Soaring Apartment Prices in Ho Chi Minh City (Old)

Ho Chi Minh City’s (Old) Apartment Prices Surge

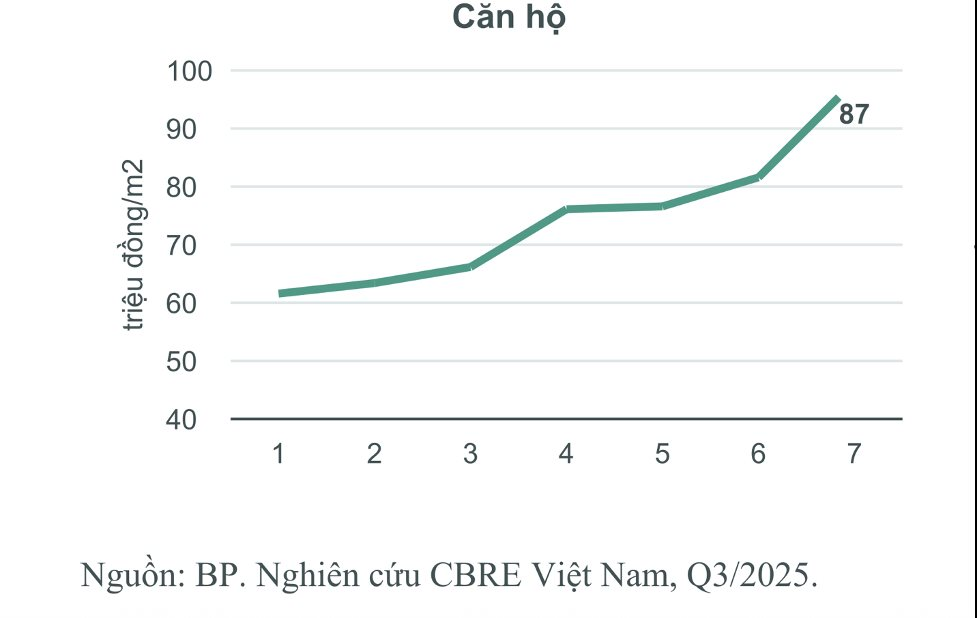

CBRE Vietnam’s Q3/2025 report reveals that primary market apartment prices in Ho Chi Minh City (Old) have reached VND 87 million/m², a 6.3% increase from the previous quarter and a 31% jump year-on-year. In Q2/2025, prices stood at VND 82 million/m², marking a VND 5 million/m² rise in just three months.

Notably, the upward pressure from the primary market has spilled over into the secondary market, pushing average prices to VND 60 million/m², up 13% quarterly and 25% annually.

According to CBRE, despite improved new supply in Q3, Ho Chi Minh City’s market remains supply-constrained relative to demand, sustaining price growth in both primary and secondary segments. Key trends driving the market include legal clarity and a shift towards outlying areas.

Rising Ho Chi Minh City apartment prices drive investment to neighboring regions.

CBRE representatives note that the rapid price increase in Ho Chi Minh City apartments is prompting buyers, especially those with genuine housing needs, to exercise greater caution. In major cities like Hanoi and Ho Chi Minh City, new projects priced above VND 120 million/m² are increasingly dominant, tilting the market towards luxury segments while mid-range supply shrinks, limiting options for real buyers.

Meanwhile, Binh Duong emerged in the first nine months of the year with nearly 11,000 new apartments priced below VND 60 million/m², becoming a “buffer zone” for affordable housing and attracting capital from Ho Chi Minh City (Old).

Ms. Duong Thuy Dung, CEO of CBRE Vietnam, highlights that expanded Ho Chi Minh City areas like old Binh Duong and Long An offer abundant supply at prices averaging 30% for low-rise homes and 50% for apartments compared to Ho Chi Minh City (Old).

She explains that the significant price gap, coupled with inter-regional infrastructure development and larger land reserves, positions these areas as viable alternatives for homebuyers, particularly young individuals or families seeking spacious, affordable living. This trend is also driving investment away from Ho Chi Minh City (Old), boosting satellite city growth.

