I. MARKET TRENDS IN WARRANTS

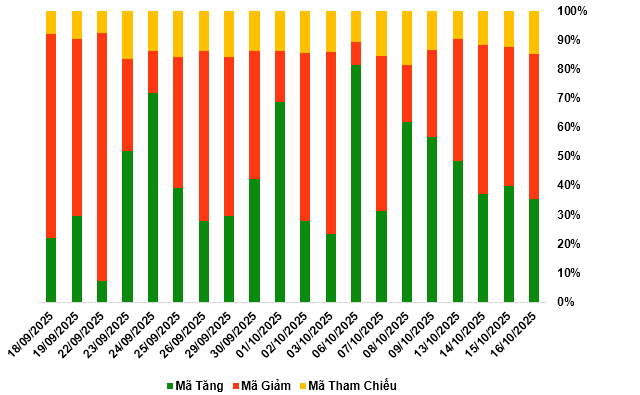

By the close of trading on October 16, 2025, the market recorded 93 gainers, 132 decliners, and 39 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

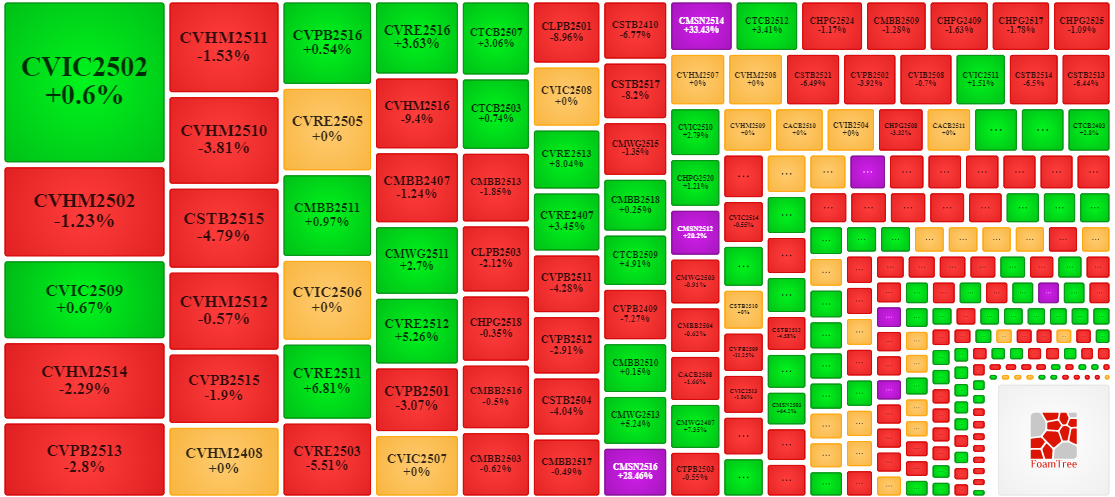

During the October 16, 2025 session, sellers dominated the market, driving down the prices of most warrant codes. Notably, the leading decliners were CVHM2502, CVRE2503, and CVPB2515.

Source: VietstockFinance

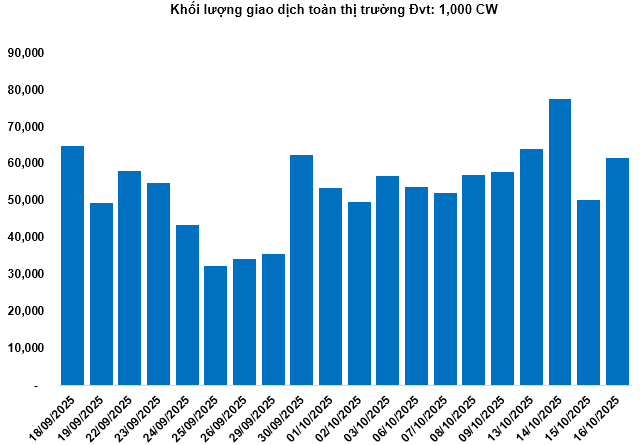

Total market volume on October 16 reached 61.56 million CW, up 22.93%; trading value hit 172.76 billion VND, a 42.21% increase from October 15. CMSN2507 led in volume with 3.54 million CW, while CVHM2514 topped in trading value at 14.09 billion VND.

