While the stock market grapples with volatility, real estate stocks are bucking the trend, shining brightly. DIG took center stage, hitting its ceiling price with a “zero sell” status and millions of buy orders at the ceiling price. Following suit, other real estate stocks like NLG, PDR, KBC, HDC, DXG, and NVL all surged, with gains exceeding 3%.

Strong inflows poured into real estate stocks, with DIG, DXG, NVL, and PDR ranking among the most liquid stocks on the market. This highlights a renewed investor optimism towards this sector.

Driven by Robust Earnings

Positive earnings forecasts are fueling the rally. DIC Corp (DIG) anticipates a Q3 pre-tax profit of VND 171 billion, a stark contrast to the VND 6 billion loss in the same period last year. In the first nine months, the company recorded VND 1.896 trillion in revenue and other income, with a pre-tax profit of VND 209 billion, a fivefold increase year-on-year.

Similarly, Housing Development Corporation (HDC) reported impressive preliminary results, with a pre-tax profit of VND 666 billion, a staggering 35 times higher than the previous year. The company projects a full-year pre-tax profit of VND 755 billion, nearly ten times the 2024 figure.

In a recent report, MBS Securities forecasts a 68.7% year-on-year increase in Q3 2025 profits for listed real estate companies, driven by a low base and some exceptional financial gains. New project launches are expected to contribute significantly from Q4 onwards.

Nam Long (NLG) is projected to see a 504% profit surge to VND 210 billion, thanks to product deliveries at Southgate and Nam Long Can Tho, along with financial gains from the sale of a 15.1% stake in the Izumi project to Tokyu Corporation.

Vinhomes (VHM) is expected to achieve a profit of VND 12,948 billion, a 65% increase, primarily from projects like Royal Island, Wonder City, and OCP 2&3. MBS estimates VHM has already achieved 60% of its annual profit target after nine months.

Phat Dat (PDR) is forecasted to see a 273% profit increase to VND 190 billion in Q3, driven by the sale of an 80% stake in the Thuan An 1 project and the launch of a new phase in Bac Ha Thanh – Quy Nhon Iconic, which is expected to further boost results in Q4 2025 and 2026.

