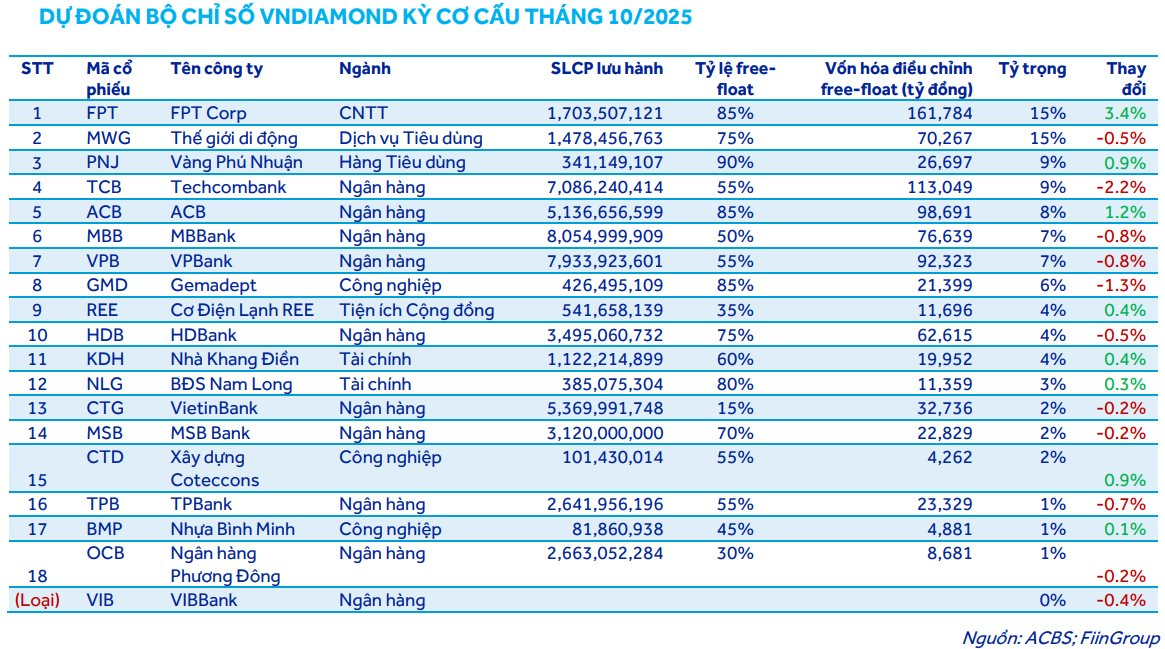

The Ho Chi Minh City Stock Exchange (HOSE) will officially announce the constituent list of the VNDIAMOND index on October 20, 2025. In its latest report, ACBS Securities highlights several changes to the VNDIAMOND index in this upcoming announcement.

Specifically, during the October 2025 review, VIB shares will be officially removed from the index after being placed on the deletion watchlist for one period due to insufficient foreign ownership limits (FOL).

Additionally, CTD shares will officially become a retained stock for two consecutive periods, increasing its weight limit from 50% (for newly added stocks) to 100% (for retained stocks).

Currently, there are 6 ETFs tracking the VNDIAMOND index, with the three largest being: FUEVFVND (NAV = VND 13,677 billion), FUEMAVND (NAV = VND 343 billion), and FUEKIVND (NAV = VND 78 billion). The remaining three funds have assets under management of less than VND 5 billion.

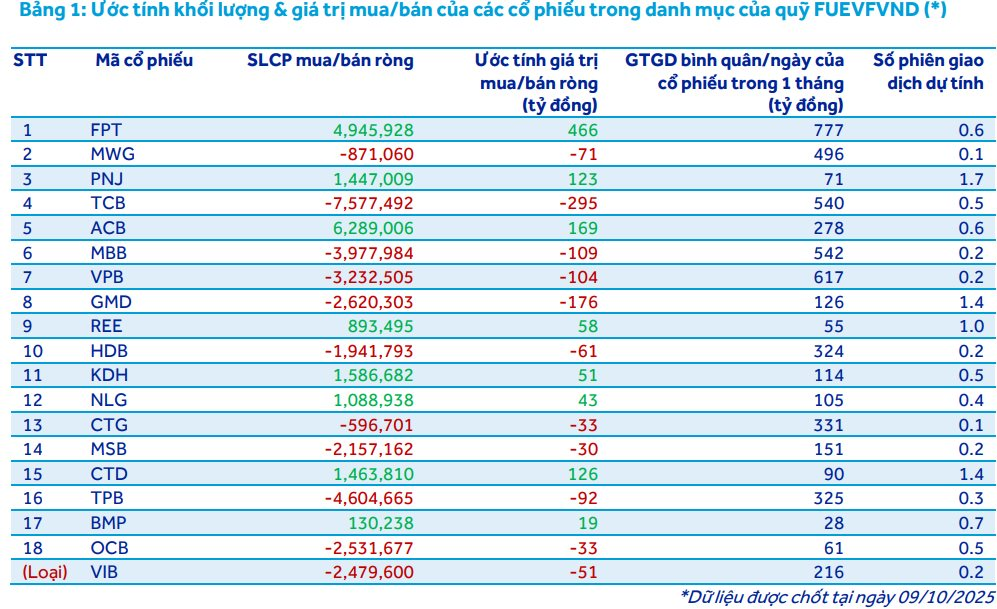

ACBS believes that rebalancing smaller funds will have minimal market impact. Therefore, the analysis team only estimates the rebalancing transactions for the largest fund, FUEVFVND.

FUEVFVND is expected to execute its portfolio rebalancing from October 22, 2025. The top 3 stocks with the highest net buying are FPT, ACB, and CTD, while the top 3 stocks with the highest net selling are TCB, GMD, and MBB. Most stocks are anticipated to complete rebalancing within one trading session, except for PNJ (1.7 sessions), GMD, and CTD (1.4 sessions).

ACBS Securities projects that FPT will be the most purchased stock by FUEVFVND during the October 2025 rebalancing, with an estimated value of nearly VND 466 billion, equivalent to 4.9 million shares. Conversely, TCB will be the most sold stock, with over VND 295 billion, equivalent to nearly 7.6 million shares.

Foreign Investors Dump Over 400 Billion VND in Blue-Chip Stock on October 15th

Foreign investors’ trading activity has once again become a negative factor, as they engaged in net selling with a total value of 883 billion VND across the entire market.

Vietnam’s Largest Auto Distributor Reports Q3 Profit Surging 59x Year-on-Year, Stock Hits Daily Limit Up

In the first nine months of the year, the company achieved a remarkable net revenue of 20,547 billion VND, marking a 27% increase compared to the same period in 2024. The parent company’s post-tax profit soared to 450 billion VND, an astounding 8.7-fold growth year-over-year.