The VN-Index experienced a tug-of-war, fluctuating around the benchmark throughout the October 16 session. A positive note was the surge in buying momentum towards the end, propelling the VN-Index to close nearly 9 points higher at 1,766.85. Trading volume remained robust, with matched orders on HoSE reaching approximately VND 35 trillion.

Foreign trading emerged as a highlight, with net buying exceeding VND 404 billion across the market. Here’s a breakdown:

On HoSE, foreign investors net bought approximately VND 527 billion

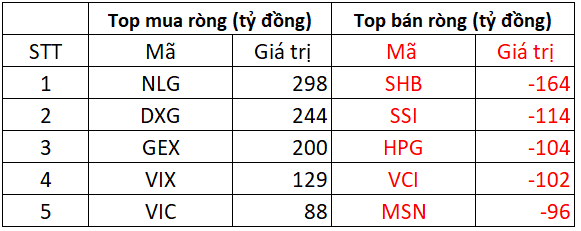

On the buying side, NLG led the market with a net inflow of VND 298 billion. GEX and DXG also saw strong net buying, each surpassing VND 200 billion. Following closely, VIX and VIC were among the top net buys, ranging from VND 88 billion to nearly VND 130 billion.

Conversely, SHB witnessed the heaviest net selling at VND 164 billion. SSI, HPG, and VCI also featured prominently in the net selling list, with values ranging from VND 100 to 114 billion. Additionally, MSN faced net selling of nearly VND 100 billion.

On HNX, foreign investors net sold around VND 131 billion

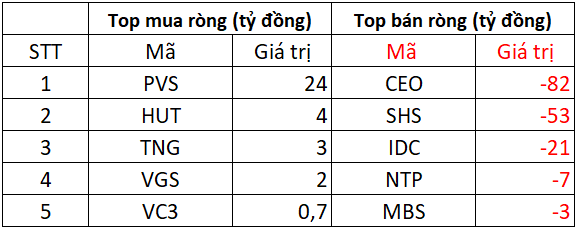

On the buying side, PVS saw the strongest net buying at VND 14 billion. Other stocks like HUT, TNG, and VGS also attracted modest net buying from foreign investors.

In contrast, CEO and SHS faced significant net selling, with values of VND 82 billion and VND 53 billion, respectively. IDC was net sold at VND 21 billion, while NTP and MBS saw minor net selling.

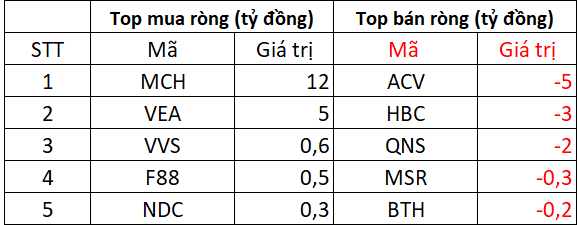

On UPCOM, foreign investors net bought approximately VND 8 billion

On the buying side, MCH and VEA saw net buying of VND 5-12 billion. F88, VVS, and NDC also attracted net buying, albeit in smaller amounts.

Conversely, ACV, HBC, and QNS faced net selling ranging from VND 2 to 5 billion. MSR and BTH experienced negligible net selling.

Market Pulse 15/10: VN-Index Closes in the Red, Financial and Tech Sectors Buck the Trend

At the close of trading, the VN-Index dipped 3.11 points (-0.18%), settling at 1,757.95 points, while the HNX-Index climbed 0.79 points (+0.29%), reaching 276.12 points. Market breadth favored decliners, with 446 stocks closing lower compared to 257 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.

Vietstock Daily 16/10/2025: Clear Market Polarization?

The VN-Index remains volatile, with declining liquidity reflecting investors’ cautious sentiment. Currently, the Stochastic Oscillator has issued a sell signal in the overbought territory, indicating heightened short-term correction risks. Should selling pressure persist, the index is likely to retest the 1,700–1,711 point range, aligning with the September 2025 peak.