“Catalysts” for the Real Estate Wave

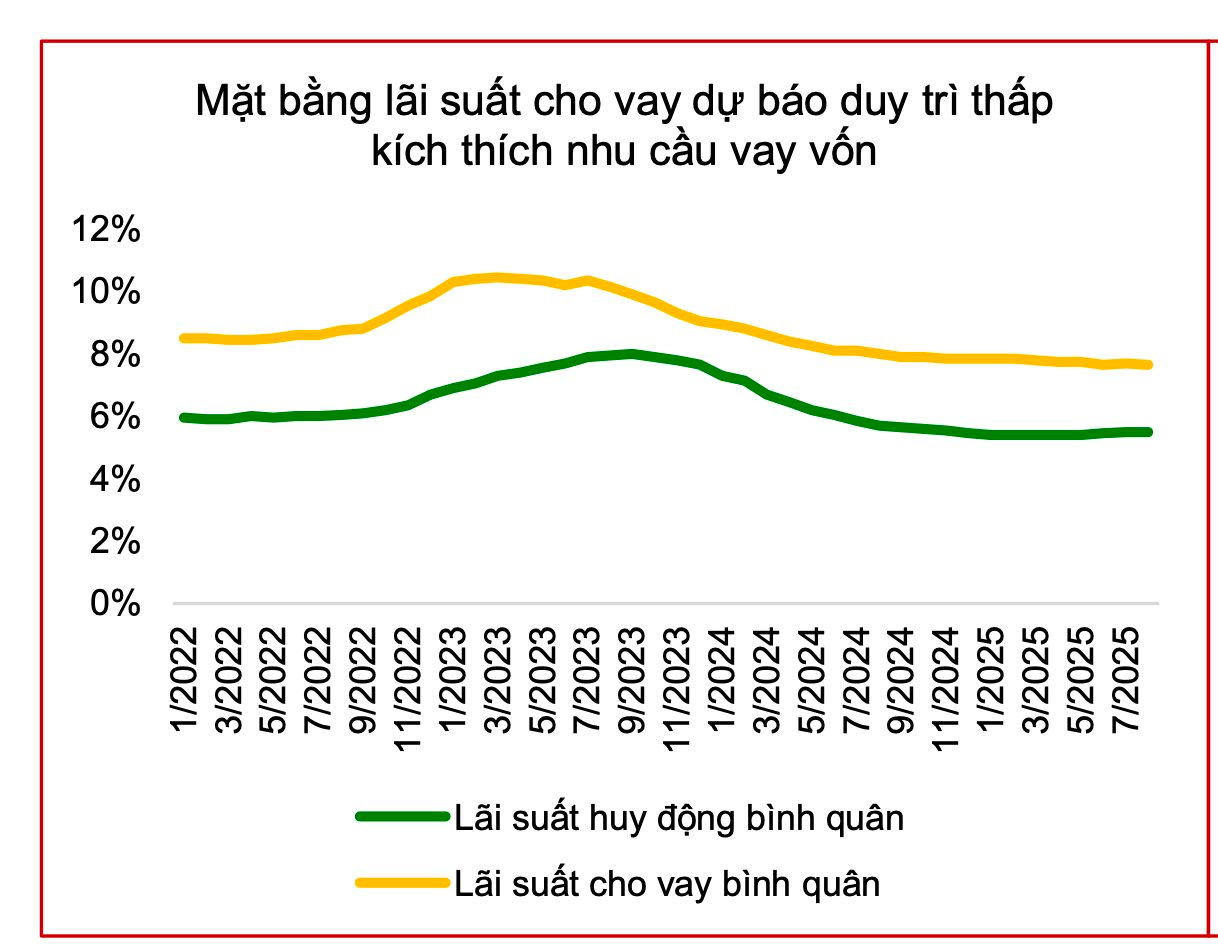

Agriseco Securities shares the positive outlook, citing several macroeconomic factors supporting the real estate market’s recovery: (1) stable low mortgage rates; (2) continued legal unblocking policies; (3) potential province mergers driving long-term growth; and (4) increased infrastructure investment.

Low interest rates stimulate housing demand and investment, boosting market liquidity. Robust infrastructure development is also seen as a driver of property value appreciation. According to Batdongsan.com.vn, completed infrastructure projects in 2025-2026 could increase land prices in surrounding areas by 10-15% annually. Companies with large land banks near key infrastructure projects, such as VHM, NLG, KDH, DXG, HDC, VPI, NVL, PDR, and DIG, are expected to benefit directly.

In terms of business operations, Agriseco notes that the second half of 2025 will be a breakout period as companies like VHM, KDH, NLG, HDG, HDC, DXG, and TCH begin handing over major projects, significantly improving performance compared to the first half. From 2025 to 2026, sales are expected to continue growing, particularly for reputable companies with well-located projects in major cities and suburbs, such as VHM, KDH, NLG, DXG, HDG, TCH, and HDC. This sales growth will be a key driver of industry profit growth in the coming years.

