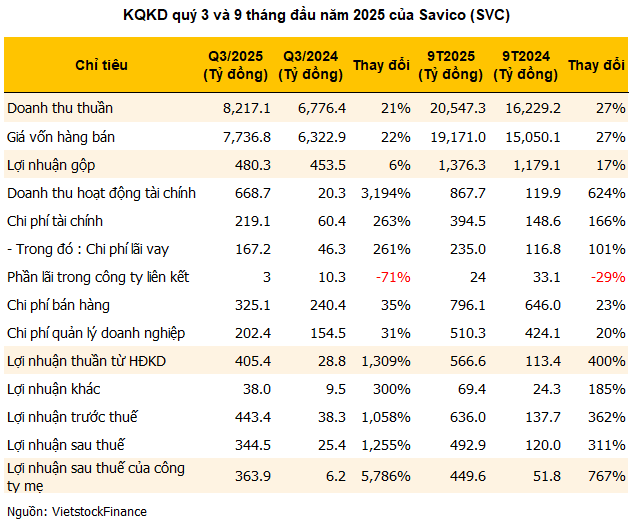

Savico has released its Q3/2025 consolidated financial report, revealing a staggering net profit of VND 364 billion, a nearly 5,800% surge compared to the same period last year, which saw a modest VND 6 billion. This marks the highest quarterly profit in the company’s history, surpassing even the 2022 record of VND 333 billion and nearly quadrupling the entire 2024 profit of VND 100 billion.

|

Q3 revenue reached VND 8,271 billion, a 21% increase, driven by a thriving automobile market and an expanded network of subsidiary companies. The most significant highlight was the financial income of nearly VND 669 billion, a 3,200% jump year-over-year, primarily from VND 537 billion in investment sales profits. Savico attributed this income to the transfer of capital in a real estate project during the period.

This financial gain is likely linked to Savico’s successful transfer of its capital stake in the Long Hòa – Cần Giờ luxury residential project, yielding over VND 619 billion through a public auction. The buyer was Gelex Infrastructure JSC.

|

Spanning nearly 30 hectares in Long Hòa commune, Cần Giờ district, the project is designed as a high-end residential area for approximately 4,000 residents. Savico partnered with HCM City Foreign Trade and Investment Development JSC (Fideco, HOSE: FDC) in 2002, with a 50-50 capital contribution. The project received land allocation from the HCM City People’s Committee in 2005 but faced prolonged delays due to legal issues, as noted in Fideco’s 2024 annual report. |

9-Month Profit Doubles Annual Target

In the first nine months of 2025, Savico achieved revenue of over VND 20,547 billion, a 27% increase, with a net profit of nearly VND 450 billion, up 767% year-over-year and 4.5 times the 2024 profit. This performance has already surpassed 120% of the annual profit target, despite only meeting 69% of the revenue goal.

However, the cash flow statement shows a net cash outflow from operating activities of over VND 1,018 billion, a significant rise from the VND 322 billion outflow in the same period in 2024, primarily due to increased receivables and inventory.

As of September 2025, Savico’s inventory stood at VND 2,344 billion, a 40% increase from the beginning of the year, with goods accounting for 91%. Receivables rose by 40% to VND 1,082 billion, while other short-term receivables surged 2.4 times to over VND 2,597 billion, including VND 1,611 billion from investment partnerships.

Savico holds VND 567 billion in cash and cash equivalents, down 32% from the start of the year. Short-term loans increased by 24% to VND 3,455 billion, while long-term debt soared 70% to VND 2,154 billion, primarily from bank loans. The company also recorded a VND 500 billion short-term payable to Tasco Investment LLC, a wholly-owned subsidiary of Tasco JSC (HNX: HUT).

Following the announcement of the record profit, SVC shares hit their ceiling price on October 16, closing at VND 21,400 per share, and continued to rise to VND 22,850 per share on the morning of October 17. This represents a 1.5x increase over the past three months and a 29% gain year-over-year, with average trading volume of nearly 4,300 shares per session. The stock previously peaked at over VND 25,000 per share in early September 2025.

| SVC Stock Price Performance Over the Past Year |

– 09:51 17/10/2025

Craft Beer Company’s Q3 Profits Surge Over 800%, Exceeding Annual Targets by 100x

After a loss-making first half of 2025, Saigon Beer – Bac Lieu JSC (UPCoM: SBL) reported a staggering 837% surge in Q3 net profit year-over-year, propelling its nine-month cumulative profit to over 100 times its full-year target of a mere VND 16 million.

What Drove Viglacera’s (VGC) Profits to a 7-Quarter Low?

Viglacera’s consolidated after-tax profit for Q3 reached 118 billion VND, marking a 50% decline compared to the 234 billion VND recorded in Q3 2024.