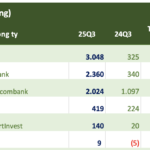

As of the morning of October 16th, 16 securities companies have released their Q3 2025 financial reports.

Saigon-Hanoi Securities Corporation (SHS) is the latest to report a significant surge in Q3 profits. Specifically, its operating revenue reached VND 816 billion, triple that of Q3 2024. Notably, gains from FVTPL assets soared to VND 394 billion, six times higher than the previous year. Additionally, brokerage revenue jumped to VND 137 billion (+180%), and earnings from lending and receivables reached VND 256 billion (+132%).

Operating expenses unexpectedly dropped by 26% year-on-year to VND 120 billion, thanks to active proprietary trading. As a result, SHS reported pre-tax profits of VND 590 billion in Q3, eight times higher than the same period last year.

In the first nine months, SHS’s pre-tax profit reached VND 1,379 billion, up 45% year-on-year, surpassing the 2025 target set by the shareholders’ meeting. Outstanding debt hit VND 9,136.66 billion, a 135% increase year-on-year, reflecting robust trading demand and effective risk management.

Vietcap Securities (VCI) also released its Q3 2025 financial report, posting an operating revenue of VND 1,443 billion, a 48% increase from Q3 2024. The majority of VCI’s revenue came from proprietary trading, with gains from FVTPL financial assets reaching VND 667 billion, up 25%.

Earnings from lending and receivables, as well as brokerage revenue, also saw strong growth, reaching VND 313 billion (+52%) and VND 372 billion (+103%), respectively.

With revenue surging, VCI’s operating expenses also rose significantly to VND 686 billion. Consequently, pre-tax profit climbed 96% year-on-year to VND 1,086 billion.

For the first nine months, Vietcap’s operating revenue reached VND 3,454 billion, a 28% increase year-on-year. Pre-tax profit stood at VND 1,086 billion, up 30% from the same period last year.

To date, CV Securities is the only company reporting a loss in Q3. Specifically, its operating revenue reached nearly VND 8 billion, up 72% year-on-year. However, operating expenses exceeded VND 9 billion, primarily due to brokerage fees. Coupled with nearly VND 4 billion in securities company management costs, CV Securities reported a pre-tax loss of over VND 5.2 billion in Q3, marking its 13th consecutive quarter of losses.

Latest Securities Company Data Update (Oct 10): Top Players Unveil Q3 Earnings, Revealing Multi-Fold Profit Surges

Several leading securities companies have unveiled remarkable financial performance in Q3 2025, showcasing robust growth and resilience in a dynamic market environment.

MBS Joins the “Billion-Dollar Club” for the First Time, Surging to Top 6 Market Share on HOSE

MBS Securities Corporation has unveiled its Q3 2025 financial results, reporting a remarkable profit of VND 418 billion, a 1.9-fold increase compared to the same period last year. With a cumulative nine-month profit of VND 1,030 billion, MBS has achieved a significant milestone by joining the prestigious “Thousand Billion Club” and securing a position among the top 6 brokerage firms on the Ho Chi Minh City Stock Exchange (HOSE).

Stock Market Shares: A Compelling Choice to Ride the Upgrade Wave

Vietnam’s official upgrade to secondary emerging market status by FTSE Russell unlocks significant opportunities for the securities sector, particularly for companies with strong fundamentals, robust growth potential, and the capability to attract foreign capital. Amid this backdrop, VPBankS launches its record-breaking IPO, offering an attractive opportunity for investors looking to capitalize on this market elevation.