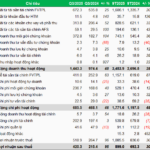

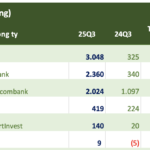

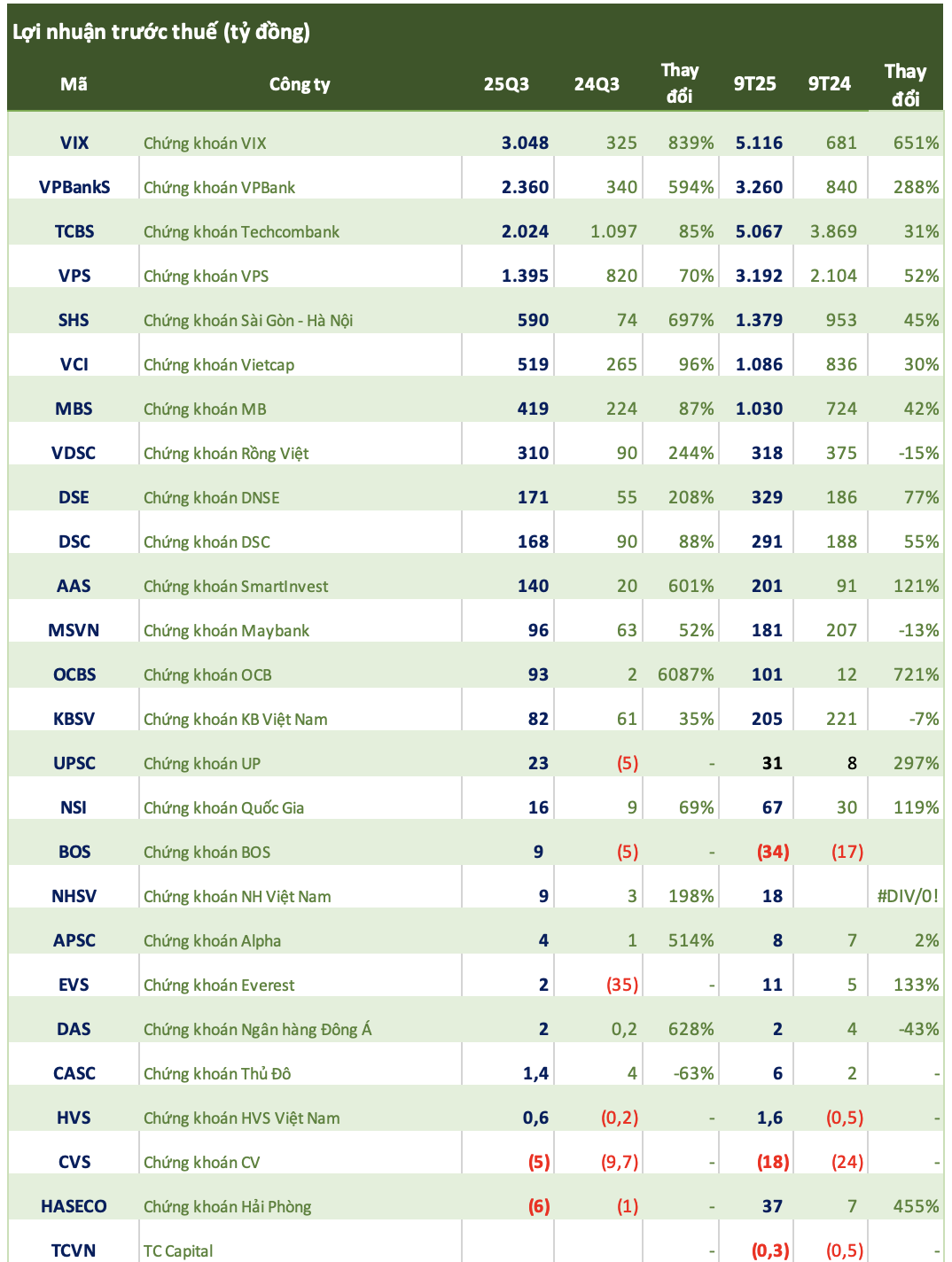

As of the morning of October 17th, 26 securities companies have released their Q3/2025 financial reports.

