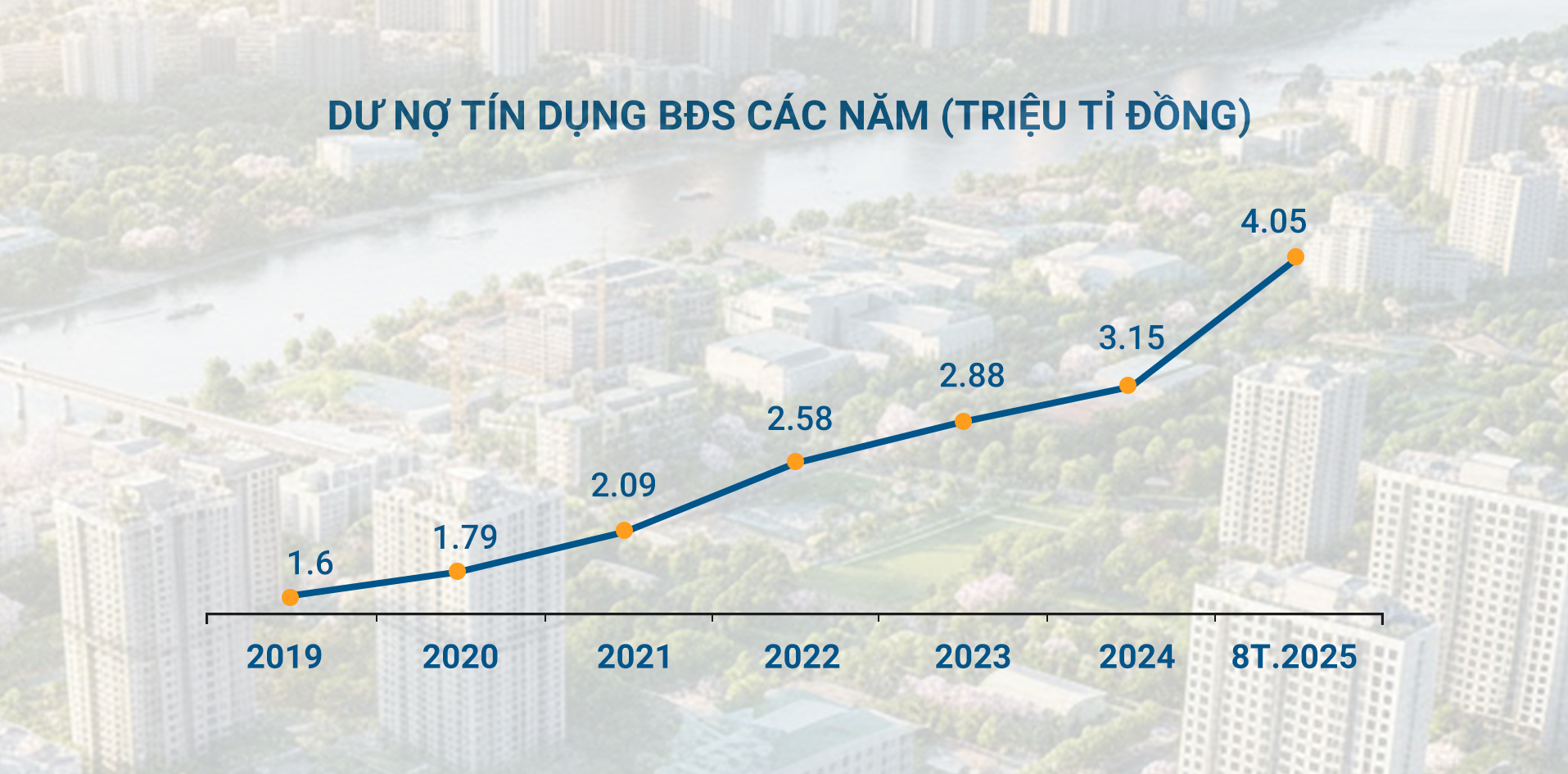

According to the State Bank of Vietnam, by the end of August 2025, real estate debt had surpassed VND 4.08 trillion, a nearly 19% increase compared to the end of 2024, accounting for nearly a quarter of the total debt in the economy.

Many anticipate that abundant capital, reduced interest rates, and supportive policies will help the market recover after the sluggish period of 2022-2023. However, there are cautious views as money continues to flow into real estate amidst rising property prices.

