The consultation period runs from October 5th to October 23rd. The core focus of the proposal is to allow shareholders holding stocks from the merger of SVC Holdings (now Tasco Auto JSC) into Tasco to transfer part or all of their shares to VIAC. It also suggests waiving the obligation for a public tender offer if VIAC’s ownership exceeds 25% of the capital.

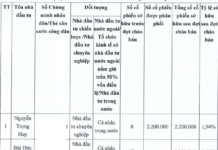

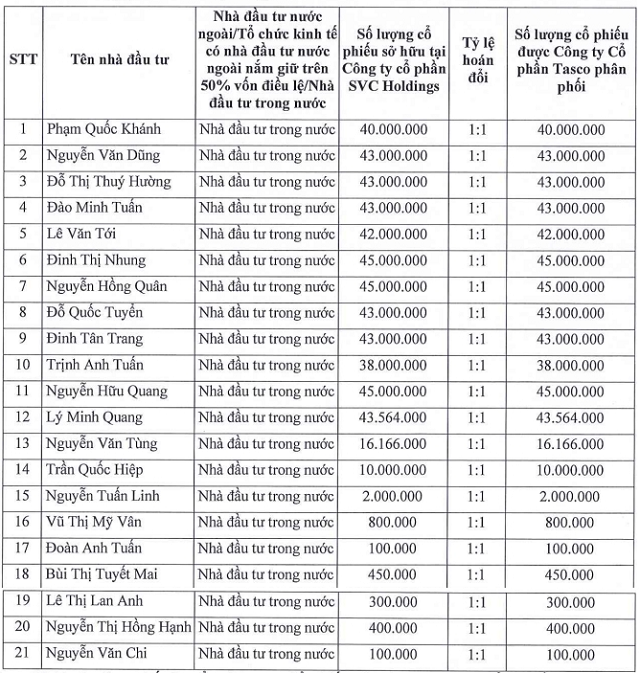

The story began in 2023 when Tasco issued nearly 544 million shares to swap for the entire capital of SVC Holdings, the parent company of Saigon General Service Automobile Distributor (Savico, HOSE: SVC), at a 1:1 ratio. Post-merger, Tasco’s charter capital surged from VND 3.48 trillion to VND 8.92 trillion, adding 21 new shareholders who collectively held 60.9% of the shares, locked in for the first year.

Over the next four years, these shareholders can only transfer shares internally or sell to other investors with approval from Tasco’s Annual General Meeting (AGM). In 2024, Tasco’s AGM approved the transfer of shares to VII Holding, a company co-founded by Tasco’s Chairman, Vu Dinh Do. VII Holding recently completed its acquisition of a 30% stake in Tasco.

Now, VIAC is proposed as the next investor to receive share transfers under the same mechanism, committing to hold the shares until August 31, 2028, unless internal transfers are approved by the AGM.

List of investors in the August 2023 share swap. Source: Tasco

|

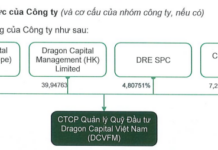

VIAC (No.1) Limited Partnership, based in Singapore, is an investment fund under Vietnam Oman Investments (VOI), a joint venture between the Oman Investment Authority (OIA) and the State Capital Investment Corporation (SCIC). VIAC is no stranger to Tasco’s leadership, particularly new CEO Hoang Minh Hung, who chairs Saigon Water Infrastructure JSC (Saigon Water, UPCoM: SII) and has had past disagreements with VIAC representatives.

Currently, SII owes over VND 154 billion to VIAC and another foreign investor, Manila Water South Asia Holdings Pte Ltd, stemming from the transfer of shares in Cu Chi Water Supply and Drainage JSC.

VIAC invested in SII in 2013, acquiring a 12.05% stake. Two years later, when SII established Cu Chi Water Supply and Drainage JSC to develop the Cu Chi Water Plant, VIAC and Manila Water acquired a 49% stake. The project underperformed and incurred losses, prompting both investors to seek conversion of their stakes in the subsidiary into direct shares in SII, a listed company.

In late 2023, SII’s Board approved a new share issuance for the swap, with a deadline of February 1, 2025. However, SII’s 2025 semi-annual audited financial report shows the company still owes over VND 154 billion to each party, with negotiations ongoing.

At the 2025 AGM, Manila Water disputed this accounting, asserting no negotiations were underway and demanding full payment. Manila Water and VIAC also opposed several proposals, citing non-compliance with procedures and potential risks to shareholders. These differences have strained relations between SII’s leadership and foreign shareholders.

SII Chairman: Cu Chi Water Plant to Achieve Cash Flow Independence by 2032

Company Linked to Chairman Vu Dinh Do Completes 30% Stake Acquisition in Tasco

SII Post-Acquisition (Part 3): Nature of ‘Payables’ and Future Plans

– 15:02 October 16, 2025

Tasco Chairman’s Company Plans to Invest 250 Billion VND for 18.2% Stake in Wife’s Board-Member Firm, Stock Surges 60% in Under Two Months

VII Holding previously made headlines by acquiring over 302 million shares of Tasco (stock code: HUT), representing 28.32% of its charter capital, thereby becoming the largest shareholder in the company.