Northern Investment Capital Shifts Southward

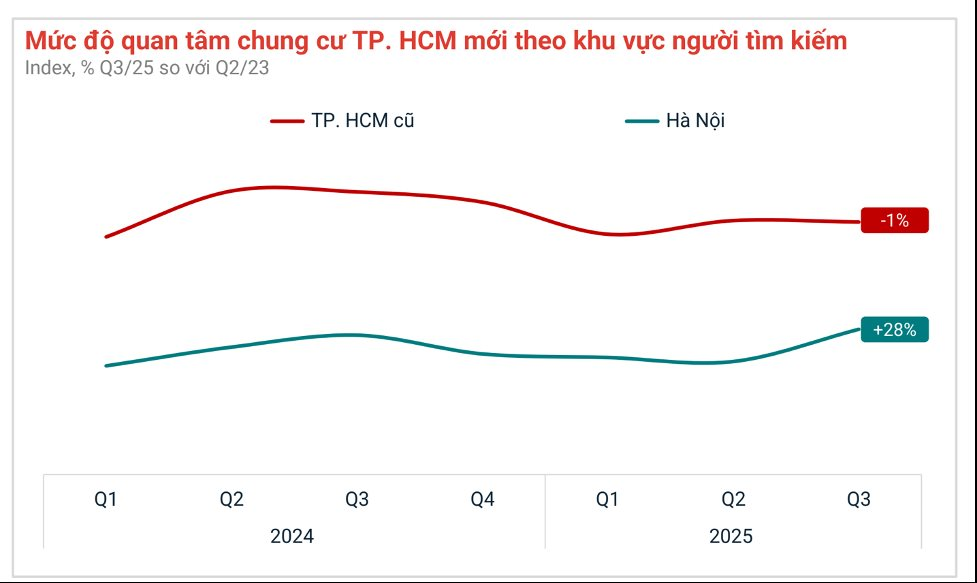

Recently, stagnating property prices in Hanoi and northern provinces have prompted investors to redirect capital southward, particularly to Ho Chi Minh City (New), anticipated to appreciate post-provincial merger. This southward shift is especially evident as the year-end approaches.

Northern investors show heightened interest in Ho Chi Minh City apartments. Source: Batdongsan.com.vn

Mr. Dinh Minh Tuan, Director of Batdongsan in the Southern region, attributes this southward capital flow to price disparities. Hanoi’s high property prices have diminished investment appeal, while the South remains attractive due to lower prices and strong infrastructure-driven growth potential.

Northern investors are particularly interested in Ho Chi Minh City projects near major infrastructure or within TOD planning zones. For instance, An Gia’s recent launch of 35 commercial podium shops at The Gió Riverside (Dong Hoa Ward, Ho Chi Minh City), priced from VND 68 million/m²—10-30% of District 2 and 9 (Ho Chi Minh City Old) prices—has drawn significant northern investment due to its rarity and potential.

These podium shops feature flexible designs with 1 ground floor and 1 mezzanine, dual entrances, and 100-150 m² areas, ideal for business, leasing, or mid-to-long-term investment. Upon completion, The Gió Riverside will host major F&B brands, retail chains, and convenience stores.

Buyers need only pay 21% (approx. VND 1.5 billion) upfront, with bank financing and 36 months of interest-free support from the developer (extendable 12 months post-handover). Additional perks include up to 18.5% discounts.

Similarly, Phu Dong Group offers shophouses at Phu Dong Sky Garden with gifts up to VND 1 billion, 5-year management fee waivers, and 5-year rental guarantees at VND 22 million/month.

Fresia Riverside by Tan Van Real Estate (TV Holdings), exclusively marketed by EximRS, is another project attracting northern investors. Located on Bui Huu Nghia Street, Bien Hoa (Dong Nai), it offers reasonably priced apartments from VND 1.79 billion/2-bedroom unit, with incentives like 2% early bird discounts, 5% for quick payments, and 0.5%/month installment plans.

Mr. Dinh Minh Tuan notes that northern investors anticipate Ho Chi Minh City property prices to rise as rapidly as Hanoi’s did in 2023-2024, diversifying their portfolios and seeking better returns.

Beyond profits, northern investors are increasingly drawn to sustainable rental income and infrastructure benefits. This capital shift from Hanoi and Ho Chi Minh City to neighboring areas reflects a flexible investment strategy, as investors seek growth in emerging markets.

