On October 15th, the VN-Index closed at 1,757 points, down 3 points (0.18%).

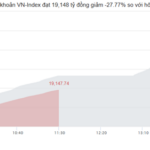

The morning session of October 15th began with the VN-Index rising. However, shortly after, the index fluctuated within a range of approximately 13 points.

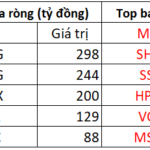

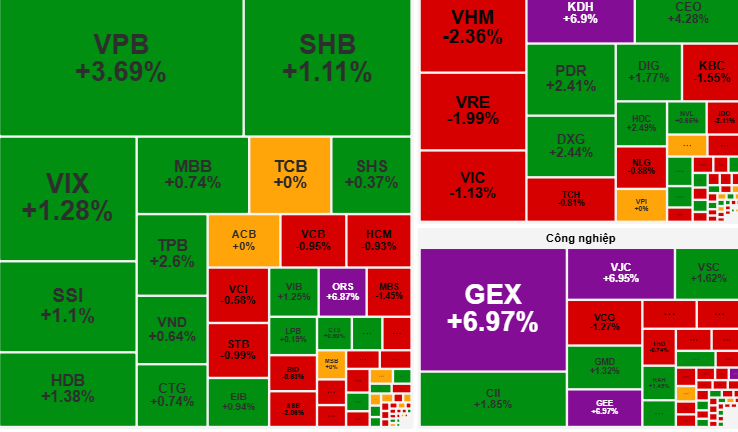

The highlight of the morning session was the strong performance of banking stocks such as VPB, LPB, MBB, and the GEX ecosystem group (GEE, GEX), which helped the VN-Index maintain its upward trend. Nevertheless, increased profit-taking pressure towards the end of the morning session caused the VN-Index to dip slightly.

In the afternoon session, the market continued to oscillate around the 1,760-point mark, with a clear tug-of-war between buyers and sellers. After a series of heated sessions, the Vingroup stocks underwent a correction, putting pressure on the overall index.

Conversely, blue-chip stocks in the banking sector, the GEX ecosystem, and VJC (Vietjet) acted as pillars of support, helping the VN-Index narrow its decline. Notably, the real estate sector became a magnet for capital inflows, with KDH and HDG hitting their ceiling prices, and other stocks like DIG and NVL also posting significant gains.

At the close of trading, the VN-Index settled at 1,757 points, down 3 points (0.18%).

According to VCBS Securities, the VN-Index is currently consolidating momentum around the 1,750-1,780 range. The divergence among blue-chip stocks indicates that the market is adjusting after a strong prior rally.

VCBS advises investors to consider taking short-term profits on stocks that have reached their targets or show reversal signals, while maintaining exposure in stocks that continue to trend upward.

Meanwhile, Dragon Capital Securities (VDSC) noted that liquidity decreased on October 15th, reflecting a cautious stance between supply and demand. VDSC views this as a normal development, as the market needs time to attract additional capital.

VDSC forecasts that in upcoming sessions, the VN-Index will find support around the 1,750 level and may rebound to challenge supply pressure at the 1,800 resistance.

Both VCBS and VDSC agree that investors should use the current correction as an opportunity to gradually increase their stock holdings, while avoiding chasing prices at high levels. Sectors currently attracting capital, such as securities, banking, and real estate, may offer opportunities for exploratory investments.

KBSV Raises VN-Index Forecast Above 1,800 Points, Backed by Strong Supportive Factors

As we enter the fourth quarter, KBSV anticipates that the growth drivers established in recent quarters will not only persist but also expand further.

Market Pulse 15/10: VN-Index Closes in the Red, Financial and Tech Sectors Buck the Trend

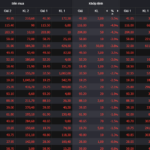

At the close of trading, the VN-Index dipped 3.11 points (-0.18%), settling at 1,757.95 points, while the HNX-Index climbed 0.79 points (+0.29%), reaching 276.12 points. Market breadth favored decliners, with 446 stocks closing lower compared to 257 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.

Vietstock Daily 16/10/2025: Clear Market Polarization?

The VN-Index remains volatile, with declining liquidity reflecting investors’ cautious sentiment. Currently, the Stochastic Oscillator has issued a sell signal in the overbought territory, indicating heightened short-term correction risks. Should selling pressure persist, the index is likely to retest the 1,700–1,711 point range, aligning with the September 2025 peak.