Au Lac Joint Stock Company (ALC) has released its Q3/2025 financial report, revealing a revenue of VND 342 billion, an 8% decrease compared to the same period in 2024.

However, thanks to a 38% reduction in cost of goods sold, the company’s gross profit surged nearly 11 times, from VND 11 billion in Q3/2024 to VND 117 billion in Q3/2025. Gross profit margin improved significantly from 2.92% to 34.2%.

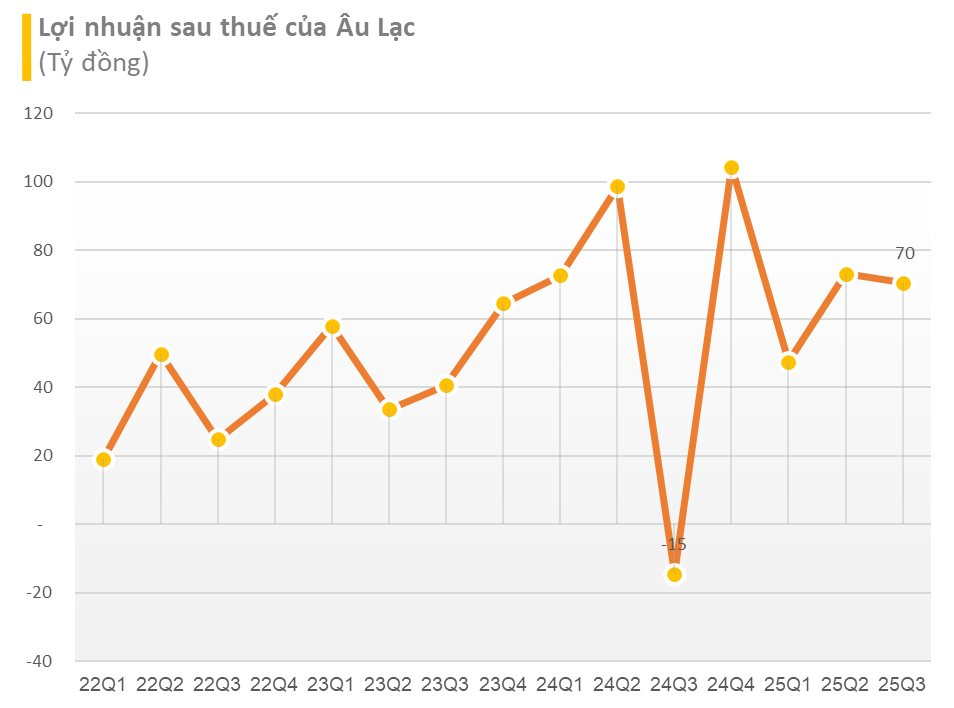

This turnaround helped the company shift from a post-tax loss of VND 15 billion in Q3/2024 to a post-tax profit of VND 70 billion in the current quarter.

In the first nine months of 2025, despite an 18% year-on-year revenue decline to VND 957 billion, post-tax profit reached VND 191 billion, a 22% increase compared to the same period last year.

As of the end of Q3/2025, Au Lac’s total assets stood at VND 2,241 billion, a slight 1.3% decrease from the beginning of the year. Total liabilities decreased by 20% from VND 869 billion to VND 691 billion, with total loans amounting to VND 517 billion.

Au Lac Joint Stock Company is a leading private enterprise in the maritime transport sector, specializing in oil tankers. The company is chaired by Mrs. Ngo Thu Thuy, a prominent figure in Vietnam’s financial market, particularly known for her involvement in the power struggle at Eximbank (EIB) in the past.

Previously, Au Lac was a long-term shareholder of Vietnam Export-Import Commercial Bank (Eximbank – code: EIB). The company later sold all its EIB shares and shifted its investment to ACB.

Since early 2023, Au Lac has gradually divested its ACB shares, completely exiting its holdings in Q1/2024.

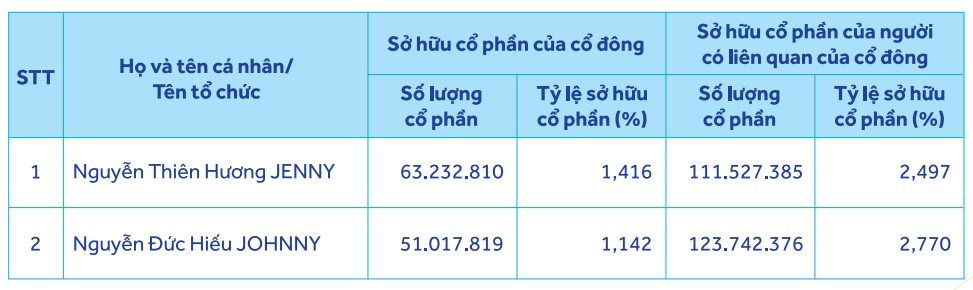

According to ACB’s shareholder list published on April 29, 2025, Mrs. Thuy’s two children, Nguyen Thien Huong JENNY and Nguyen Duc Hieu JONNY, hold over 63.2 million and 51 million ACB shares, respectively.

The total number of ACB shares held by these individuals and related parties is over 174.76 million.

Compared to the September 2024 disclosure, both individuals increased their holdings in ACB, with the total shares held by related parties rising from 173.83 million to 174.76 million.

In the previous disclosure, another related shareholder holding ACB shares was Thien Huong International Education Village Joint Stock Company.

Based on ACB’s closing price of VND 24,050 on April 29, 2025, the value of these shares exceeds VND 4,200 billion.

May 23, 2025, marked the ex-dividend date for ACB’s 2024 dividend, with a 10% cash dividend and a 15% stock dividend. Cash payment is scheduled for June 5, 2025, and stock issuance by June 30. ACB has yet to update the latest ownership ratio of this shareholder group.

VPBankS Unveils Record-Breaking Profits Ahead of Highly Anticipated IPO

With robust results from proprietary trading, financial advisory services, and lending activities, VPBank Securities Joint Stock Company (VPBankS) reported pre-tax profits of nearly VND 2.4 trillion in Q3 and approximately VND 3.3 trillion for the first nine months of the year. This marks a significant year-over-year increase and achieves over 73% of the annual target. Another notable highlight is the margin loan balance reaching a new milestone.