|

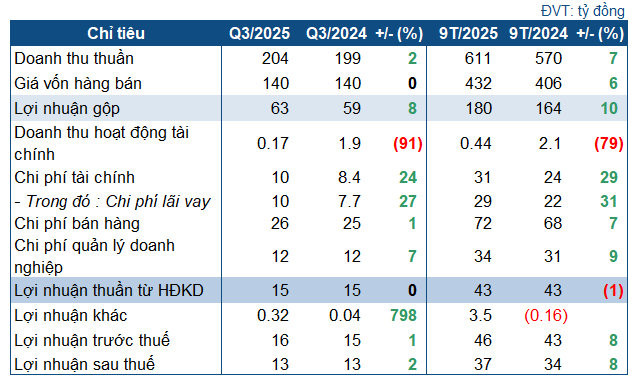

AGP’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3/2025, AGP recorded net revenue of nearly VND 204 billion, a slight increase of 2.4% year-on-year. Cost of goods sold remained relatively stable, driving an 8% rise in gross profit to over VND 63 billion.

Operating expenses saw modest fluctuations, with the most significant increase in financial costs, up 24% to over VND 10 billion. After deducting expenses, the company’s post-tax profit reached nearly VND 13 billion, a modest 2% uptick.

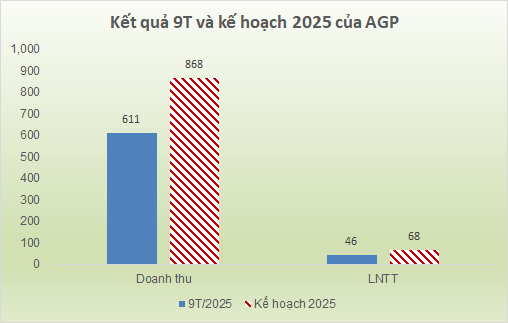

For the first nine months, the company achieved VND 611 billion in net revenue and VND 37 billion in post-tax profit, up 7% and 8% respectively compared to the same period last year. Against the 2025 Annual General Meeting’s targets, AGP has fulfilled over 70% of its revenue goal and nearly 68% of its pre-tax profit objective.

As of Q3’s end, AGP’s total assets reached over VND 1.24 trillion, a 13.5% increase from the beginning of the year, with over VND 703 billion in current assets (up 15%). Cash and deposits stood at over VND 47 billion, 2.5 times higher than at the start of the year.

Notable increases were seen in inventory, up 13% to VND 348 billion, and construction in progress, which surged 113% to nearly VND 101 billion, primarily due to investments in pharmaceutical plant expansions and a new liquid medicine factory in Binh Hoa (over VND 60 billion). While the current ratio exceeds 1, the quick ratio of 0.5 indicates potential liquidity risks if debt obligations are due simultaneously.

– 16:47 15/10/2025

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.

Hodeco Secures Significant Profits Despite Real Estate Revenue Shortfall Through Strategic Sale of Affiliated Company Equity

Amidst a staggering 87% decline in real estate revenue, Hodeco has defied the odds by reporting record profits, attributed to the strategic sale of shares in Ocean Entertainment Construction Investment Corporation Vung Tau.