The villa and townhouse market (referred to as landed property) in Ho Chi Minh City (HCMC) during Q3/2025 remains characterized by limited supply and high prices, mirroring the trends observed in the first half of the year.

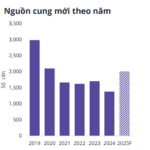

Surveys reveal a trickle of new landed property supply in HCMC. In the past quarter, only 226 units at the Gladia By The Waters project were launched, priced between VND 23 billion and VND 70 billion per unit, depending on size.

Several projects are gearing up for launch, poised to significantly boost market supply. These include The Meadow (next phase) and new offerings at Vinhomes Green Paradise Can Gio.

In the western gateway area of the city, Vinhomes Green City (Tay Ninh Province) led the market in the last quarter. Projects like Eco Retreat, King Hill Residences, and The Solia also contributed to heightened market activity.

Landed property supply in HCMC has been scarce in recent times. Photo: S.T

|

Commenting on the HCMC landed property market, Ms. Duong Thuy Dung, Managing Director of CBRE Vietnam, noted a slight recovery in Q3 after a prolonged slowdown.

Compared to the previous quarter, primary market prices remained stable at VND 303 million/m². However, secondary market prices surged 18% year-on-year, averaging VND 167 million/m².

According to Ms. Dung, with limited supply and high prices in HCMC’s established areas, gateway regions offer a viable alternative, particularly for owner-occupiers.

CBRE Vietnam forecasts that post-merger, landed property supply from now until year-end could exceed 2,400 units, underscoring Greater HCMC’s role in meeting housing demand.

Echoing this view, representatives from Avison Young’s research division noted persistent new supply shortages in HCMC’s landed property market last quarter, alongside high prices.

Most notably, Thu Thiem New Urban Area saw ultra-luxury villas approach VND 1 billion/m², setting a new benchmark for the high-end segment.

A view of the coastal megacity Vinhomes Green Paradise Can Gio. Photo: Anh Phuong |

At other luxury projects, primary market prices typically ranged from VND 250–300 million/m². Secondary market prices were significantly lower, reflecting buyer caution.

“Overall liquidity remains subdued due to high capital costs and a wait-and-see attitude. Demand in HCMC’s peripheral areas is stronger, thanks to lower prices and improved infrastructure. Looking ahead, high-end landed properties in the city retain appeal due to scarcity and price appreciation potential,” Avison Young representatives stated.

Amid limited new supply, recent news about the upcoming launch of the coastal megacity Vinhomes Green Paradise Can Gio has captured investor interest. Daily, numerous visitors from the city center travel via Binh Khanh ferry to explore the project.

A real estate brokerage director shared that over the past month, he has escorted dozens of investor groups to survey Vinhomes Green Paradise Can Gio, including many from northern Vietnam.

He noted that while the developer has not announced an official launch date, partnerships with distributors are underway for the debut phase. He predicts landed property prices at the project will start from VND 200 million/m².

Anh Phuong

– 06:00 15/10/2025

Southern Region’s Apartment and Townhouse Market: A Comprehensive Overview

Property buyers in Ho Chi Minh City are returning to the market, with one broker reporting the successful sale of three apartments and one townhouse in the past three months.

Dutch Conglomerate Invests Hundreds of Millions to Acquire CJ and Masan Plants, Plans to Relocate Asia Headquarters to Ho Chi Minh City

A positive signal for Ho Chi Minh City’s investment environment emerges as De Heus, a global leader in animal feed production, expresses its intention to establish its regional headquarters in the city. This announcement was made during a meeting between the corporation’s leadership and Mr. Nguyen Van Duoc, Chairman of the Ho Chi Minh City People’s Committee, on October 2nd.