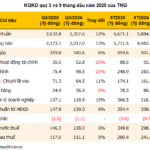

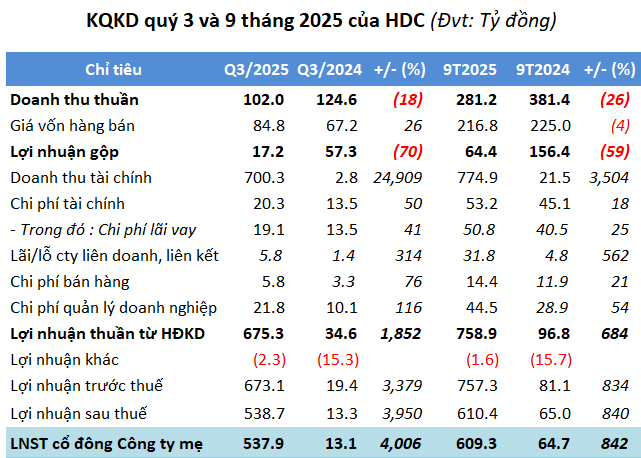

According to the Q3/2025 Consolidated Financial Statements, Ba Ria – Vung Tau Housing Development JSC (Hodeco, HOSE: HDC) recorded net revenue of VND 102 billion, an 18% decrease compared to the same period last year. This decline is primarily due to a sharp 87% drop in real estate sales, which contributed only VND 8 billion. Meanwhile, the cost of goods sold increased, resulting in a gross profit of just over VND 17 billion, a 70% decrease. The gross profit margin also narrowed from 46% to nearly 17%.

Hodeco attributed the lackluster performance in Q3 to the ongoing challenges in the real estate market, which have impacted sales activities.

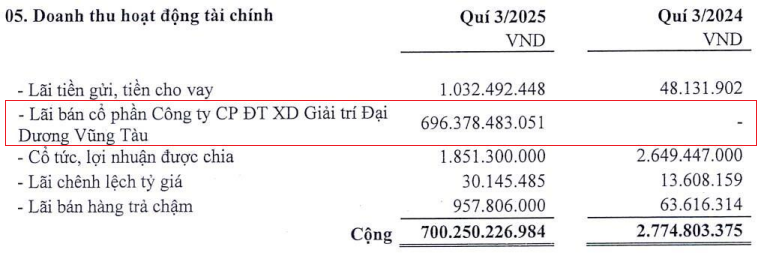

However, financial revenue soared to over VND 700 billion, a staggering 250 times higher than the same period last year, thanks to a VND 696 billion gain from the sale of shares in Ocean Entertainment Investment and Construction JSC Vung Tau. This led to a record-high net profit of nearly VND 538 billion, 41 times higher than the previous year, despite a 78% increase in financial, selling, and administrative expenses, totaling VND 48 billion.

Source: HDC

|

Combined with the first half results, the 9-month net revenue reached over VND 281 billion, a 26% decrease, while net profit after tax exceeded VND 610 billion, 9.4 times higher. Compared to the 2025 plan, HDC has achieved only 19% of its revenue target but has surpassed its profit goal by 44%.

Source: VietstockFinance

|

Significant Increase in Cash Holdings

HDC‘s total assets at the end of Q3 reached over VND 5,400 billion, an 11% increase from the beginning of the year. Notably, cash and cash equivalents surged to over VND 280 billion, more than 27 times higher than the start of the year.