DSC Securities is the latest to report significant profits in Q3. The company generated an operating revenue of 260 billion VND, with FVTPL asset profits exceeding 116 billion VND, a 1.5x increase year-over-year. Interest income from lending and receivables reached 71 billion VND, and brokerage revenue surpassed 43 billion VND. As a result, DSC’s pre-tax profit hit 168 billion VND, an 88% surge compared to Q3/2024, bringing the 9-month pre-tax profit to 291 billion VND, a 55% growth year-over-year.

Maybank Securities recorded a 52% year-over-year increase in Q3 pre-tax profit, reaching 96 billion VND. For the first 9 months, the company’s pre-tax profit totaled 181 billion VND, a 13% decline year-over-year.

KB Securities reported 309 billion VND in Q3 operating revenue, a 38% increase. Key contributors were interest income from lending and receivables at 159 billion VND and brokerage revenue at 109 billion VND. Operating expenses were approximately 117 billion VND. Consequently, KBSV’s pre-tax profit reached nearly 82 billion VND, a 35% growth compared to Q3/2024. For the first 9 months, the company recorded 205 billion VND in pre-tax profit.

Notably, OCB Securities (OCBS) saw a dramatic surge in Q3 pre-tax profit to 93 billion VND, a staggering 6,087% increase year-over-year. Q3 operating revenue reached 136 billion VND, with FVTPL asset profits exceeding 66 billion VND, a 472x jump. Interest income from lending and receivables also rose significantly to over 22 billion VND, complemented by 19 billion VND in brokerage revenue.

The strong Q3 performance boosted OCBS’s 9-month pre-tax profit to 101 billion VND, a 721% increase year-over-year.

Hai Phong Securities (Haseco) reported a Q3 pre-tax loss of nearly 6 billion VND, compared to a 1 billion VND loss in Q3/2024. The primary cause was a sharp decline in FVTPL asset profits, dropping from 11 billion VND in the previous year to just over 560 million VND this quarter.

Q3 Earnings Surge: Vietcap, SHS, OCBS Report Significant Profits, While One Firm Extends 13-Quarter Loss Streak

Another corporate giant has unveiled its financial performance, joining the wave of third-quarter earnings reports from the securities sector.

Vietcap Securities Doubles Q3 Net Profit on Strong Brokerage and Lending Performance

Vietcap Securities Corporation (HOSE: VCI) has released its Q3/2025 financial report, revealing a remarkable net profit of over 420 billion VND, doubling the figure from the same period last year. This impressive growth is primarily driven by robust brokerage and lending activities. Consequently, the company’s cumulative profit for the first nine months of the year has surged to nearly 900 billion VND, marking a 30% increase year-on-year.

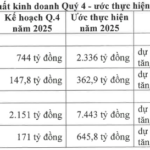

Phú Tài Aims to Surpass 2025 Profit Target by Over 35%

The Board of Directors of Phu Tai Corporation (HOSE: PTB) has approved the estimated consolidated business results for the first nine months of 2025, reporting a revenue of VND 5,292 billion and pre-tax profit of nearly VND 475 billion. This represents a 15% increase in revenue and a 36% surge in pre-tax profit compared to the same period last year.

Q3/2025 Financial Report Deadline: Binh Minh Plastics Reports Record Profits, While a Steel Company Sees 91% Profit Decline

Two hydropower companies have announced their financial results. Song Ba Hydropower (SBA) reported a 91% increase in pre-tax profit for Q3 and a 64% rise for the first nine months, while SHP Hydropower saw a 2% growth in Q3 pre-tax profit and a 31% increase year-to-date.