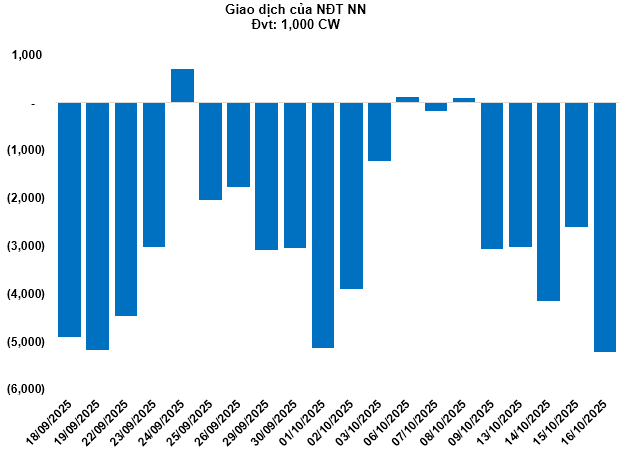

Foreign investors continued net selling on October 16, totaling 5.21 million CW. CHPG2515 and CVHM2522 were the most heavily sold.

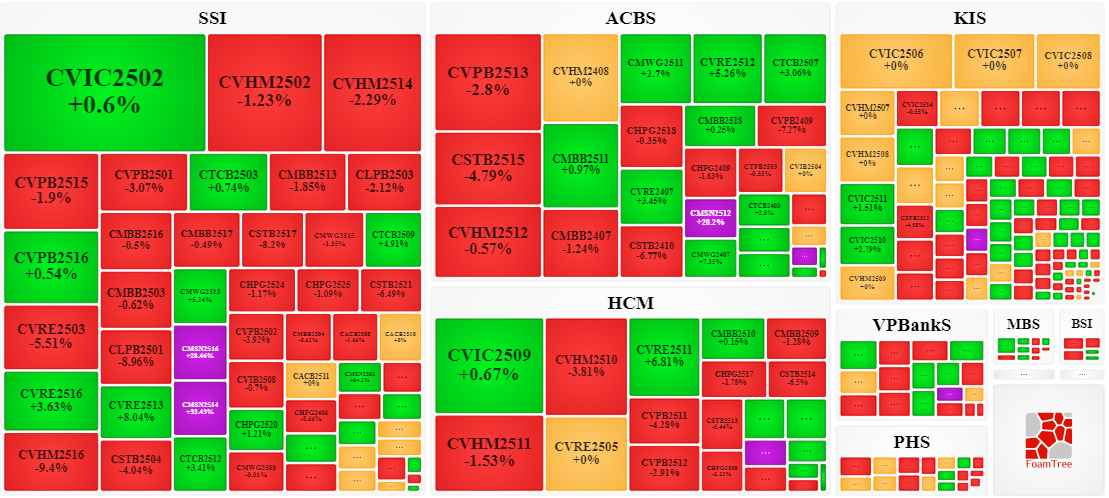

Securities firms SSI, ACBS, KIS, HCM, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

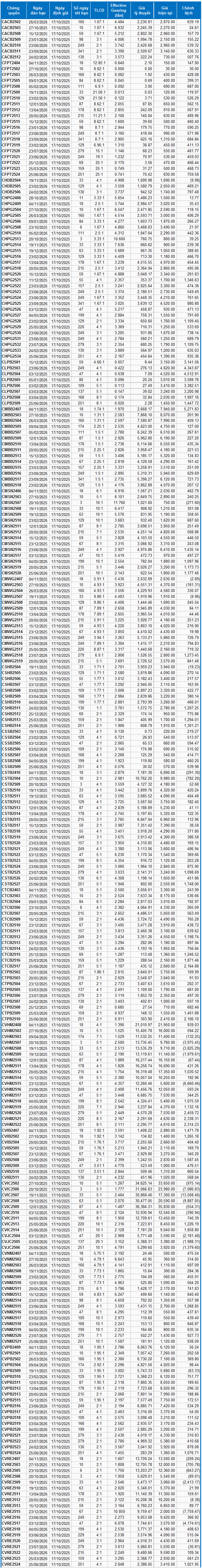

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from October 17, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to the valuation, CVIC2507 and CVIC2508 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CMSN2507 and CVRE2515 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 16/10/2025

Real Estate Market in Vietnam’s Third-Largest Metropolis: Condos Reign Supreme, Land Plots Stall

Discover the top-performing apartment districts with impressive price growth: Hong Bang (up 45.2%, averaging VND 2.4 billion per unit), Kien An (up 40.2%, VND 1.6 billion), An Duong (up 18%, VND 1.7 billion), and Ngo Quyen (up 17.1%, VND 3 billion).

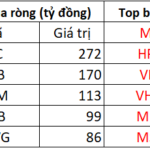

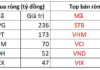

Foreign Block Continues Net Selling Spree, Offloading Over a Trillion Dong as VN-Index Hits New Peak, Heavily Dumping Bluechip Stocks

In the afternoon trading session, VIC emerged as the most heavily net-bought stock across the entire market, with a remarkable value of approximately 272 billion VND.