Front-Running Phase

Following its official upgrade to the secondary emerging market category, Vietnam’s stock market has entered a genuine phase of “stock filtering.” Numerous domestic and international organizations have released reports forecasting allocation ratios for Vietnam’s market and identifying stocks likely to be included in international indices.

Earlier, starting in September 2025, the Xtrackers FTSE Vietnam Swap UCITS ETF—managed by Deutsche Bank—transitioned to tracking the STOXX Vietnam Total Market Liquid (TMI) Index. This index was redesigned with criteria to measure the performance of highly liquid stocks on Vietnam’s stock market.

According to STOXX’s updated guidelines, a stock is only selected if it meets the following criteria:

1. Minimum full market capitalization of VND 3,000 billion,

2. Free-float market capitalization of at least VND 2,500 billion,

3. Average daily trading value (ADTV) of at least VND 17 billion over six months,

4. Minimum available foreign ownership ratio of 10%,

5. Relative ADTV over six months below 40%,

6. Annual trading turnover ratio exceeding 10%.

Source: STOXX.

|

These seemingly technical criteria serve as a real filter for Vietnamese stocks to appear on the global investment map.

However, it’s important to note that the FTSE Emerging Market All Cap Index—which Vietnam will officially join after the upgrade—only takes effect from September 2026, following a preliminary review in March of the same year.

According to JP Morgan’s estimates, passive capital (ETF) from global funds will only begin disbursing after Vietnamese stocks are added to the FTSE Emerging Market All Cap Index. This capital could reach approximately USD 1.3 billion, equivalent to 0.34% of the global index’s weighting.

Analysts suggest that before this capital inflow, active funds are already taking action, creating a vibrant front-running phase.

Selected Stocks and the Battle for Index Inclusion

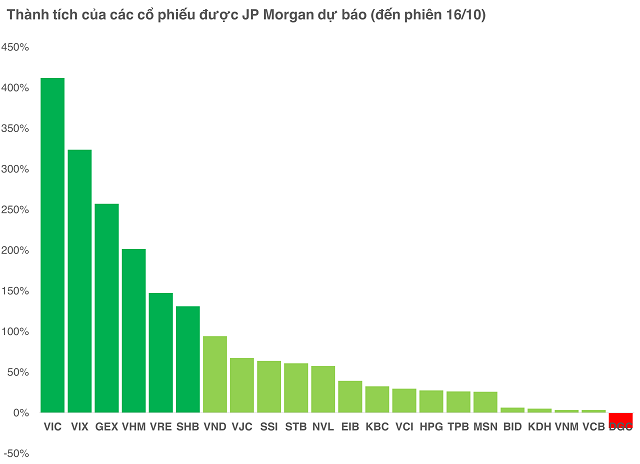

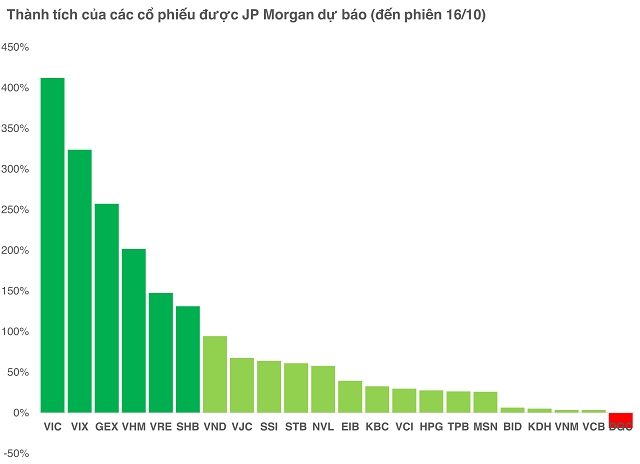

In its latest report, JP Morgan predicts that 22 Vietnamese stocks could be added to the FTSE Emerging Markets (FTSE EM) indices. This list highlights a strong overlap between domestically favored stocks and global selection criteria.

Performance of the 22 stocks predicted by JP Morgan.

|

Stocks such as VIC, VHM, VRE, GEX, SHB, and VIX have seen their prices surge far beyond their 2025 opening levels—more than doubling. Notably, VIC has increased over fivefold.

If this trend continues, foreign funds will need to enter at higher price levels for these stocks.

Meanwhile, major bank stocks like VCB and BID, despite being on the list, have shown muted movements. Some stocks, such as KDH (up 4.4%) and VNM (up 3.6%), have seen minimal gains, while others like DGC have declined sharply (-18.7%).

However, this race isn’t limited to the 22 stocks in JP Morgan’s report. At least two companies are aiming to “level up”: BSR (Binh Son Refinery) is working toward meeting the criteria for inclusion in the VN30, and TCBS (Technological Commercial Joint Stock Bank) is preparing for its IPO with an estimated market capitalization of USD 4.2 billion, leading the securities sector in equity.

Both aim to join the VN30, positioning themselves for inclusion in international indices where passive capital will be allocated in the future.

Many other names on the market are quietly preparing, from newly IPOed companies to those transferring listings, all with potential representatives.

According to Mr. Bui Van Huy, Vice Chairman of the Board of Directors and Director of Investment Research at FIDT JSC, the impact of the upgrade will primarily be felt in the medium to long term. “This is a journey, not a destination. The market is currently at a historic peak, while supportive factors are fading and external risks are emerging. The market needs further accumulation phases to prepare for the year-end wave,” he commented.

Mr. Huy also noted that in the short term, exchange rates significantly influence foreign investors. “Since the beginning of the year, compared to other currencies outside the USD, the VND has depreciated by about 10%. This remains the primary reason for foreign net selling. However, domestic factors still play a leading role. Exchange rate fluctuations or foreign net selling are inevitable trade-offs as Vietnam maintains its loose monetary and fiscal policies.”

– 08:00 17/10/2025

The Storm Within: A Martyr’s Heart

Investors anticipated a booming year as the VN-Index surged 60% from its tariff-driven lows, yet underlying anxieties continue to simmer among market participants.

VESAF Fund Lagging Market Performance Despite No Holdings in VIC Stocks

In September 2025, VinaCapital’s VESAF fund recorded a -5% return, while the VN-Index dipped by only 1.2%. Over the first nine months, the fund achieved an 11.4% gain, compared to the index’s impressive 31.2% surge.