Real estate credit debt shows a strong upward trend in 2025

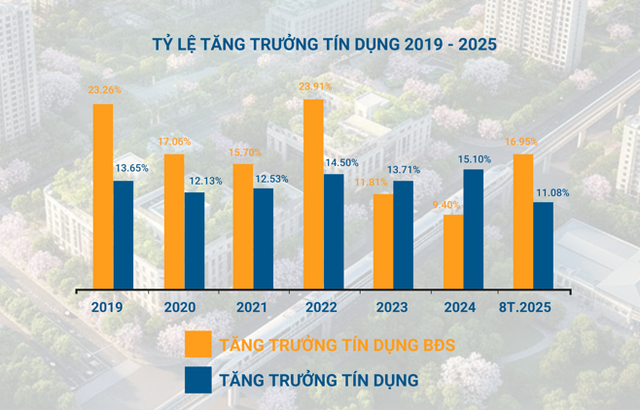

Examining the data from the two charts reveals that real estate credit debt has increased more than 2.5 times compared to 2019, while the growth rate of this sector consistently outpaces the overall credit growth of the economy. Capital is increasing rapidly, but its absorption and efficiency raise many questions.

(Data source: SBV)

Dr. Dinh The Hien, an economic expert, shared his insights on this issue.

– Reporter: Real estate credit debt has reached over VND 4 trillion, accounting for nearly a quarter of the total debt in the economy in just the first 8 months of 2025, a 19% increase compared to the end of 2024. How do you assess this figure?

Dr. Dinh The Hien: We see that the strong capital injection from public investment and credit is creating positive signals for the real estate market in early 2025. This is also what many real estate companies and investors have been expecting since the end of 2022, when there were signs that the government was restricting the flow of capital into real estate.

Dr. Dinh The Hien.

However, looking deeper, such positive information only reflects part of the picture. Over the past 2-3 years, many reports and experts have emphasized sustainable development, transparency, and stability. Yet, it seems most in the real estate sector, from policymakers, associations, and businesses to brokers, still hope the market will quickly recover from the difficulties of late 2022, returning to the “golden era” of 2017-2018. Meanwhile, capital injection is always a double-edged sword affecting the market.

– In your opinion, why is capital increasing but the market not showing significant improvement?

Dr. Dinh The Hien: It seems many in the real estate sector, from researchers, businesses, and brokers to investors, believe the market slowdown was merely a “hiccup” due to credit tightening in Q3-Q4/2022, rather than a result of previous unsustainable development.

Because of this perception, throughout 2023, 2024, and 2025, they have only focused on monitoring how much the market has recovered from difficulties. By early 2025, many organizations believed the market had overcome the sluggish phase, calling it the “spring” of real estate as both credit and public investment improved.

However, in reality, the market has nothing new to offer, still following the old pattern: launching new products, expecting buyers to purchase at high prices with the hope of selling even higher, and banks continuing to supply capital with very high lending ratios to “warm up” the market.

– Is the current credit policy on the right track?

Dr. Dinh The Hien: The State Bank’s credit policy also aims to boost the real estate market, improve liquidity, and prevent a “blood clot” like in 2022, steering the market toward a healthier state.

However, observing the first 9 months of 2025, especially from Q3 onwards, despite a significant increase in credit to the real estate market, companies are still capital-hungry, and liquidity has not improved. This indicates that the policy of boosting credit to revive the market is no longer suitable. Increasing credit is not the right remedy for the market’s ailments.

In October 2025, many argued that the real estate market’s development is unhealthy, evidenced by excessively high property prices, misaligned with housing needs, income, and sustainable investment. It is serving real estate speculators, who account for up to 80% of buyers. This shows that regulators will take decisive measures to stabilize and guide the market toward healthy development, in line with the economy.

The Ministry of Construction’s draft proposes that buying a second home can only be financed at 50%, then reduced to 30%. This measure immediately sparked mixed reactions: supporters see it as a solution to reduce investment and speculative credit in real estate; opponents point out its limitation in only restricting bank credit. However, this reflects the government’s intention to curb real estate speculation.

– How effective is bank capital currently in the market?

Dr. Dinh The Hien: According to data from associations and experts, over the past few years, about 70% of real estate transactions have been for speculative investment. Bank loans primarily serve this group of investors rather than actual homebuyers or long-term investors.

In such a market, it only appears “active” when confidence and prices rise together, leading many to believe that credit is revitalizing the market. In reality, during 2017-2018 or before the slowdown in 2021-2022, credit increased by only 11-12%, but transactions were robust because investors actively bought and sold, creating a fast money flow, making everyone feel the market was flush with cash.

In contrast, in 2022, credit rose to 16%, 50% higher than in 2017–2018, yet the market still complained of capital shortages because, from Q3, investors became hesitant, and buying power weakened, making everyone feel a lack of money due to government credit tightening.

Currently, after three years of efforts to improve the market, credit has increased as much as real estate companies hoped, but investors are reluctant to buy due to already high prices and fear of speculative risks (“buy high, sell higher”). This has prevented credit from creating waves. Real estate companies are still capital-hungry because sales are slow. The market risks a situation of “surplus and shortage”: a shortage of affordable housing for workers but a surplus of high-end apartments waiting for price increases.

