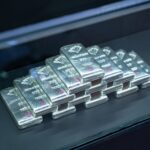

As of midday on October 16, the price of Ancarat’s 999 silver bars (1 tael) was quoted at VND 2,034,000 – 2,094,000 per tael (buy – sell). The price of 1 kg silver bars was VND 53,360,000 – 54,860,000 (buy – sell).

Crowds queuing to buy silver at Ancarat’s branch on Xa Dan Street, Hanoi

At Phu Quy Group, the price of Phu Quy 999 silver bars (1 tael) was VND 2,035,000 – 2,098,000 (buy – sell), and 1 kg silver bars were priced at VND 54,266,000 – 55,946,000 (buy – sell).

Globally, silver prices surged past $53/ounce at noon, reaching levels unseen since 2011. This spike has fueled speculative fervor, with many anticipating further rises in silver prices, mirroring the upward trend in gold.

1 kg silver bars remain consistently sold out.

Despite record-high prices, investor demand for silver remains robust. By 9 a.m. on October 16, silver retailers like Ancarat and Phu Quy had halted new orders for the day.

Distributing queue numbers for silver purchases

“By 8:30 a.m., we had already distributed all 100 queue numbers,” said Nguyen Hoang Viet, Director of Ancarat’s Xa Dan branch in Hanoi.

At this Ancarat location, each customer is limited to a maximum of 5 kg per day. Similarly, Phu Quy’s Cau Giay store has imposed a 5 kg daily limit per customer during recent sales, often selling out by 9:30 a.m.

All 100 queue numbers were claimed within minutes

“We’ve implemented purchase limits to ensure our production facility can meet delivery deadlines. Customers ordering today can expect delivery in December,” added Nguyen Hoang Viet.

Silver buyers will receive their orders in December 2025

Analysts attribute silver’s rally to two factors: investor safe-haven demand amid volatile financial markets and supply shortages coupled with rising industrial demand. Experts note that silver, among precious metals, offers faster growth and higher profit margins than gold.

Experts predict further silver price increases, driving public buying frenzy

Domestic experts caution, however, that rapid price surges often carry risks of sharp declines. Additionally, wide buy-sell spreads pose risks for short-term traders.

Avoid Falling into the “Silver Fever” Trap

By the end of October 14th, the domestic silver market remained red-hot, with prices holding steady at record highs and investors flocking to buy in anticipation of significant returns.

Why Are Major Brands Halting Silver Bullion Orders? Unraveling the Mystery

Soaring silver prices have sparked a frenzy among investors, leading to a surge in demand for silver bars and coins. This unprecedented rush has overwhelmed suppliers, forcing several major brands to temporarily halt new silver orders.