|

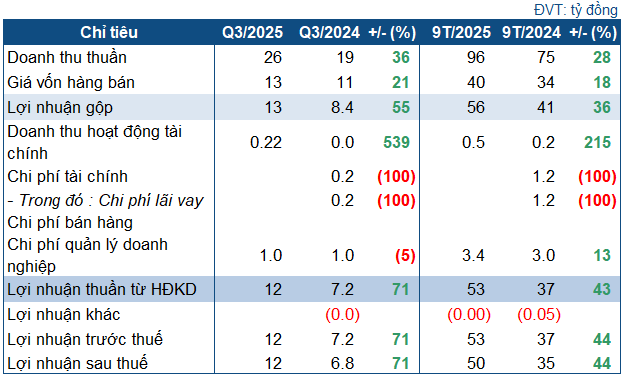

NTH’s Q3/2025 Business Results

Source: VietstockFinance

|

Specifically, NTH recorded net revenue of over 26 billion VND in Q3, a 36% increase year-over-year. The cost of goods sold rose at a slower pace, driving a 55% surge in gross profit to over 13 billion VND.

After deducting expenses, NTH achieved a post-tax profit of nearly 12 billion VND, up 71%. The company attributed this growth primarily to more favorable hydrological conditions compared to the same period last year, which boosted electricity output and revenue.

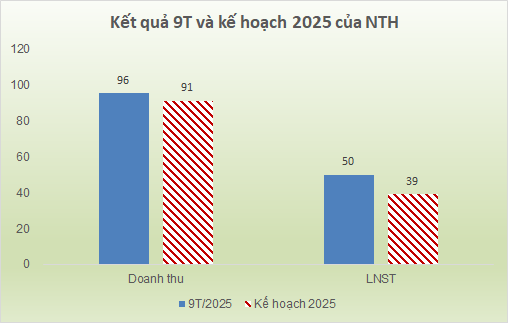

For the first nine months of the year, NTH reported net revenue of 96 billion VND and post-tax profit of 50 billion VND, up 28% and 45% year-over-year, respectively. Compared to the plan approved by the 2025 Annual General Meeting, the company exceeded its revenue target by 4% and its post-tax profit target by 27%.

Source: VietstockFinance

|

As of the end of Q3, NTH‘s total assets reached 198 billion VND, slightly down from the beginning of the year. Current assets increased by 21% to 46 billion VND. Cash and cash equivalents rose by 30% to 27.6 billion VND. Short-term receivables from customers grew by 12% to 17.5 billion VND.

On the capital side, NTH demonstrated a healthy financial structure with no recorded debt. Liabilities primarily consisted of short-term payables such as payables to suppliers and taxes, totaling 11 billion VND, or 5.5% of total capital.

– 08:08 18/10/2025

Q3/2025 Financial Report Deadline: Binh Minh Plastics Reports Record Profits, While a Steel Company Sees 91% Profit Decline

Two hydropower companies have announced their financial results. Song Ba Hydropower (SBA) reported a 91% increase in pre-tax profit for Q3 and a 64% rise for the first nine months, while SHP Hydropower saw a 2% growth in Q3 pre-tax profit and a 31% increase year-to-date.

Legal Concerns for Buyers: Navigating Property Purchase Risks

When asked about the “biggest risk concerns when buying real estate,” most customers express worries regarding project legality, construction delays, and the project’s liquidity, carefully considering these factors before committing their funds. In contrast, concerns about price fluctuations and rental potential are less prominent.