In China, “ghost towns” have emerged. In Vietnam, observing Ho Chi Minh City, districts like 2, 7, 9, or Tan Phu, where there is real demand, projects are selling well, but many new urban areas remain deserted, with few amenities, primarily serving speculators.

This year’s real estate credit, though significantly increased, has not created a real money flow between buyers and businesses. Many companies are still capital-hungry due to slow sales, while inventory has surged. By June 2025, inventory reached about VND 570 trillion, the highest in 20 years, concentrated among large enterprises. This capital primarily flows into businesses rather than reaching actual buyers.

This is a risk the government has recognized, leading to strong directives to reduce speculation and guide the market toward sustainability, in line with the General Secretary and Prime Minister’s directives.

– Do you think the market is repeating the “asset bubble” cycle of the past?

Dr. Dinh The Hien: In 2006-2007, when Vietnam opened up strongly to integration, the stock and real estate markets both surged, coupled with robust infrastructure investment. Credit increased by 20-30%, fueling explosive real estate growth but also posing risks to the banking system as prices rose too high, leaving investors unable to buy, and speculators unable to sell, leading to a “crash.”

The government then launched a VND 29 trillion package but failed to save the market. The state had to tighten credit. The government “locked up” bad debts to help commercial banks continue operating. During this period, the government was very decisive after a phase of overheated growth.

After 2012, real estate companies realized they couldn’t rely solely on credit but needed real financial capacity. By 2022, the situation somewhat resembled the past, with the handling of SCB Bank and its relationship with Van Thinh Phat, similar to the mandatory acquisition of some weak banks at zero dong previously. However, the government now has more experience, handling the situation flexibly to avoid a market freeze like in 2011–2012.

The 2024 Real Estate Business Law also aims to tighten the market, directing capital to efficient areas.

In summary, the market will not enter a real estate bubble because the government remains vigilant, preventing commercial banks from mobilizing capital indiscriminately, as seen in late 2022, and not allowing interest rates and inflation to rise. However, the government seems to be seeking long-term solutions to adjust the real estate market toward sustainable development, with potentially stronger measures in the future, from legal, planning, to real estate taxation.

– From the perspective of credit and capital efficiency, what does the “asset bubble cycle” look like currently?

Dr. Dinh The Hien: By 2025, signs of “capital overuse” have reappeared. Specifically, if total credit increases by 16% and GDP grows by 8% as targeted by the Prime Minister, it would take 2 units of credit to generate 1 unit of GDP, nearing overuse.

If GDP growth reaches only 6.5%, as recently predicted by the IMF and World Bank, it would require 2.5 units of credit to produce 1 unit of GDP growth, indicating a significant decline in capital efficiency.

If the government adjusts credit growth to 20% to revive the economy, including real estate, we would be stepping into capital overuse.

Specifically in real estate, the situation is alarming: credit increases by about 20%, but sector growth is only 3–4%, meaning it takes 5-6 units of credit to generate 1 unit of growth. This indicates a large capital deficit, showing low credit efficiency and bubble risks. If this trend continues, the market could repeat the bubble and freeze scenario of 2012.

– What is your forecast for the real estate market in 2026–2027?

Dr. Dinh The Hien: In my view, 2026 will see two main trends.

First, industry professionals still haven’t changed their investment approach, continuing to view real estate as a speculative tool.

Second, the market will be restructured, closely tied to efficiency and economic development, rather than “leading the way” as before.

In reality, real estate “leading” economic development is only effective in a few well-planned projects with substantial resources; most are speculative, like condotels or abandoned resorts launched before real demand emerged. This has led to a surplus of high-end segments and a shortage of affordable housing.

From 2026, the market is expected to focus on actual homebuyers and real investors, particularly in Hanoi, Ho Chi Minh City, and satellite urban areas with good infrastructure and connectivity, high rental potential. Prices will stabilize at reasonable levels.

In 2026, the real estate market in areas with good infrastructure and connectivity will thrive. (Image: AI)

Additionally, in 2026, land in economic hubs with developed infrastructure linked to industrial zones, logistics, and ports will recover. Specifically, in the South, areas like the new Ho Chi Minh City towards the sea, parts of Dong Nai, and Tay Ninh (Ben Luc – Long An) are emerging as attractive destinations.

By 2027, as these industrial zones become operational, industrial real estate and housing for experts and workers will be key drivers. In the North, the Hanoi – Hai Phong – Bac Ninh corridor will also focus on industrial zones and ports.

Only a few financially capable developers can “lead the way.” Most must align real estate development with actual urbanization and industrialization. Only then can the market truly develop sustainably, in sync with the economy.

– Thank you for your insights!

Da Nang Announces 9 Real Estate Brokerage Firms Following Price Manipulation Crackdown

Before commencing operations, real estate brokerage, consulting, and management businesses are required to submit their company information to the Department of Construction. This submission ensures their details are published on the Housing and Real Estate Market Information System.