Source: Batdongsan.com.vn

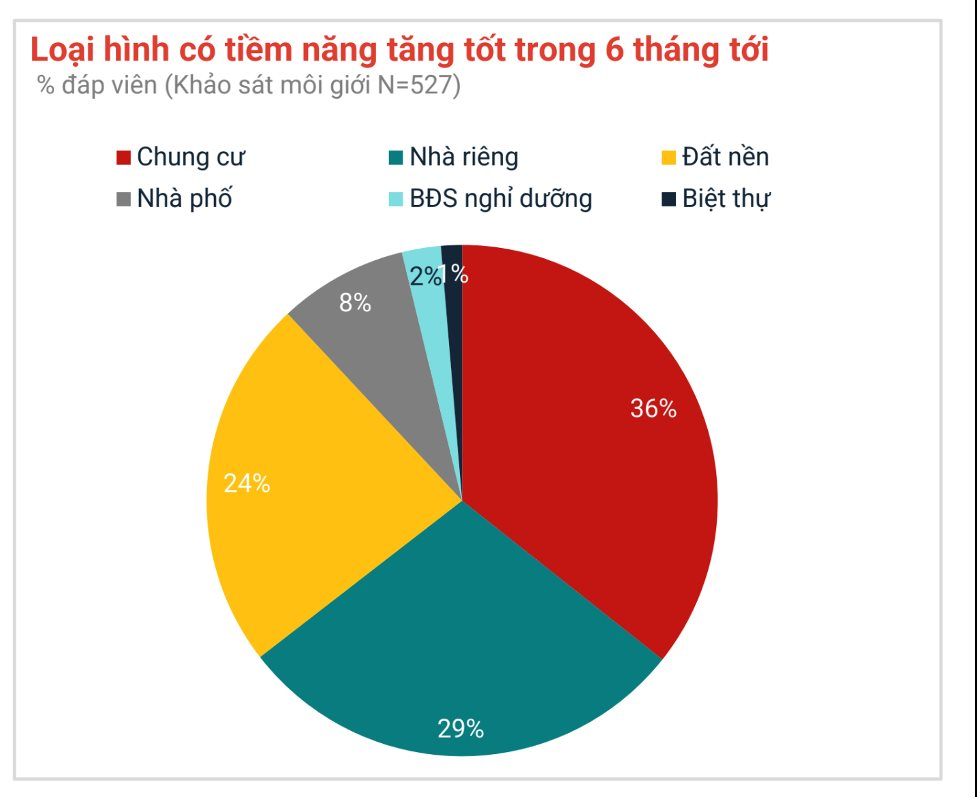

Batdongsan.com.vn data shows Ho Chi Minh City’s post-merger interest surge, led by apartments driven by real demand and rental investment. In Q3/2025, apartments saw the highest interest growth (36%), followed by private houses (29%), land plots (24%), and townhouses (8%), indicating a shift towards practical, exploitable properties.

Northern investors are now favoring high-end apartments over land plots and townhouses, prioritizing legal clarity, reputable developers, and well-planned infrastructure. Experts stress that sustainable property value growth relies on local economic leverage, infrastructure, and investment climate improvements.

Investors should avoid short-term speculation, instead focusing on data-driven analysis and project/area potential to mitigate risks.

Why Bầu Đức Returned to Real Estate: The Forgotten 15-Year-Old Land HAGL Left Behind Due to “Excess Wealth” Could Now Be Sold to Pay Off Debts

Bầu Đức revealed that the land designated for the project has been owned by HAGL for over 15 years, dating back to the company’s heyday. “Back then, I was like a wealthy kid, so I didn’t even think about it. If I had, I might have sold it to pay off debts by now,” he remarked.

Conquering the North: Happy One’s Brand Ecosystem Expansion Strategy

Vạn Xuân Group is not just expanding its footprint in Ho Chi Minh City but is accelerating the growth of its Happy One ecosystem into the Northern region. This move transcends mere geographical expansion; it represents the propagation of a core philosophy rooted in “authentic quality – genuine value.”

Unveiling the Investment Wave in Gated Cities: The Secret Behind Sold-Out Launches

The phenomenon of “sold out upon launch” is sweeping across provinces featuring master-planned, fully integrated urban developments managed by professional operators. In Tân Hưng Ward, Hai Phong, the Ecorivers Urban Area’s mid-rise Eco Riverside subdivision sold out rapidly upon release, surpassing transaction expectations and sparking a wave of excitement among investors.