The trio of stocks VIC, VHM, and VRE deducted over 14 points from the VN-Index, declining by 4-5%, becoming the focal point driving the market downward in today’s session. This marks the most significant adjustment for this group since the beginning of the month, following a continuous uptrend that helped many Vin-affiliated stocks reach new peaks.

Previously, VIC’s share price surpassed the 200,000 VND/share milestone, recording an all-time high. Despite a 4.3% drop in the session, VIC’s shares remain near their previous peak, currently at 204,000 VND/unit, indicating short-term profit-taking pressure but an unbroken positive mid-term trend.

The VN30 group dominated by red.

Alongside Vin-affiliated stocks, shares in the VN30 basket also faced heavy selling pressure, with 26 declining. Profit-taking spread to the banking sector, with stocks like CTG, LPB, and VPB falling over 3%. On the HoSE, no banking stocks retained their green status, as SHB, MBB, OCB, STB, VIB, TCB, and MSB all adjusted downward.

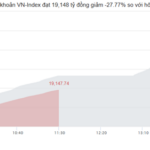

The broad decline in large-cap and highly liquid stocks created significant downward pressure, pulling the VN-Index well below its short-term support level. Investor sentiment was notably impacted as leading stocks reversed. Real estate shares were bathed in red, with PDR, GEX, TCH, KDH, KBC, HDG, and IJC all experiencing sharp drops.

Related stocks such as VIX, IDC, and MHC also declined. However, a rare bright spot was GEE, which bucked the trend with a 2.6% increase, somewhat helping the market maintain balance amid widespread adjustment pressure.

At the close, the VN-Index fell 35.66 points (2.22%) to 1,731.19. The HNX-Index dropped 0.97 points (0.35%) to 276.11, while the UPCoM-Index rose 0.3 points (0.27%) to 112.67. Liquidity increased amid late-session selling pressure, with HoSE trading value exceeding 42 trillion VND.

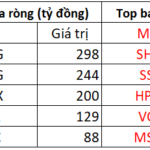

Foreign investors added to the downward pressure, resuming net selling of over 2,044 billion VND, concentrated in VSH, VRE, SSI, and VCI.

FPT Stock Plummets 9x Since Truong Gia Binh’s “Unstoppable Momentum” Remark 9 Months Ago

FPT shares have plummeted nearly 33% since Chairman Truong Gia Binh’s bold statement, “the momentum is unstoppable,” during the Lunar New Year celebration, resulting in a staggering $3.7 billion wipeout from the corporation’s market capitalization.

Market Pulse 15/10: VN-Index Closes in the Red, Financial and Tech Sectors Buck the Trend

At the close of trading, the VN-Index dipped 3.11 points (-0.18%), settling at 1,757.95 points, while the HNX-Index climbed 0.79 points (+0.29%), reaching 276.12 points. Market breadth favored decliners, with 446 stocks closing lower compared to 257 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.