Capital Increase: The Foundation for SHB’s Sustained Growth

Banking operations typically achieve double-digit growth, primarily driven by core lending activities. However, in several periods, credit growth rates at listed banks have outpaced the growth of equity capital. Experts unanimously agree that increasing chartered capital is an inevitable trend for Vietnam’s banking system. This aims to enhance financial capacity, improve risk resilience, and meet Basel III capital safety requirements. SHB is no exception to this trend.

A review of SHB’s first-half 2025 performance reveals impressive growth figures. Outstanding loans reached nearly 595 billion VND, a 14.4% increase, with a diversified lending portfolio across key economic sectors.

SHB’s consistent loan growth over the past five years highlights its competitive advantage in serving corporate clients, the primary driver of industry-wide credit expansion. SHB provides comprehensive capital solutions within corporate ecosystems, supporting all stages of the value chain, from production and supply to services. Despite robust lending growth, SHB maintains stringent asset quality management, continuously enhancing its portfolio.

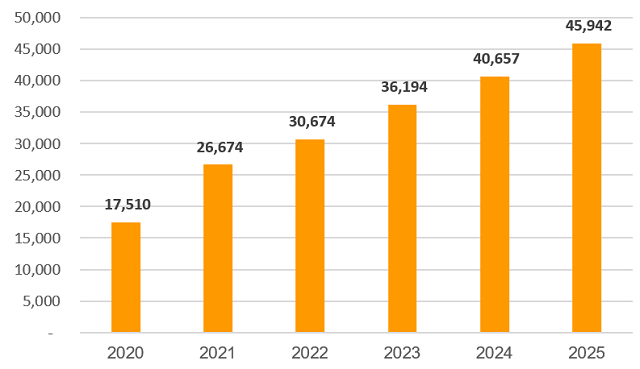

SHB’s Chartered Capital Over the Years

|

SHB’s capital increase plan is well-justified, enabling the bank to expand its credit portfolio, boost revenue, and dilute non-performing loan ratios.

Notably, while the banking sector typically experiences slower credit growth at the beginning of the year, SHB is bucking this trend, setting the stage for a stronger full-year performance. This underscores SHB’s significant growth potential, particularly as its capital capacity is strengthened. Key drivers include Vietnam’s economic growth momentum, accommodative monetary policies, public investment acceleration, and SHB’s strong corporate client base.

A successful capital increase will also bolster SHB’s capital buffer, maintaining a high Capital Adequacy Ratio (CAR) well above the minimum requirements set by the State Bank of Vietnam. This reflects the bank’s robust financial health and strong risk resilience.

While SHB has not yet disclosed its nine-month business results, experts anticipate sustained growth. This is fueled by steady quarterly credit expansion, improved profit margins through optimized funding and capital structures, controlled operating costs, and stable asset quality. The bank’s flagship credit programs and technology investments are beginning to yield results, laying the groundwork for accelerated growth in the final quarter and beyond.

Recently, SHB completed its chartered capital increase to 45,942 billion VND, as approved by the Annual General Meeting earlier this year. This was achieved through a 13% dividend payment in shares for the second tranche of 2024. The bank had previously completed the first tranche of 2024 dividends, paying 5% in cash. The total dividend payout for 2024 is 18%, with plans to maintain this level in 2025.

Accelerating Digital Transformation: Reducing Costs, Enhancing Experience, Driving Efficiency

Vietnam’s banking sector is rapidly investing in technology, with an average annual compound growth rate exceeding 20%, reflecting a strong commitment to digital transformation. Leading banks are leveraging AI, Big Data, and process automation to expedite approvals, reduce operational costs, and enhance customer experiences.

A significant portion of the additional capital will be allocated to technology, including core banking systems, data analytics, process automation, and security solutions. The goal is to further lower the cost-to-income ratio (CIR), shorten processing times, and personalize services for different customer segments. As technology permeates every aspect of banking, from credit appraisal and risk management to customer service, it expands profit margins and elevates user experiences.

With enhanced capital capacity, the most immediate value is in improved service capabilities. Larger credit limits and digitized appraisal and approval processes enable SHB to respond faster, design flexible credit packages tailored to corporate cash flows, and diversify retail solutions (e.g., home loans, auto loans, credit cards). The “retail within wholesale” model leverages the ecosystem of corporate clients (suppliers, dealers, employees), creating a dual benefit: relying on a stable cash flow foundation while expanding profit margins in the retail segment and diversifying portfolio risk.

Extensive Partnerships with Domestic and International Stakeholders

SHB distinguishes itself through its extensive partnerships with state-owned enterprises, private corporations, and international financial institutions. The bank plays a key role in serving major programs and projects, with a broad network of core corporate clients across supply and value chains.

SHB is also a leader in international cooperation, mobilizing medium to long-term capital from the World Bank, ADB, JICA, and others to promote green credit in areas such as SME support, rural finance, sustainable agricultural transformation, and renewable energy.

Notably, SHB was selected by the World Bank and Green Climate Fund (GCF) as the Risk-Sharing Facility Manager for the Vietnam Scaling Up Energy Efficiency Project (VSUEE), with a total value of 86.3 million USD. This funding not only provides reasonably priced medium to long-term capital but also helps the bank diversify its capital structure, enhance environmental and social risk management in line with international standards, and expand safe and effective credit in support of sustainable growth.

In summary, the capital increase opens three strategic pillars for SHB: strengthening financial capacity, expanding service capabilities, and accelerating digital transformation. By leveraging its corporate ecosystem and international partnerships, SHB is poised to lead in safe and effective credit, creating sustainable value for customers and shareholders in the new economic cycle.

– 11:05 14/10/2025

VPBank and Rikkeisoft Join Forces to Expand Global Reach

On October 10th, Rikkeisoft Joint Stock Company and Vietnam Prosperity Joint Stock Commercial Bank (VPBank) officially signed a Memorandum of Understanding (MOU).

The Leading Tech City

Ho Chi Minh City is pioneering a transformative vision: a “Digital Government – Digital Society – Digital Citizen” model. In this innovative framework, all administrative processes, monitoring, and feedback mechanisms operate in real-time, ensuring unparalleled efficiency and connectivity for its citizens.

Minister of Home Affairs: Civil Servants Are the “Key of Keys” in Building a Modern National Governance Framework

At the discussion session on the afternoon of October 12th, Minister of Home Affairs Phạm Thị Thanh Trà emphasized that civil servants are the “key of keys” in Party building and national governance. In the context of the digital era and deep integration, she advocated for the establishment of a new public service value system—one that is civilized, innovative, and rooted in the spirit of serving the people.

Inspiring a Beautiful Life: Vietnamese Businesses Championing Sustainable Values

For nearly three decades, ROX Group has forged a path of sustainable development, crafting aspirational living spaces, industrial zones that foster livelihoods, and green energy fields. We’ve woven a spirit of beauty and relentless innovation into everything we do, propelling our nation forward into the digital age.