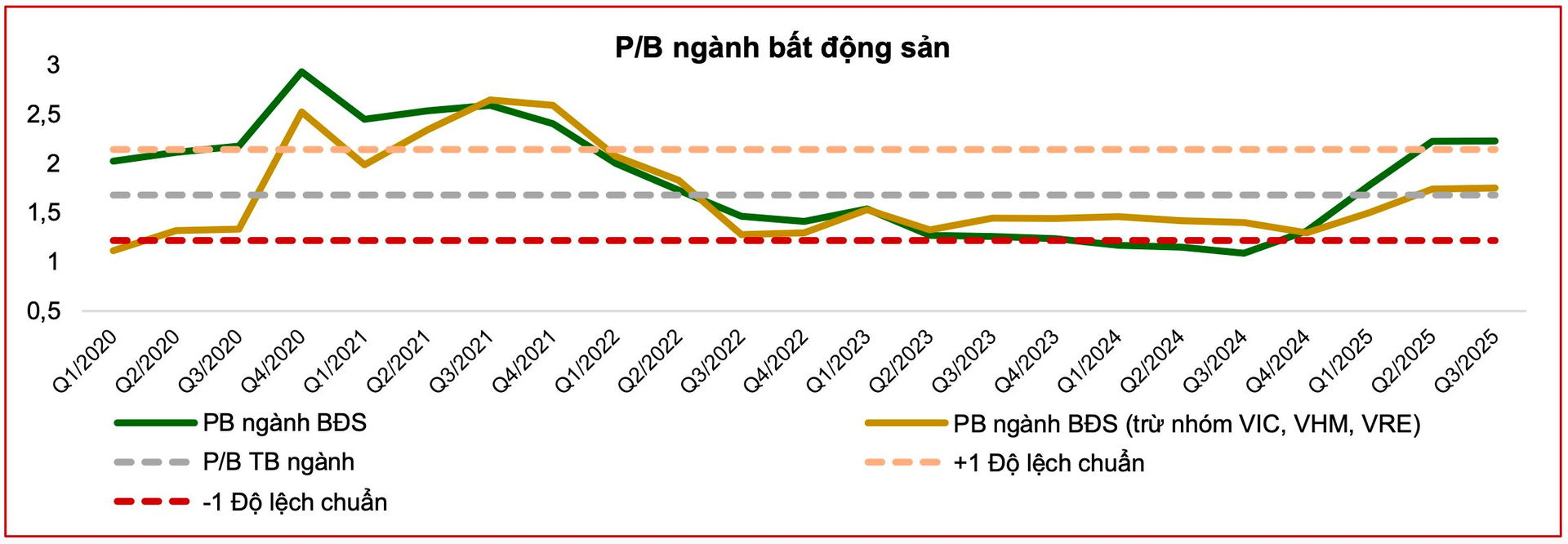

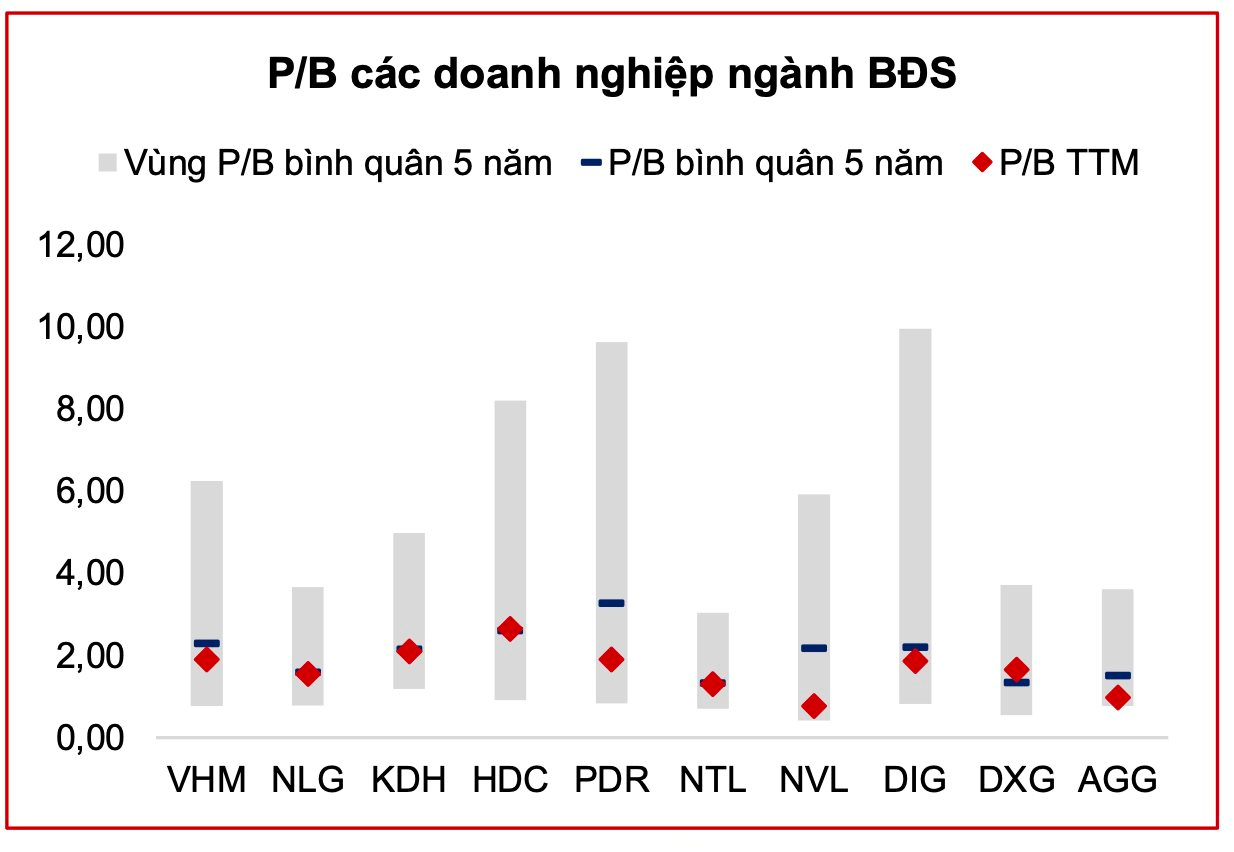

In terms of valuation, real estate stocks are currently trading at a P/B ratio of 2.2 times, higher than the 5-year average of 1.8 times and approaching the +1 standard deviation level. However, excluding large-cap stocks (VIC, VHM, VRE), the industry’s P/B ratio is around 1.7 times, equivalent to the long-term average, indicating that most companies are still reasonably valued.

After a period of decline and sideways movement in 2024, the real estate sector index has surged 128% since the beginning of 2025, far outpacing the VN-Index’s 31% gain. This rally is primarily driven by VIC and VHM, while other stocks have seen more moderate increases of 20-60% (according to Fiinpro-X). This reflects expectations of industry recovery due to improved legal frameworks, supply, and market demand.

Overall, Agriseco believes that real estate sector valuations have returned to their 5-year average, but with noticeable polarization. Large-cap stocks (VIC, VHM, VRE) have rebounded strongly but remain below their historical averages, while mid- and small-cap stocks (KDH, NLG, DIG, HDC…) are still reasonably valued or discounted, aligning with their 2-3 year outlook.

Agriseco sees investment opportunities in companies with clean land banks, strong execution capabilities, and those benefiting from legal policies, despite short-term risks from profit-taking pressures after the sharp rally and project disbursement progress.

The New Face of North Central Vietnam’s Premier Growth and Development Hub

In recent years, Nghe An has been making remarkable strides across all fronts, from transportation infrastructure to economic development, steadily solidifying its position as the new growth hub of the North Central Coast region.

Hot This Week: Ho Chi Minh City’s Ring Road 3 Set for Technical Opening by Year-End

Proposals to increase the income threshold for social housing eligibility to 40 million VND/month for couples, Dong Nai’s commitment to commence and complete over 9,000 social housing units next year, the final 100-day push to open Ho Chi Minh City’s Ring Road 3 by year-end, and updates on resolving bottlenecks for nearly 3,000 stalled projects are among the top headlines of the past week.

Proposed Recommendations to the Ministry of Construction Regarding Can Tho Airport

The People’s Committee of Can Tho City has urged the Ministry of Construction to promptly approve the investment policy for the upgrade of Can Tho International Airport. The project aims to increase the airport’s capacity to 7 million passengers annually in phase 1, with a further expansion to 12 million passengers per year in phase 2, significantly boosting regional development.