Hodeco (HDC) Reports Remarkable Q3 2025 Earnings Growth

Bà Rịa – Vũng Tàu Housing Development Corporation (Hodeco, stock code: HDC) has released its Q3 2025 consolidated financial report, showcasing a staggering surge in profits. The company’s after-tax profit reached nearly VND 539 billion, a 40-fold increase compared to the VND 13.3 billion recorded in the same period last year.

Financial Highlights of Hodeco’s Q3 Performance

This profit growth did not stem from core business operations. In fact, Hodeco’s consolidated net revenue for the quarter declined by 18% year-on-year, totaling VND 102 billion.

The primary driver of this exceptional result was financial activities, specifically the sale of Hodeco’s entire 47.27% stake in Ocean Entertainment Construction Investment JSC in Vũng Tàu.

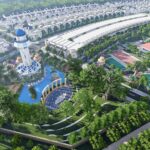

This company is the developer of the Ocean Tourism Complex, a 19-hectare project in Vũng Tàu with an estimated investment of over VND 10,000 billion. The transaction generated over VND 696 billion in financial revenue for Hodeco.

Ocean Tourism Complex. Image: Hodeco

According to the consolidated financial report, in the first nine months of 2025, Hodeco recorded pre-tax profit of VND 757.3 billion and after-tax profit attributable to the parent company’s shareholders of VND 609.3 billion.

With these results, the company projects full-year 2025 pre-tax profit of VND 755 billion and after-tax profit of VND 608 billion, exceeding annual targets by 42% and 43%, respectively. Hodeco plans to distribute a higher dividend for 2025, estimated at 20%, and has approved a bonus share issuance of over 21.4 million shares at a 12% ratio.

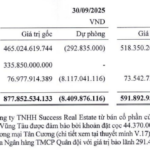

As of September 30, 2025, Hodeco’s total assets reached VND 5,404 billion, an 11% increase from the beginning of the year. Inventory (VND 1,433 billion) and long-term work-in-progress (VND 1,662 billion), primarily from ongoing real estate projects, constitute a significant portion of the asset structure.

On the financing side, total liabilities amount to VND 2,523 billion, with short- and long-term financial debt totaling VND 1,626 billion, accounting for approximately 30% of total capital.

Hodeco’s Financial Position as of Q3 2025

In the stock market, HDC shares have shown positive momentum. On October 15, HDC traded between VND 41,100 and VND 42,250 per share. Compared to its mid-April 2025 low, the stock has surged by nearly 90% in value.

Profit Explosion: Real Estate Firm on HoSE Projects 34x Surge in Q3 2025 Earnings

Hodeco’s remarkable Q3 2025 business performance was primarily driven by the successful share transfer of the Ocean Resort project in Rach Dua Ward, Vung Tau City.

Hodeco Raises $13.5 Million via Bond Issuance to Expand Land Fund for Phước Thắng Project

Hodeco (HOSE: HDC), a leading real estate developer in Ba Ria – Vung Tau, successfully closed its second consecutive private bond issuance on September 18th, raising VND 300 billion. This brings the total funds raised from the two issuances to VND 500 billion (at par value).