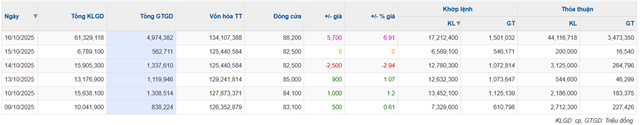

On October 16th, MSN shares surged to their upper limit, reaching 88,200 VND per share. Trading volume skyrocketed to over 61 million shares, equivalent to a transaction value exceeding 4.974 trillion VND.

This surge is likely linked to a significant share transfer between SK Group and a new investor. According to UBS Investment Bank, the transaction advisor, SK Invest VINA II Pte. Ltd. successfully sold approximately 42.6 million MSN shares, valued at an estimated $127 million (over 3.4 trillion VND) through a block deal.

The sale price ranged between 78,000 and 79,300 VND per share, representing a discount of 3.9% to 5.5% compared to MSN’s closing price on October 15th. Registration, pricing, and allocation took place from October 15th to 16th, with settlement expected on October 20th.

Following this transaction, SK Group is expected to significantly reduce its holdings in Masan, retaining only a negligible amount. This move aligns with the South Korean conglomerate’s strategy to restructure its investment portfolio in Vietnam.

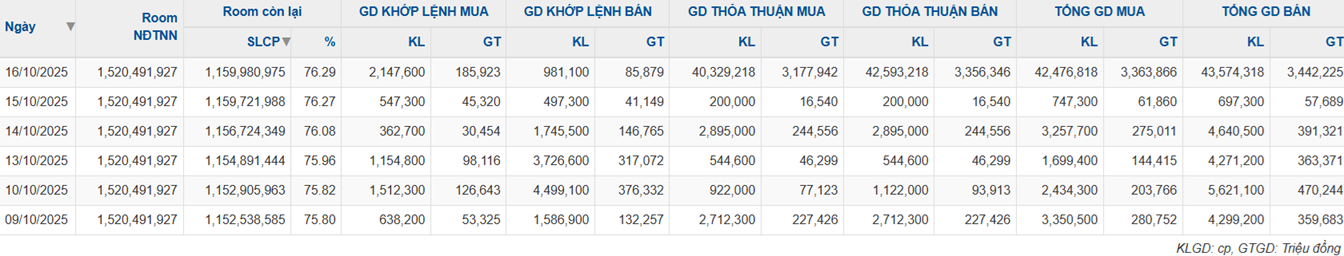

Foreign investors were net sellers of nearly 43.46 million MSN shares on October 16th, while buying approximately 42.5 million shares. This activity strongly suggests the transaction involved SK Invest and another foreign investor.

Earlier, in September 2024, Masan invested $200 million to acquire a 7.1% stake in WinCommerce from SK Group. Two months later, the South Korean fund divested 76 million MSN shares, reducing its ownership to 3.67% and ceasing to be a major shareholder. Masan’s leadership stated that the South Korean fund remains optimistic about MSN’s growth trajectory, profitability, and Vietnam’s long-term consumer growth potential. Both parties aim to collaborate in realizing these opportunities.

With Vietnam’s upgrade to Secondary Emerging Market status by FTSE Russell in September 2026, global financial institutions like J.P. Morgan, HSBC, SSI Research, and SHS Research unanimously predict a substantial influx of foreign capital into Vietnam starting late this year. This influx is expected to focus on leading companies with strong fundamentals, such as Masan Group.

SSI forecasts Masan’s Q3 2025 after-tax profit at approximately 1.7 trillion VND, a 31% increase year-over-year and 5% quarter-over-quarter. The actual reported figure could be even higher, reaching nearly 90% of the annual profit target within just nine months. This performance reflects significant operational improvements and the success of focusing on high-growth potential segments.

– 16:34 16/10/2025

Masan Surges Past 91,000 VND/Share, Hits Near 3-Year High

Shares of Masan Group Corporation (HOSE: MSN), chaired by billionaire Nguyen Dang Quang, surged again in the morning session on October 17th, reaching 91,100 VND per share—the highest level since February 2023. This follows an unexpected ceiling-hit on October 16th, driven by a remarkable 44 million share block trade, creating a significant ripple effect across the market.

Accelerating Energy Projects: General Secretary To Lam Urges Murphy Oil to Expedite Vietnam’s Oil and Gas Initiatives

Vietnam’s General Secretary has affirmed the nation’s commitment to fostering a conducive environment for foreign investment and business operations, particularly in the energy sector. This includes extending support to U.S. companies seeking to establish or expand their presence in Vietnam’s thriving energy market.