|

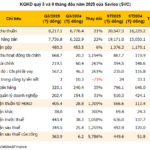

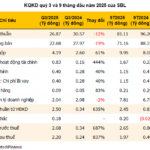

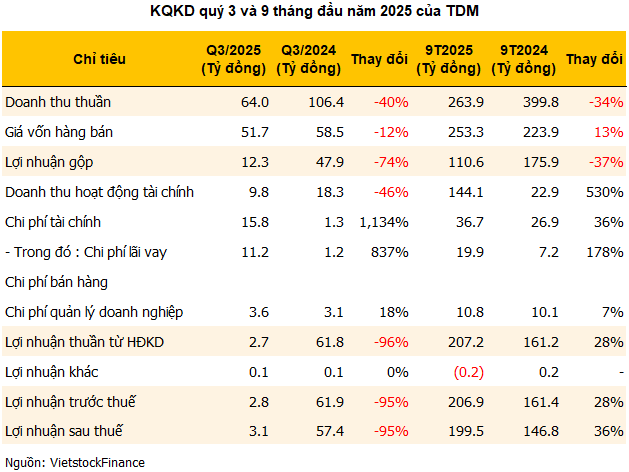

TDM reported a net profit of just over VND 3 billion in Q3/2025, the lowest quarterly figure since its inception, marking a 95% decline compared to the same period last year. Revenue for the quarter also plummeted by 40% to VND 64 billion, the lowest in over seven years, due to decreases in both water supply volume and pricing. Gross profit margin fell below 35% for the first time, settling at just over 19%.

Beyond the core business decline, the financial segment has become a burden. Financial revenue in Q3 was less than VND 10 billion, a 46% drop, primarily due to the absence of a VND 1,400 per share dividend from Can Tho Water Supply and Drainage JSC, as seen last year. Conversely, financial expenses surged by over 1,100% to nearly VND 16 billion, largely driven by interest expenses on loans for the DN1600 raw water transmission pipeline project from the Tan Ba intake to the Di An water plant, along with other financial borrowings.

| TDM Hits Quarterly Profit Nadir |

For the first nine months of 2025, despite a 34% revenue decline to under VND 264 billion, TDM still achieved a net profit of nearly VND 200 billion, a 36% increase year-over-year. This result was primarily driven by dividends and profit-sharing totaling VND 139.5 billion, nearly eight times higher than the same period last year, including a dividend of nearly VND 107 billion from Binh Duong Water and Environment JSC (Biwase, HOSE: BWE). TDM is a strategic shareholder of Biwase, holding 37.42% of its charter capital.

Significant Investment in Water Ecosystem

As of September 30, 2025, TDM‘s total assets reached over VND 3,424 billion, an increase of VND 400 billion from the beginning of the year. Key changes included inventory doubling to VND 165 billion and long-term financial investments rising by 31% to VND 2,181 billion.

During the period, TDM executed several new investment deals: acquiring 20 million shares (20.7% equity) in Biwase Long An Water JSC from Biwase for over VND 322 billion; purchasing 4.9 million shares (10% equity) in Phu My Vinh Investment and Construction JSC for over VND 169 billion; and acquiring 1 million shares (8.33% equity) in Biwase Can Tho Water JSC for a total of VND 23 billion.

All three investments were initiated in 2025. Currently, TDM‘s largest investment is in Biwase, with a book value of VND 1,061 billion, while its fair value stands at nearly VND 3,991 billion, almost four times the book value.

As of September, TDM held bank deposits of over VND 266 billion, down by more than half from the beginning of the year. Total liabilities reached nearly VND 850 billion, an increase of VND 345 billion, including short-term loans and finance leases of VND 183 billion (up 62%) and long-term loans of VND 539.5 billion (up 122%). Notably, the company secured a new loan of VND 320 billion from Kasikornbank Public Company Limited.

On the HOSE, TDM shares traded at VND 58,000 per share on the morning of October 17, down 2% over the past three months but up over 29% year-over-year. Average trading volume was nearly 15,000 shares per session.

| TDM Share Price Performance Over the Past Year |

– 13:12 17/10/2025

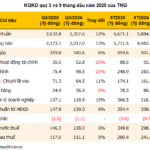

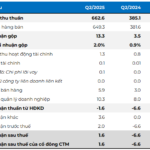

TNG Sets New Quarterly Revenue and Profit Records, Stock Defies Downtrend

TNG Investment and Trading JSC (HNX: TNG) sustains its growth momentum following a record-breaking Q2, with Q3/2025 revenue and profit reaching all-time highs. However, the stock price has diverged, declining nearly 20% over the past year.