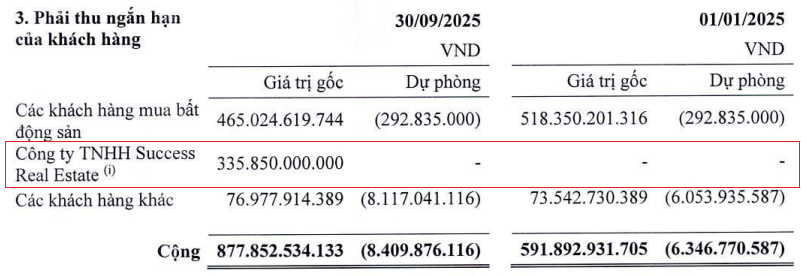

It is worth mentioning that HDC recorded a short-term receivable of nearly VND 336 billion from Success Real Estate LLC, arising from the sale of shares in Ocean Vung Tau JSC. This receivable is secured by a VND 44 billion deposit from Tan Cuong Investment and Trade Consultancy JSC and a VND 291 billion payment guarantee letter issued by Military Commercial Joint Stock Bank (MB, HOSE: MBB) on June 27, 2025.

Source: HDC

|

Additionally, HDC recorded another receivable of nearly VND 238 billion from Ms. Nguyen Thi Phuong Tam. According to the company’s explanation, this is the payment for Ms. Tam’s purchase of shares in Y Ngoc Binh Thuan Resort Real Estate Trading JSC, as per the principle transfer agreement signed on November 25, 2021.

In August 2025, the HDC Board of Directors agreed to change the method of acquiring the Da Vang Sea Tourism Area project by splitting Y Ngoc Binh Thuan JSC into two legal entities. HDC will own a 46% stake in the new entity, Y Ngoc Da Vang Resort Real Estate Trading JSC, and plans to increase its ownership to 95.15% by acquiring shares from the new entity’s shareholders.

Inventory reached over VND 1,433 billion, a 5% increase, primarily concentrated in The Light City complex project with over VND 934 billion. Work-in-progress costs exceeded VND 1,662 billion, a 22% increase, spread across various projects, including the Long Dien residential area (HCMC) with nearly VND 794 billion, Co May urban area with VND 646 billion, Phuoc Thang urban area with VND 205 billion, and others.

Liabilities decreased by 3% to over VND 2,523 billion. Financial debt accounted for 64% of total liabilities, amounting to VND 1,626 billion, including nearly VND 500 billion in bond debt.

At the 2025 Extraordinary Shareholders’ Meeting in late September, Hodeco’s leadership announced plans for 2026, including the recognition of partial revenue from the transfer of Thong Nhat apartment buildings. The company will also continue operations in Q4/2025 at the Hai Dang – The Light City, Ngoc Tuoc 2 villa area, Tay 3/2 residential area, and Ecotown Phu My projects, with results to be reflected in the 2026 financial statements.

Following the merger with HCMC and the involvement of major enterprises in project development, Vung Tau real estate prices have adjusted upwards but remain lower than HCMC. HDC leadership is optimistic that the Vung Tau (old) real estate market will significantly improve once the expressway and airport become operational. Hodeco plans to expand its development to additional projects in other provinces.

Hodeco raises VND 300 billion through bonds to expand land fund at Phuoc Thang project

– 15:45 16/10/2025

Credit Policies, Tax Regulations, and Housing Inequality in Vietnam

Property prices not only reflect the physical balance of supply and demand but also serve as a mirror to the equity of opportunity distribution. When credit and tax policies disproportionately favor those who already possess assets, the system perpetuates inequality, turning real estate into a hotbed for both financial risk and eroding trust.

Over 4 Million Trillion Dong in Real Estate Credit: What Could Happen Next?

As of the end of August 2025, real estate credit outstanding debt has surpassed 4 million trillion VND, accounting for nearly a quarter of the total debt in the economy. This substantial capital inflow is anticipated to stimulate market recovery, yet it also raises concerns regarding capital efficiency and the potential risk of an asset bubble.

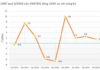

TNG Sets New Quarterly Revenue and Profit Records, Stock Defies Downtrend

TNG Investment and Trading JSC (HNX: TNG) sustains its growth momentum following a record-breaking Q2, with Q3/2025 revenue and profit reaching all-time highs. However, the stock price has diverged, declining nearly 20% over the past year.