Ready for a New Phase of Growth

The ceremony was attended by Mr. Luong Hai Sinh, Chairman of the Board of Members of the Vietnam Stock Exchange, representatives from regulatory bodies, partners, shareholders, and all SHS employees.

This event not only marks the inauguration of a new workspace but also signifies SHS’s long-term vision for development during a transformative period in Vietnam’s stock market, following its upgrade to secondary emerging market status by FTSE Russell. SHS remains committed to a sustainable growth strategy centered around customer satisfaction, continuously enhancing service quality, investing in infrastructure, and expanding operational scale to meet the increasingly diverse needs of investors.

The new SHS headquarters features a modern design optimized for functionality, embracing an “open financial office” model where technology, people, and services seamlessly integrate to deliver a convenient and efficient “one-touch” experience for clients.

Speaking at the ceremony, Mr. Nguyen Chi Thanh, CEO of SHS, stated, “This is a pivotal milestone marking a new phase of SHS’s growth. Investing in physical infrastructure is investing in the future—a modern, synchronized, and internationally aligned operational governance system. The new headquarters will serve as a hub connecting intelligence, technology, and services—a foundation for SHS to continue establishing itself as a trusted and pioneering securities brand.”

Mr. Nguyen Chi Thanh, CEO of SHS, speaking at the inauguration ceremony

The launch of the new headquarters is part of a comprehensive system-wide infrastructure upgrade project, aligned with the goal of standardizing processes, heavily investing in digital transformation, and developing high-quality human resources. This aims to realize the “Service Branding” philosophy—building a brand through exceptional service quality and customer experience.

SHS’s network spans key economic hubs such as Hanoi, Ho Chi Minh City, Da Nang, Hai Phong, and Can Tho. This expansion enhances local accessibility and service delivery, while establishing a professional, synchronized, and investor-friendly financial services network.

At each location, SHS prioritizes modern infrastructure, a professional advisory team, and a welcoming trading environment, fostering corporate culture, strengthening trust, and elevating the experience for hundreds of thousands of individual and institutional clients.

2025 also marks significant personnel growth. As of September 2025, SHS employs over 350 staff, a 14.4% increase from 2024. The workforce structure has been streamlined for quality and specialization, focusing on attracting high-caliber talent in investment advisory and information technology. Investment advisors account for 46% of total staff, with 20% being managers and experts. This reflects SHS’s experienced and highly skilled workforce—a critical foundation for the upcoming growth surge.

SHS Achieves 2025 Business Targets in Just 9 Months

2025 has been a breakthrough year for SHS, with consistent growth in scale and efficiency. As of September 30, 2025, total assets surpassed VND 20 trillion, a 57% increase from the same period in 2024. This growth is primarily driven by financial investments, margin lending, and expanded equity, highlighting robust operational growth and a strengthened financial foundation.

Q3 2025 pre-tax profit reached VND 590 billion, nearly 8 times higher than the previous year. For the first 9 months, SHS recorded VND 1,379 billion in pre-tax profit, a 45% increase year-on-year, exceeding the annual target set by the shareholders’ meeting.

Estimated EPS for the latest four quarters is VND 1,682 per share, with ROAE at 12.5% and ROAA at 8.7%, demonstrating superior capital efficiency and profitability compared to industry averages.

The new SHS headquarters features a modern design optimized for functionality, embracing an “open financial office” model

In August 2025, SHS’s market capitalization exceeded USD 1 billion for the first time, ranking it among the top 60 largest companies on the Vietnamese stock market. This milestone underscores investor confidence in SHS’s growth potential and solidifies its position as a leading financial institution with a stable foundation and long-term growth prospects.

With a strong financial base and standardized operations, SHS is expanding its product portfolio to include Margin S30, SH69, and specialized wealth management solutions. Regular strategic reports and in-depth market, sector, and company analyses provide valuable insights for informed investor decision-making.

SHS achieves 2025 business targets in just 9 months

The new headquarters inauguration coincides with Vietnam’s stock market entering a period of robust growth and regional integration. SHS’s proactive investment in expansion and standardization not only enhances competitiveness but also positions it as a leader in innovation, service excellence, and investor experience optimization.

With a solid financial foundation, modern infrastructure, and a high-caliber workforce, SHS is poised for its next growth phase, aiming to become Vietnam’s leading financial and investment group in the coming years.

VPS Announces Minimum IPO Price of VND 60,000 per Share

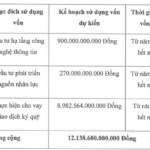

Late in the afternoon on October 13th, the Board of Directors of VPS Securities JSC (VCK) passed a resolution approving changes to their previously announced IPO plan. Notably, the minimum offering price was set at 60,000 VND per share, aiming to raise over 12.1 trillion VND.

Launch of VN100 Index Futures Trading: A Milestone for Vietnam’s Derivatives Market

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that the introduction of the VN100 Futures Contract (HĐTL VN100) into trading aligns with the roadmap of the Securities Market Development Strategy by 2030. This move also reflects the global trend of developing derivative products in international markets.