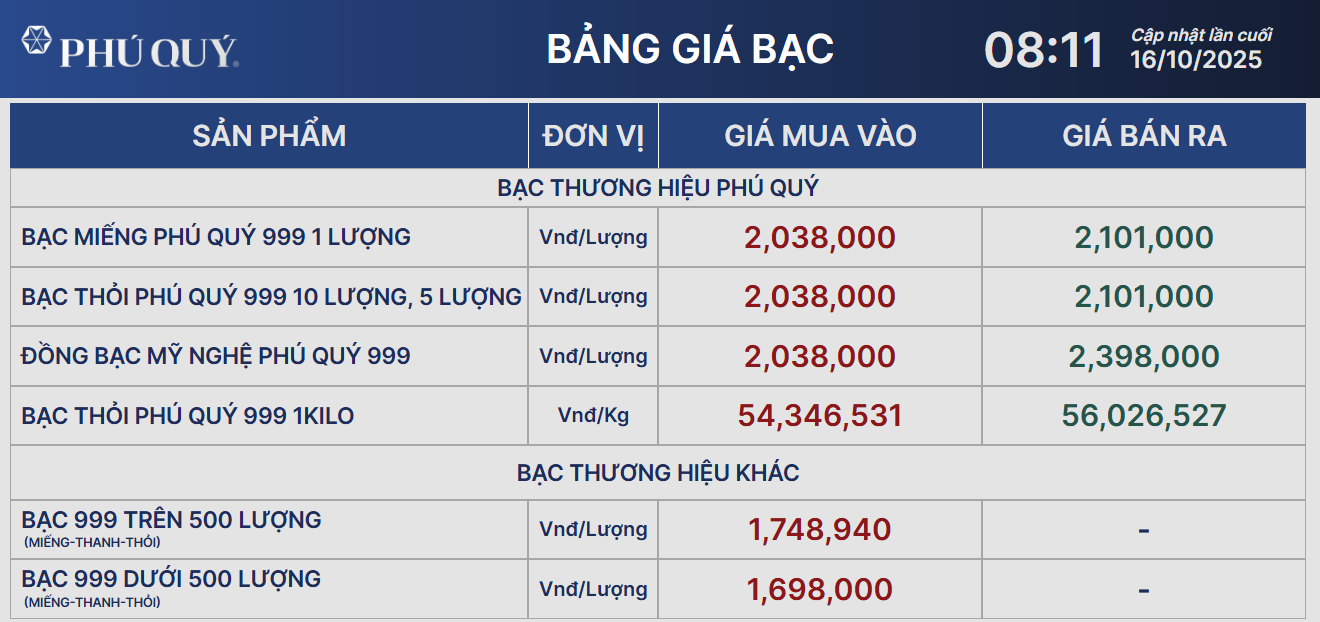

According to data from Phu Quy Jewelry Joint Stock Company, silver prices continued to rise today. The price of 999 silver (1 tael) is listed at VND 2,038,000 per tael (buy) and VND 2,101,000 per tael (sell). Over the past week, buyers have profited 8.6%, and 84.2% over the past year.

Meanwhile, the price of 999 silver bars (1 kg) also surged, reaching VND 54,346,531 per bar (buy) and VND 56,026,527 per bar (sell), as of 08:11 on October 16.

Globally, silver prices hit $53.17 per ounce.

Silver prices rebounded above $52 per ounce on Wednesday (October 15), maintaining levels near the historic highs set in the previous session. This surge is driven by a global supply crisis that has fueled the strongest price rally in years.

The shortage is particularly acute in the London market, where a short-term squeeze caused silver leasing rates to spike over 30% on Friday (October 10). This development pushed the cost of maintaining short positions to nearly unsustainable levels. Simultaneously, strong import demand from India has further tightened global supplies, forcing some investment funds to temporarily halt new capital inflows into silver ETFs.

In financial markets, Federal Reserve Chair Jerome Powell’s dovish remarks, acknowledging labor market weakness, bolstered expectations of further rate cuts. This has enhanced the appeal of precious metals like silver and gold, which thrive in low-interest-rate environments.

Geopolitically, tensions escalated after President Donald Trump threatened to impose sanctions on Chinese vegetable oil imports in retaliation for Beijing’s halt on U.S. soybean purchases.

Avoid Falling into the “Silver Fever” Trap

By the end of October 14th, the domestic silver market remained red-hot, with prices holding steady at record highs and investors flocking to buy in anticipation of significant returns.