% decline in real estate revenue, Hodeco has defied the odds by reporting record profits, attributed to the strategic sale of shares in Ocean Entertainment Construction Investment Corporation Vung Tau.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.